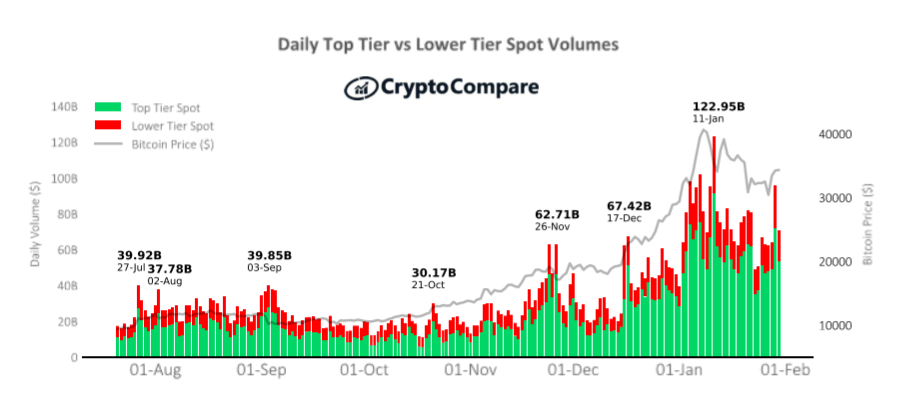

Cryptocurrency spot and derivatives trading volumes have surged last month as the price of bitcoin moved to a high near $42,000 and subsequently crashed to less than $30,000 before recovering.

According to CryptoCompare’s January 2021 Exchange Review, spot trading volumes increased 97% in January to $2.34 trillion, while derivatives volumes increased 101% to $2.89 trillion. Across January, the report adds, volume from the top 15 largest Top-Tier exchanges rose 151.6% on average.

Top-Tier cryptocurrency exchanges are determined according to CryptoCompare’s Exchange Benchmark and are graded AA-BB. Daily trading volume on cryptocurrency exchanges hit a new maximum of $122.95 billion on January 11, the report adds.

The figure dwarfs the previous record of $67.42 billion seen in December. It came during a sharp correction that saw the price of bitcoin drop below the $30,000 from its $42,000 then all-time high. Since then, BTC has hit a new high near $48,000.

Most trading activity, it adds, was driven by Top-Tier exchanges, which have seen their market share grow over that of Lower-Tier exchanges.

Exchanges charging traditional taker fees represented 96% of the total exchange volume last month, while those implementing Trans-Fee Mining (TFM)represented less than 4%. Binance was the largest exchange by trading volume in January, trading $459.6 billion, up 109% from the previous month.

It was followed by Huobi Global, which traded $191.7 billion after seeing its volume rise 134% and by OKEx, which traded $149.3 billion thanks to a 113% rise. These three trading platforms represented approximately 65% of the trading volume of the top 15 Top-Tier exchanges.

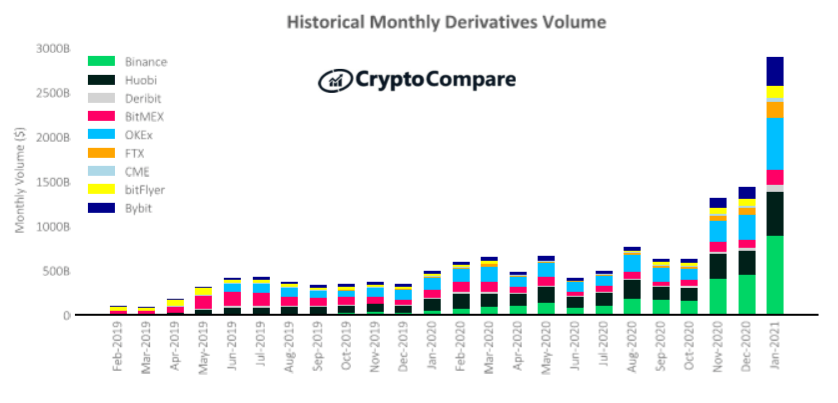

Derivatives Volumes More Than Doubled

Derivatives trading volumes increased by 101% in January to a new all-time high as mentioned above. Binance was the largest derivatives trading platform that month trading $890 billion, up 97% since December.

The exchange was followed by OKEx, which traded $582 billion, and Huobi, which traded $499 billion. OKEx’s volume went up 102.2% that month, while that of Huobi moved up 85.4%. These exchanges were followed by Bybit, which traded $318 billion after seeing its volume grow 138.9%.

The Chicago Mercantile Exchange (CME) traded roughly 285,000 contracts last month, setting a new monthly record. In dollar terms, it traded over $50.1 billion. It maintained the highest open interest for bitcoin futures contracts at $2 billion, followed by OKEx’s $1.6 billion.

Featured image via Pixabay.