A newly released report from cryptocurrency exchange OKEx and blockchain data firm Kaiko shows that while large bitcoin holders – whales – sold at a profit as the price of BTC kept going up, retail investors chased the rally while remaining confident.

The report looks at trade sizes to gauge who may be behind the orders. It defines retail traders as those trading up to 0.5 BTC, and professional traders as those trading up to 2 BTC. Between 2 BTC and 5 BTC were large traders and whales, while between 5 and 10 BTC were institutions.

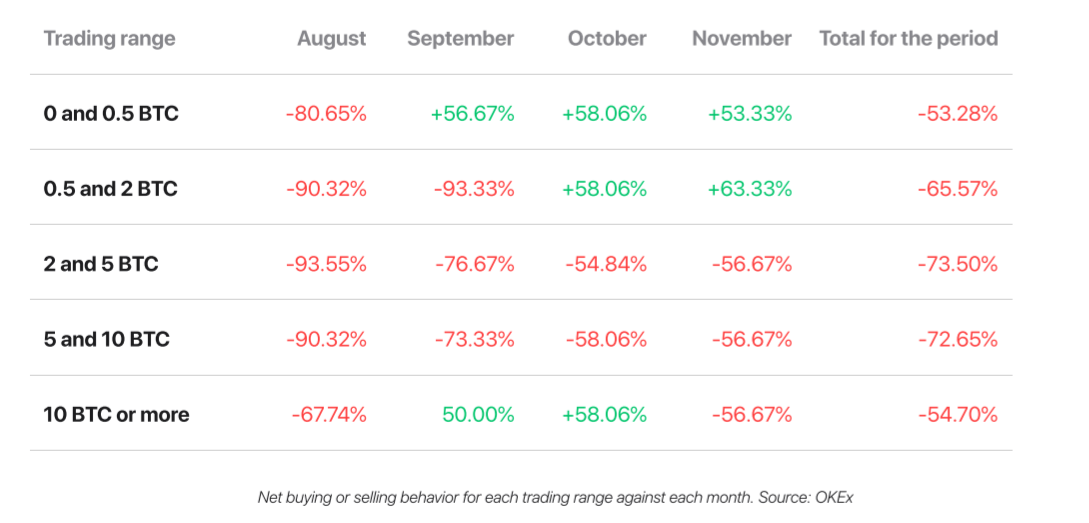

According to the report, which analyzed trading data from August to November of this year, a period in which the price of bitcoin moved from about $11,000 to a new all-time high close to the $20,000 mark, there was heavy net selling throughout August across all trading ranges, as traders were likely taking profits after BTC’s price broke into $11,000 territory.

In October of this year, the price of bitcoin moved up from $10,500 to $13,500 and while retail and professional traders joined the rally and kept buying, larger traders started selling. Those trading 10 BTC or more, however, bought during the rally.

In November, both retail and professional traders kept on buying into the rally, while larger traders, whales and institutions started taking profits. OKEx and Kaiko dug deeper, and analyzed day-by-day trading activity in the last week of November.

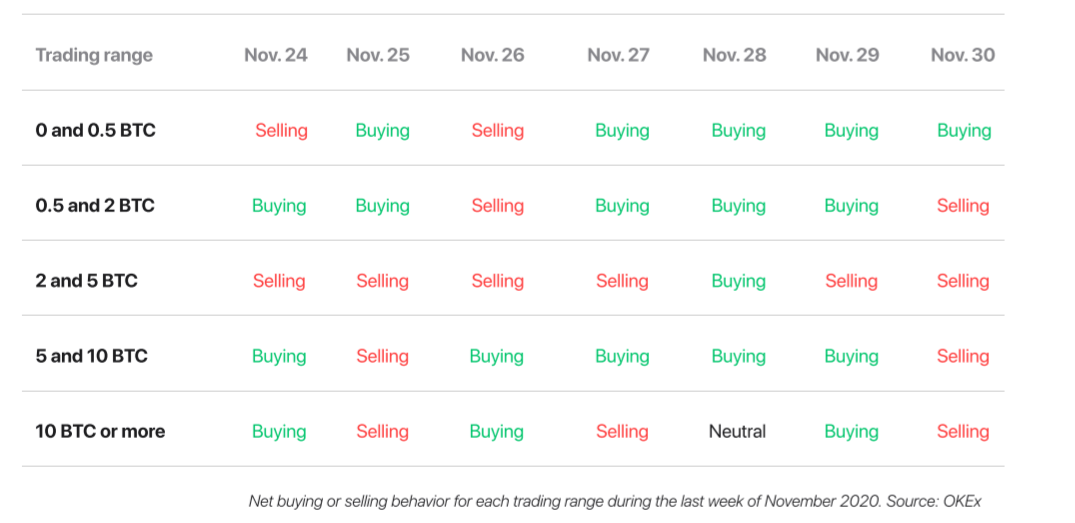

The firms found that most traders, with the exception of retail traders, took profits when the price of bitcoin hit a new all-time high on November 30. Those trading between 2 and 5 BTC mostly bought BTC under $11,500, and were the ones taking the most profit then.

Per OKEx, all trader personas except for whales and institutional investors panic-sold BTC during the so-called Thanksgiving crash on November 26, when bitcoin dropped from $19,000 to $16,000 before recovering. Here, whales and institutions bought “cheap” coins as others sold.

The report concludes that retail traders “have been chasing Bitcoin’s price rally,” while bitcoin whales seemingly took profits and institutions remained “somewhat balanced” as the price of bitcoin moved up this year.

It adds:

Overall, it appears that large traders, whales and institutions that accumulated Bitcoin around $10,000 levels decided to take profits during this rally, while retail traders mostly kept adding to their positions during the price surge.

While it adds that as a result “retail traders will be trapped in the short- to mid-term” overall market sentiment is bullish and could mean “their losses may be short-lived.”

As CryptoGlobe reported, on-chain data has shown that BTC’s whale population hit a new all-time high in late November as entities with over 1,000 BTC in their wallets came close to 2,000 in number.

Featured image via Pixabay.