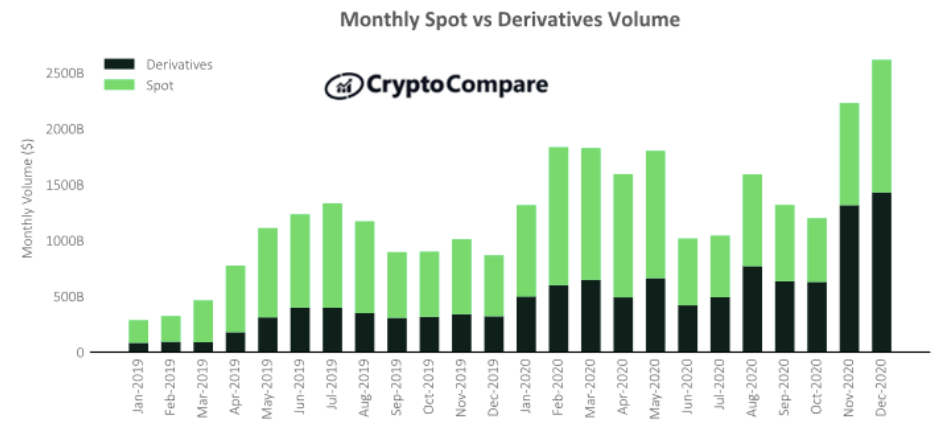

Derivatives trading volumes in the cryptocurrency space hit a new all-time high of $1.43 trillion in December, after rising 8.6% when compared to the previous month. In December, it’s worth noting, the price of BTC surged to $29,000.

According to CryptoCompare’s December 2020 Exchange Review, while derivatives trading volumes surge to a new all-time high of $1.43 trillion, total spot volumes increased by 30% to $1.19 trillion.

Binance, the report reads, was the leading derivatives exchange last month, with a monthly trading volume of $451 billion, up 12.5% since November. It was followed by OKEx, which traded $282.2 billion, and Huobi, which traded $269.3 billion. While OKEx’s volume went up 21.8% compared to last month, Huobi’s dropped 7.6%.

Derivatives trading platform also hit a new daily record last month, as on December 17 daily trading volume hit $91.92 billion. While the volume is significant, CryptoCompare adds, it did not break the previous record set on November 26, when $93.6 billion were traded.

The top four crypto derivatives trading platforms – Binance, OKEx, Huobi, and Bybit – represented 76.8% of the volume traded on December 17. As for open interest, OKEx led the market overall, with an average of $1.8 billion. It was followed by Binance’s $1.7 billion and CME’s $1.3 billion. Top exchanges saw their open interest go up, while that of Binance dropped 20%.

When it comes to BTC perpetual futures Binance has the highest open interest at $1.02 billion, followed by BitMEX’s $498 million. Regulated futures exchange CME had, meanwhile, the highest open interest for BTC futures at $1.31 billion, followed by OKEx’s $1.1 billion.

OKEx led when it comes to ether futures contracts, but it’s worth noting that the CME has announced the launch of an ether futures contract on February 8 of this year. Each ether futures contract is set to have 50 units of ETH and the derivative will trade between 5:00 p.m. and 4:00 p.m. CT from Sunday to Friday. The contracts are eligible to be exchanged for physical transactions, an official announcement reads.

Featured image via Pixabay.