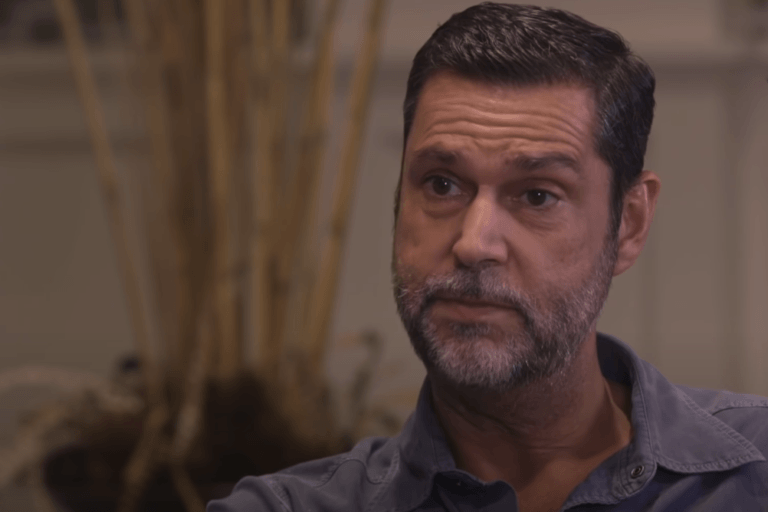

Former Goldman Sachs executive Raoul Pal, who is seen as an important influencer in the crypto community, has shared his thoughts about the recent fall of Bitcoin’s price from nearly $65K to around $30K.

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

Pal claimed the recent price crash revealed crypto’s resiliency, without imposing risk on the greater financial sector.

On May 25, he wrote on Twitter:

He went on to say:

- “There were no daisy chains of collateral losses. There was no collateral pressure. Stablecoins remained stable. A few exchanges went down for an hour or two. No exchange big losses occurred, no need to mutualise losses either. No protocol failed. No firms needed rapid funding.“

- “No one had open ended losses. The system didn’t break. It offered zero systemic risk to the broader financial world. Speculators lost money and that is it.“

- “This is what I first saw in crypto back in 2012. A new, anti-fragile financial system that doesn’t break in times of stress, where ownership of assets is clear and losses are not mutualised to tax payers. This was a big two weeks for crypto and for the future financial system.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.