On Friday (November 20), Dan Morehead, the founder, Co-CIO, and CEO of blockchain-focused investment firm Pantera Capital Management LP (“Pantera Capital”), talked about Bitcoin in the November 2020 issue of his firm’s monthly newsletter (“Pantera Blockchain Letter”).

Why U.S Election Results Should Push the Bitcoin Price Higher

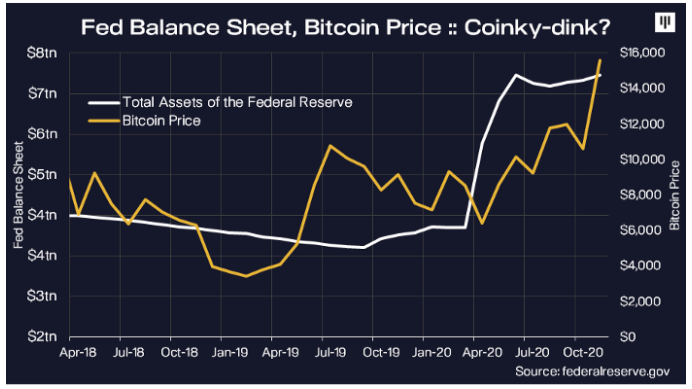

As Morehead correctly points out, it currently looks there will be once again a divided U.S. Congress: a Democrat-controlled House of Representatives and a Republican-controlled Senate. Morehead believes this will “likely result in more pressure on the Federal Reserve to expand their balance sheet” — since it will be very hard for any large fiscal stimulus packages House Democrats come up to get passed by the Senate — and that the necessary monetary stimulus from the Fed will come in the form of quantitative easing (“money printing”), which will “inflate the price of things whose quantity cannot be “eased” — like gold, bitcoin, real assets, and even equities.”

Why There Is a Bitcoin Shortage and Why It Will Only Get Worse

Morehead argues that that currently there is a Bitcoin shortage since users of Square’s Cash App and PayPal’s recently-launched crypto service are “already buying more than 100% of all newly-issued bitcoins.”

Why more than 100%? Morehead says “Square’s Cash App is estimated to be buying around 40% of all newly-issued bitcoin” and “PayPal is already buying almost 70% of the new supply of bitcoins.”

How does Morehead know how much Bitcoin PayPal is buying since PayPal has not reported how much Bitcoin its users are buying?

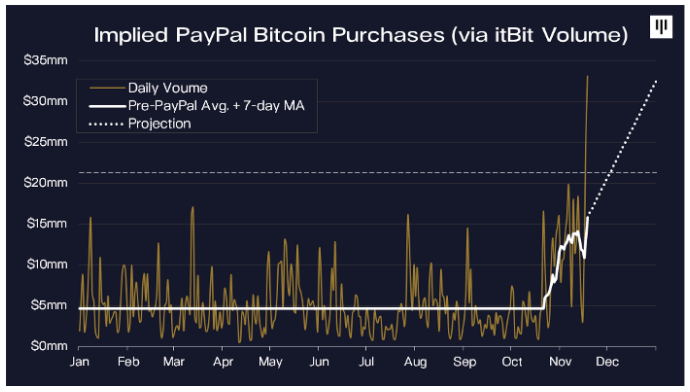

Apparently, Pantera figured this out by looking at the increase in the monthly trading volume of crypto exchange itBit:

“PayPal’s crypto infrastructure provider is Paxos. Prior to PayPal’s integration of crypto, itBit, the Paxos-run exchange, was doing a fairly constant amount of trading volume — the white line in the chart below. When PayPal went live, volume started exploding. The increase in itBit volume implies that within four weeks of going live, PayPal is already buying almost 70% of the new supply of bitcoins.”

Furthermore, Morehead says that “if their growth persists, PayPal alone would be buying more than all of the newly-issued bitcoin within weeks.”

And if institutional demand for Bitcoin continues, as is widely expected, “the supply scarcity will become even more imbalanced,” and of course “the only way supply and demand equilibrates is at a higher price.”

Why Even at $18,000 Bitcoin Does Not Look Overvalued

The Pantera Capital CEO says that although the price of Bitcoin has gone up quite a bit in the past several weeks, “it’s still below the highs and is trading well below its ten-year logarithmic trend.” Also, he says that even at $18,000, “the price of bitcoin is 52% below its long-term regression.”

Morehead goes on to say that “the trend would put bitcoin at $37,000 today,” and that Bitcoin is “trading at the 22nd percentile of expensiveness relative to trend,” which means that it is does not at all overvalued.

Highlights From Morehead’s Recent Interview With Peter McCormack

In episode 279 of the “What Bitcoin Did” podcast, which was released on November 17, the host of the podcast Peter McCormack interviewed Morehead and his old friend Mike Novogratz, who is the founder and CEO of Galaxy Digital.

Two of the most interesting highlights from this interview came from Morehead’s answers to the following two questions:

- “Is there anything more exciting than Bitcoin right now as an investment?“

- Will Bitcoin “be banned”? “Will they regulate it out?”

Regarding the former, Morehead remains super bullish on Bitcoin, even more so than usual at the moment:

“This thing is eclipsing everything out there. For the next 20 years, I think Blockchain will be more interesting than any other investment. For a while, Mike used to keep calling me and say, ‘Hey man, what do you think about the Brazilian real?’ or something. I’m like, ‘I can’t think about anything else. It’s a hundred percent Bitcoin.’”

And regarding the latter, Morehead believes that some people might be unjustifiably worried by regulatory risks:

“I think Bitcoin’s reached its escape velocity. There was a time when regulators or even maybe an oligopoly of banks could have shut it down. It’s now way bigger than that. I think one of the big announcements was when China announced their version of it. It’s game on now. Somebody is going to build a blockchain-based payment system. China is going to build one, Bitcoin has one, there’s going to be some others. You can’t put the toothpaste back in the tube. It’s out.”