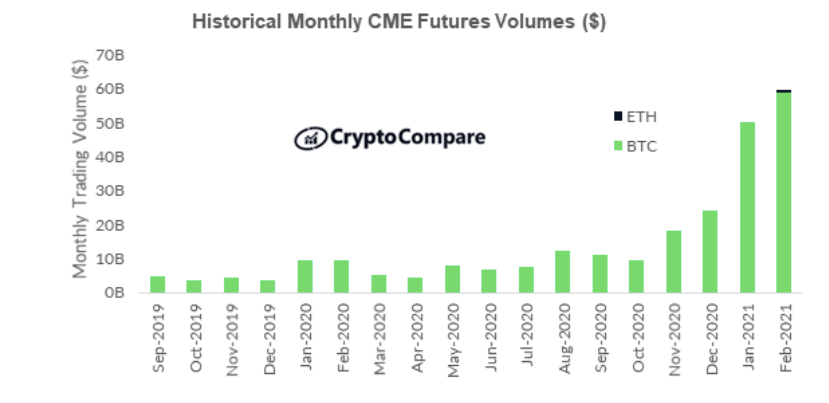

Last month the cryptocurrency futures contracts offered by the Chicago Mercantile Exchange (CME) saw their trading volume reach $59.6 billion. Its BTC futures made up the majority of the trading volume, with the newly launched ETH futures contracts reaching $1 billion.

According to CryptoCompare’s February 2021 Exchange Review, CME’s bitcoin futures trading volume increased by 16.9% to $58.6 billion. The trading platform’s average open interest for BTC futures increased by 23% to $2.5 billion last month, while its ETH futures open interest averaged $61.2 million.

CME’s ETH futures’ trading volume shows a huge level of interest in the second-largest cryptocurrency by market capitalization. While $1 billion is a relatively small trading volume compared to other crypto-focused products, it’s worth noting it takes time for markets to develop.

Bakkt’s Bitcoin Monthly futures contracts, as data from the Intercontinental Exchange shows, also took a while to grow in trading volume. CryptoCompare’s report points out that derivatives trading volumes across native cryptocurrency trading platforms have remained steady in February, while open interest jumped.

Derivatives trading volumes decrease by 0.3% last month to $2.89 trillion Binance was the largest derivatives trading platform by trading volume after trading $1.06 trillion that month. It was followed by OKEx, which traded $525 billion, and by Huobi, which traded $399 billion.

Binance also had the highest open interest across all derivatives products, with $7.3 billion on average. The runner-up was OKEx with $6.4 billion, followed by Huobi with $5.1 billion. Derivatives trading platforms traded a daily record of $215.4 billion on February 22.

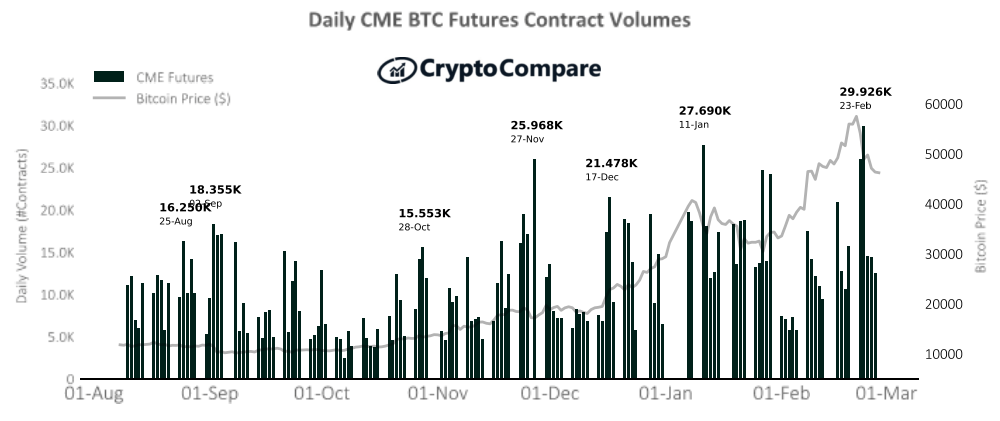

As for CME, its daily maximum for the month was achieved on February 23, when 29,926 BTC futures contracts were traded. The maximum was reached following Bitcoin’s correction from its new all-time high above $58,000. The firm’s options contracts volumes decreased by 26% last month to 1,280 contracts.

It’s worth noting spot trading volumes increased by 17.2% last month to $2.74 trillion, according to CryptoCompare’s report. This means the derivatives market represents 51.3% of the total crypto market, down from 55.3% in January.

Featured image via Pixabay.