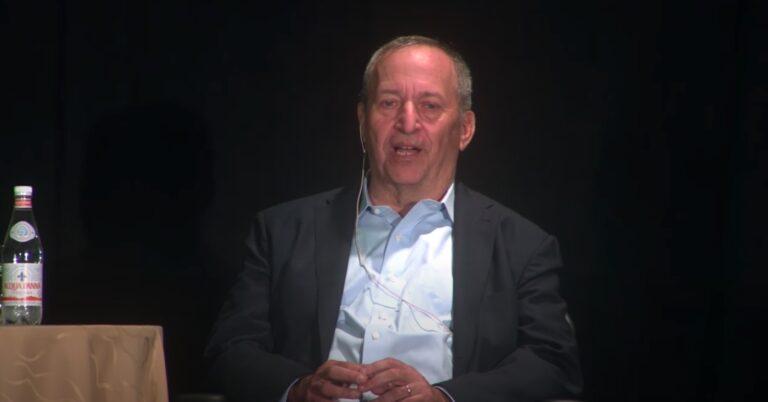

Former U.S. Treasury Secretary Dr. Lawrence H. Summers said last Friday (January 15) talked about Bitcoin and why its price should continue to go up in the long term.

Dr. Summers is one of America’s top economists. Not only was Dr. Summers the 71st Secretary of the Treasury in the Clinton Administration, he served as Director of the White House National Economic Council in the Obama Administration, as President of Harvard University, and as the Chief Economist of the World Bank. Currently, he is the President Emeritus and the Charles W. Eliot University Professor at Harvard University.

Summer’s comments about Bitcoin were delivered last Friday while being interviewed by David Westin on Bloomberg TV’s “Wall Street Week”.

Near the end of the interview, Westin asked Summers if Bitcoin is a bubble.

This was the reply:

“I’m not going to predict its fluctuations over the next six months, but I think some institutions like it, is here to stay. I don’t think that the whole thing is going to collapse. I think that having run up and then run way down, and then move back, it looks much more resilient, and therefore I think people are going to move towards it, and as people move towards it, given the finiteness of its supply, that’s going to be a factor working to raise prices.“

On 28 April 2016, Digital Currency Group (DCG), an investor in some of the best-known businesses in the crypto space, such as Abra, Coinbase, Coindesk, BitGo, and Ripple, as well as the parent company of Grayscale Investments, announced that Summers was joining the firm as a Senior Advisor.

And on 3 May 2016, while speaking at the Consensus 2016, according to CNBC, Summers said that he disagreed with JPMorgan Chase CEO Jamie Dimon’s comment in November 2015 that “no government will ever support a virtual currency that goes around borders and doesn’t have the same controls.”

Summers said:

“Jamie’s a smart guy… But Bill Gates is a smart guy too and he said the internet’s not going anyplace.“