Popular cryptocurrency exchange FTX has listed Coinbase futures contracts under the ticker CBSE ahead of the company’s highly-anticipated initial public offering (IPO), days after it was revealed Coinbase filed a Form S-1 with the U.S. Securities and Exchange Commission.

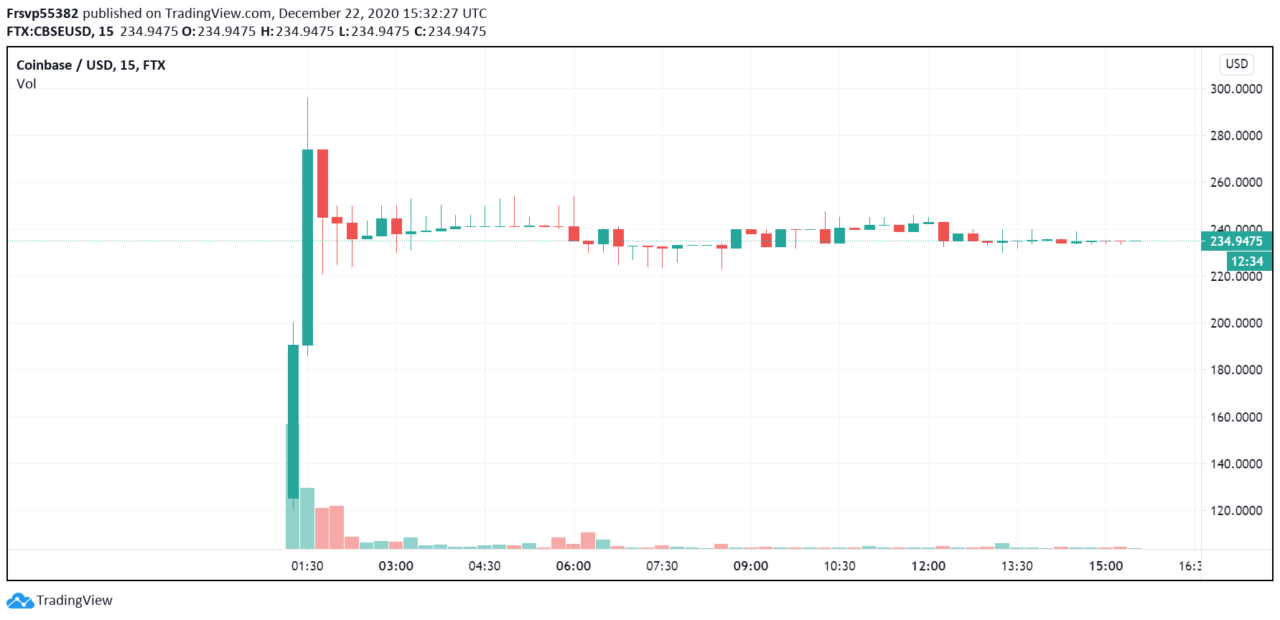

FTX is a cryptocurrency exchange that specializes in derivatives trading. The CBSE futures contracts are designed to represent shares of Coinbase and track its market cap divided by 250 million tokens. With each contract being traded at around $234, Coinbase is being valued at about $60 billion.

The contracts are reportedly going to roll over into fractional stock tokens that mirror the firm’s stock price after its first public trading day. If Coinbase isn’t trading publicly before June 1, 2022, however, the stocks will expire at a cash price of $32 each. Traders can leverage their positions up to 5x on the exchange.

FTX clarified that its listing of CBSE doesn’t necessarily mean it listed tokenized stocks, but instead listed contracts that track the market cap of Coinbase. As an example, FTX pointed to its listing of ABNB, which were listed at $60 ahead of Airbnb’s first trading day. After the IPO the firm opened at $146, which likely put FTX traders in profit.

Available data shows that CBSE contracts have been trading sideways since they were listed, although it’s only been a few hours.

As CryptoGlobe reported, Coinbase revealed earlier this month it “confidentially submitted a draft registration statement on Form S-1” with the SEC. The form is expected to become effective after the SEC reviews it, and means the firm is looking to go public.

Before companies can start offering securities to the public, the SEC requires that they “disclose important financial information through the registration of securities.” Mira Christanto, Asia Advisor at Messari, said in a Twitter thread that Messari’s analysis of Coinbase’s business values the firm at $28 billion.