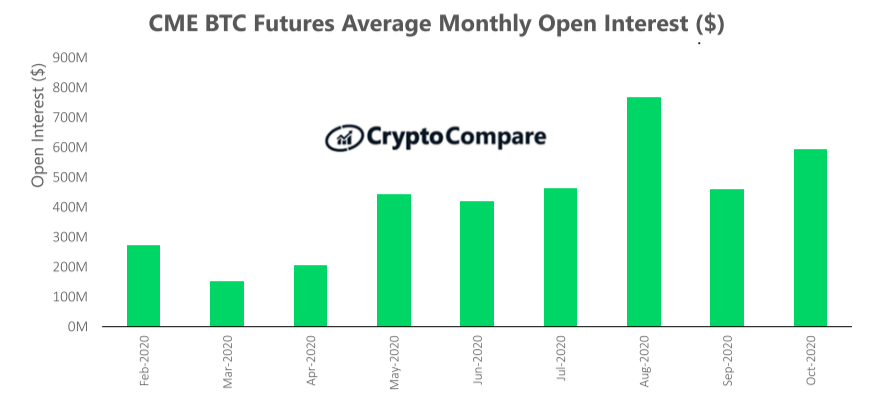

The average open interest on the Chicago Mercantile Exchange (CME), an exchange for the trading of futures and options, went up 28.6% to $593 billion in October, with the month ending with $824 million in open interest.

According to CryptoCompare’s October 2020 Exchange Review, institutional open interest on cryptocurrencies remained high throughout the month, even though spot trading volumes went down 17.6% to $557.7 billion last month.

The report details that the trading volumes of CME’s bitcoin futures contracts decreased by 23% last month, as 155,000 contracts were traded throughout the month. A daily maximum was achieved on October 28, when 15,500 contracts changed hands.

CME bitcoin options contracts also saw a decrease of 23% last month, to a total of 3,747 traded contracts. Despite the trading volume decrease, CryptoCompare’s report details that a daily maximum of 906 bitcoin options contracts were traded on the CME on October 7, a figure higher than those seen in the previous two months.

While institutional trading volumes on the CME dropped significantly, derivatives volumes across the crypto space only decreased by 2.4%, to $619.9 billion. Derivatives exchanges, the report notes, experienced a daily maximum on October 21 of $40.89 billion being traded as BTC’s price approached the $14,000 mark.

The top derivatives trading platforms for retail traders were Binance, Huobi, OKEx, and BitMEX. These reportedly represented 76.6% of the volume traded on October 21. At the end of last month, OKEx led in open interest across all derivatives products, at $1.56 billion.

As CryptoGlobe reported, the report also revealed that Top-Tier cryptocurrency trading platforms have seen spot trading volumes plunge in October, as Binance, Huobi, and OKEx lost between 31% and 42% of their trading volumes when compared to September.

Featured image via Pixabay.