This has been a tough week for Bitcoin with the price under pressure for various reasons we will discuss in this article. However, one crypto influencer believes that Bitcoin is getting ready to rebound very strongly in the next few days.

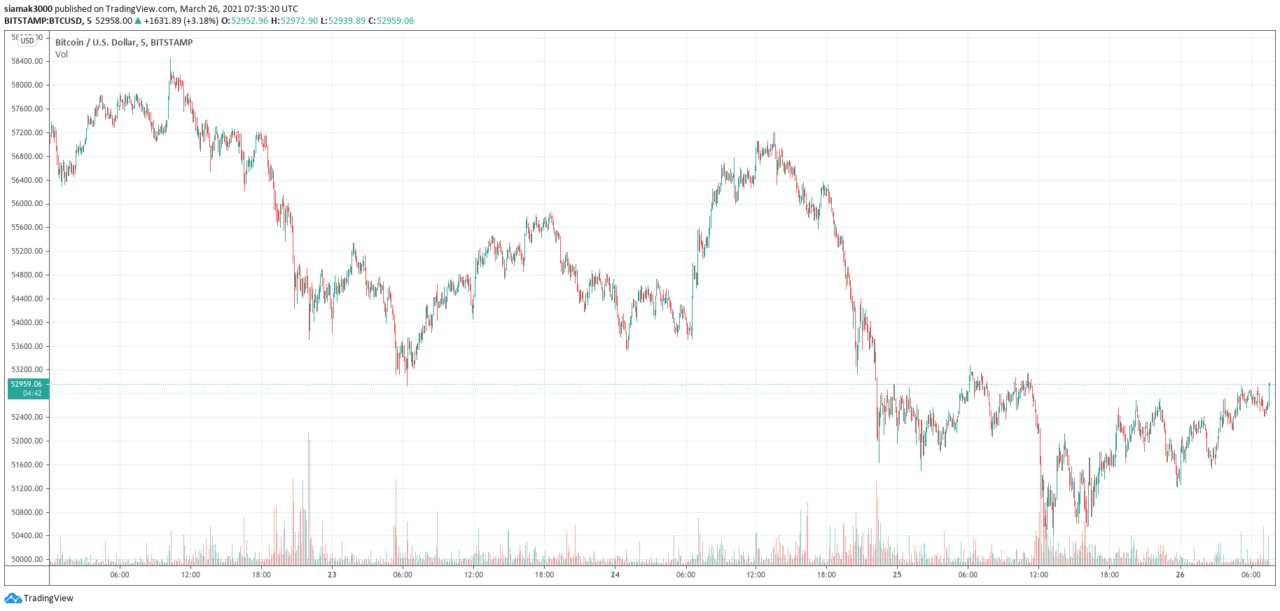

As you can see in the five-day BTC-USD price chart below from TradingView, over on crypto exchange Bitstamp, the Bitcoin price has gone from $57,775 at 07:30 UTC on Monday (March 22) to $52,979 at 07:30 UTC on Friday (March 26).

Although Bitcoin has always been quite a volatile asset and its price going down 8.3% may not seem like a big deal, what is unusual is that this price drop has come in a week that has seen so much bullish news. Here are a few examples:

- March 22: Anthony Pompliano (aka “Pomp”), who is a co-founder of Morgan Creek Digital as well as the host of “The Pomp Podcast”, released episode #517 of his podcast; this featured an interview with Jim Cramer, the host of CNBC show “Mad Money w/ Jim Cramer“, who said during this interview that the best way to prepare for the upcoming post-Covid “boom” is to buy Bitcoin.

- March 24: Tesla Co-Founder and CEO Elon Musk, announced on Twitter that the U.S. electric car maker is now accepting payments in Bitcoin in the U.S. Furthermore, unlike most people/companies that accept Bitcoin payments (usually, with the help of crypto payment processor BitPay), Tesla intends to keep all the BTC it receives rather than convert them immediately to fiat currency.

- March 25: Dawn Fitzpatrick, chief investment officer at Soros Fund Management (which is structured currently as a family office), gave an interview to Erik Schatzker on Bloomberg’s “Front Row”, during which she said that the Soros family had invested in crypto infrastructure, sang Bitcoin’s praises (especially in relation to its superiority over gold as a store of value), and generally gave the impression that they had invested in Bitcoin.

- March 25: Robert Gutmann, CEO of New York Digital Investment Group (NYDIG), revealed during a conversation with Real Vision CEO Raoul Pal that his firm has had enquiries from several sovereign wealth funds about potential investments in Bitcoin.

So, how could the Bitcoin price go down with so much bullish news around?

Well, here are a few plausible explanations:

- Legendary billionaire hedge fund manager Ray Dalio, the founder, chairman, and co-chief investment officer of Bridgewater Associates, said during an interview with Yahoo Finance Editor-in-Chief Andy Serwer that he could envision the U.S. government “under a certain set of circumstances” outlawing Bitcoin.

- The U.S. dollar index (DXY) has gone from 92.03 (at 07:30 UTC on March 22) to 92.87 (at 07:30 UTC on March 26), which is the highest level it has been since Nov 2020.

- Around $6 billion worth of Bitcoin options (mostly on crypto derivatives exchange Deribit) are set to expire later today, which could be putting some downward pressure on the spot price.

Earlier today, crypto influencer Ran Neuner said that he found it very bullish that Bitcoin had managed to hold its ground and not drop below $50K this week. Neuner says he expects the next few days to herald the arrival of “the mother of short squeezes”:

Crypto analyst and trader Michaël van de Poppe offered this technical analysis of Bitcoin’s price action a short time ago:

Currently (as of 09:44 UTC on March 26), according to data from CryptoCompare, Bitcoin is trading around $53,349, up 0.76% in the past 24-hour period.

Holger Zschaepitz, Senior Editor at the Economic and Financial desk of the German daily Die Welt and its Sunday edition Welt am Sonntag, offered a market update earlier today, where he said that the return to risk-on investor sentiment seems to be helping the Bitcoin price to go higher this morning:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.