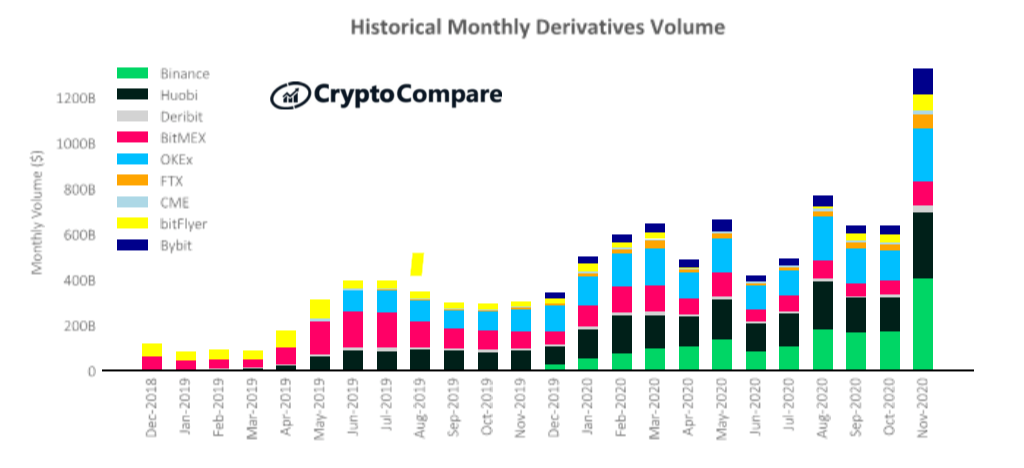

Derivatives trading volumes on cryptocurrency exchanges have surged 108% to a new monthly all-time high of $1.32 trillion, while spot trading volumes increased 59% to $906 billion, according to CryptoCompare’s November 2020 Exchange Review.

The report points out that the derivatives market now represents almost 60% of the total crypto market, compared to 53% in October. The largest derivatives exchange by monthly trading volume in November was Binance, which traded a total of $405 billion, up 132% compared to October.

Binance was followed by Huobi, which saw its derivatives trading volume go up 96% to $290.8 billion compared to October, and by OKEx, whose volume went up 83% over the same period as it traded $235.9 billion. Bybit notably saw its derivatives volume surge 187% to $113.4 billion.

Derivatives trading platforms saw their daily volume set a new record on November 26, when a total of $93.36 billion were traded in a single day, after the price of bitcoin hit a new all-time high. Binance, Huobi, OKEx, and BitMEX represented 79% of the volume traded that day.

When it comes to open interest, Binance also led the pack with $2.1 billion in open interest at the end of November, up 42% since the end of October. It was followed by OKEx’s $1.8 billion, and Huobi’s $1.4 billion.

While Binance also had the highest pen interest in BTC perpetual futures at $867 million, OKEx had the highest for BTC futures at $872 million, and for ETH futures at $218 million. OKEx’s lead on both of these was followed by Huobi.

Institutional trading volumes also went up last month. The CME set a new daily contract trading volume for 2020, with over 25,900 BTC futures contracts being traded on the exchange on November 27. The figure is, however, not a new all-time high as on May 13, 2019, 33,000, contracts were traded. In November, a total of 214,000 contracts were traded, up 37.9% since October.

Featured image via Pixabay.