After having raised $2.4 million in funding, the cryptocurrency trade automation exchange TeraBlock is gearing up for its IDO. The Initial DEX Offering (IDO) is set to go live May 11th on BSCPad.

TeraBlock raised funding from noted crypto investors including Blocksync Ventures, Blockchain.com, AU21, MarketAcross, BTX Capital, CryptoDormFund, Brilliance Ventures, Magnus Capital, and others.

The token crowdsale

Initially, TeraBlock will launch its IDO token TBC on BSCPad. For the uninitiated, an Initial DEX Offering (IDO) is a method for raising funds where the IDO coin is issued on a decentralized liquidity exchange such as Binance, Uniswap, or Bancor. Traders can easily swap tokens from the liquidity pools.

Blockchain projects have shown a preference for IDOs to distribute tokens and access immediate liquidity. In an IDO, you don’t have to pay any fee to the exchanges.

Neither do you have any restrictions on when, where, and whom to sell your tokens. It also leads to faster and fairer trading of crypto assets.

TeraBlock’s token sale is one of the most anticipated IDOs of this year.

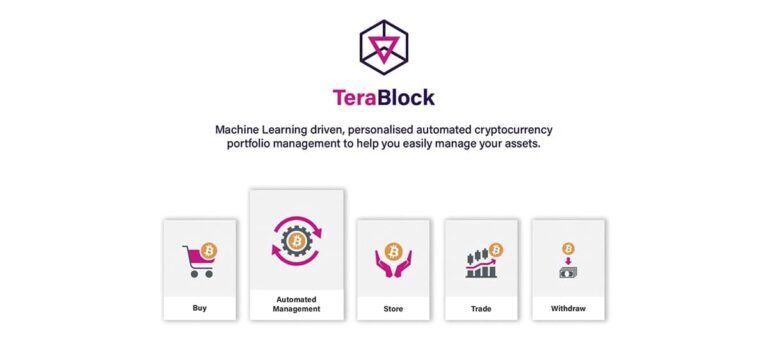

A noob-friendly platform to accelerate the DeFi adoption

Fueled by a massive bull run since last year, the global cryptocurrency market cap has surpassed $2 trillion. It has grabbed the attention of the general population who know little about cryptocurrencies and DeFi.

For someone just getting started in cryptocurrencies and DeFi, it can be overwhelming to figure out crypto wallets, exchanges, protocols, tokens, synthetic assets, etc.

They struggle to decide what to buy, how to store it securely, and balance the portfolio to reduce risk. They have to do it all manually.

As a result, many of them avoid investing in crypto assets despite their willingness to take advantage of DeFi.

TeraBlock has built its platform keeping this user segment in mind.

It not only provides guidance and resources to help them understand crypto assets, but also gives them the tools to easily buy and sell crypto.

TeraBlock combines automated portfolio management with machine learning to personalize each user’s experience depending on their needs and preferences. Since it focuses primarily on newbies, it even enables users to trade cryptocurrencies using their debit and credit cards.

The platform allows users to select their risk-reward profiles. Based on the profile users choose, TeraBlock will automatically buy and sell certain cryptocurrencies. It prevents you from taking unnecessarily high risks with your hard-earned money.

Riding on Binance’s security, liquidity, and technology

TeraBlock has partnered with Binance Cloud to get instant access to Binance’s superior technology and security solutions. Binance is the world’s largest crypto exchange.

The partnership gives TeraBlock access to Binance’s massive liquidity pool. It means that unlike other new exchanges, TeraBlock will not suffer from the lack of liquidity.

Binance will be handling the exchange’s technology development and management. It will also be responsible for user registration and anti-money laundering checks on TeraBlock.

Binance has an emergency insurance fund called Secure Asset Fund for Users (SAFU). Thanks to TeraBlock’s partnership with Binance, their users’ money will be automatically insured by SAFU.

The collaboration with Binance is aimed at providing users with the most secure and sophisticated technology that they can trust.

TeraBlock believes that a combination of noob-friendly experience, advanced technology, and high security will enable more users to trade crypto assets.