Following a successful private funding round from notable investors, Don-Key is pushing to launch a unified liquidity provider and yield farming platform to ensure shared benefits for every member, especially for newcomers arriving in the DeFi arena.

Innovative Platform Aims To Maximizing Yield Farming Returns

Decentralized finance (DeFi) is a driving force for innovation in blockchain technology, propelled by the necessity for a transparent and open financial system. Thanks to new coins such as COMP and UMA, which empowered users to lend and borrow within the ecosystem, the DeFi sector grew exponentially in 2020, paving the way for yield farming, a cornerstone concept for DeFi.

The entire yield farming process relies on liquidity providers (LP) adding funds to liquidity pools using smart contracts. In return, LPs are remunerated, usually from the DeFi protocol’s underlying fees. While all this seems feasible on paper, in reality, most crypto users aren’t qualified to establish comprehensive strategies for generating consistent returns using minimum funds.

To overcome the obstacles preventing wider yield farming adoption, Don-Key is building the world’s first social platform that brings together yield farmers, liquidity providers, and cryptocurrency holders. The platform is designed to provide yield farmers the opportunity to raise liquidity from various liquidity providers and trade on their behalf. On the other hand, it allows LPs to be active within multiple aspects of the platform while offering them dedicated features for enhanced transparency and maximized gains.

Don-Key recently closed a successful private funding round, attracting $2.2 million in fresh funding from leading investors, including AU21, Morningstar Ventures, Black Edge Capital, MoonWhale, Spark Digital Capital, Solidity Ventures, and Genesis Block Ventures. Following this effort, the organization is busily developing the platform to support the farming ecosystem by offering a diverse social trading experience and endless liquidity to execute strategies.

Capitalizing On DeFi’s Promising Outlook

Although it seems like yield farming is simply the process of generating more crypto from existing tokens, the risks are higher relative to traditional investments, especially due to the high volatility of the market. Farmers must constantly keep a tab on market updates, move coins between marketplaces to generate more returns, and continually optimize investment strategies.

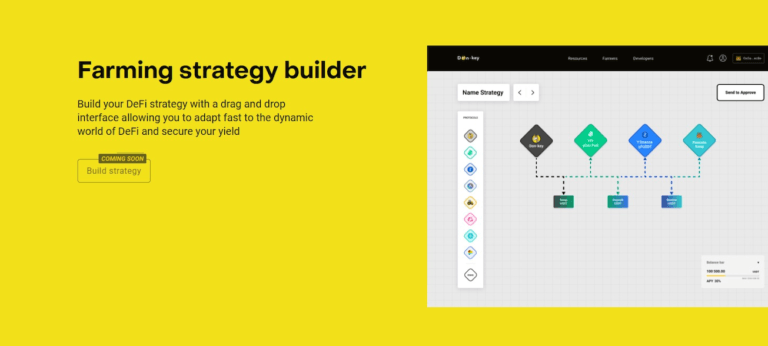

Accordingly, Don-Key’s innovative platform includes features for both yield farmers and liquidity providers, such as cross-chain integration, a drag-drop strategy builder, automatic calculation of different APYs, and one-click insurance. This augments copy farming activities, reputation management, non-custodial pools, risk assessment, multi-layered access, capital management, performance-based rewards, and real-time analytics.

On balance, the platform is designed to help farmers and LPs construct and execute multiple strategies, effectively creating an autonomous hedge fund. For their efforts, these groups receive commissions from a strategies’ collective yield and transfer liquidity from other protocols while maintaining a minimal fee structure that contributes to return maximization.

After the launch, Don-Key will operate on an open-source base, thereby encouraging other developers to add protocols, chains, functions, and tools to ensure these yields are accessible to broader swathes of the crypto community.