After the price of bitcoin dropped over 10% to $17,200 from a near all-time high, crypto analyst Ki-Young Ju and CEO of on-chain analytics firm CryptoQuant has revealed he believes bitcoin withdrawals being reenabled at popular exchange OKEx were not behind the price drop.

On Twitter, Ki-Young revealed that as soon as withdrawals were reenabled on the exchange some started trying to withdraw their funds. In some cases, in a bid to change their BTC for other cryptoassets that could support faster transactions.

In a follow-up tweet, Ki-Young added that some crypto hedge funds may be sending in BTC or USDT to take advantage of possible arbitrage opportunities on the cryptocurrency exchange, but noted that the “huge amount of withdrawals to non-exchange wallets” could bring “less supply on exchanges,” which would mean less selling pressure is on the price of BTC.

The analyst then added he believes we’re in the third scenario, with 84% of total outflows moving from OKEx going to non-exchange wallets.

Instead, analysts believe the price of bitcoin dropped as cryptocurrency investors cash in on the recent bull run that saw BTC move from little over $10,000 to $19,000 in a few weeks. Speaking to Business Insider John Kramer, a trader at crypto trading firm GSR, kept a bullish point of view.

Kramer said that it feels more like “we’re hitting a Bitcoin tipping point” as while a “cooldown is to be expected,” well-known fund managers and institutions are “ re-examining their Bitcoin theses every day, it’s getting harder to not take the asset more seriously.”

The traded added that many investors feel like the stock market is “utterly divorced from the economic reality right now,” which could have been supporting bitcoin’s rally over the last few weeks. Kramer added:

The stimulus response to the pandemic has stoked lingering concerns among several large asset managers about the devaluation of the US dollar, shining a light on Bitcoin’s finite supply.

Per his words, the “risk-return relationship for digital assets” is now uniquely attractive as it’s uncorrelated to “wider macro and increases the diversification of a traditional portfolio.”

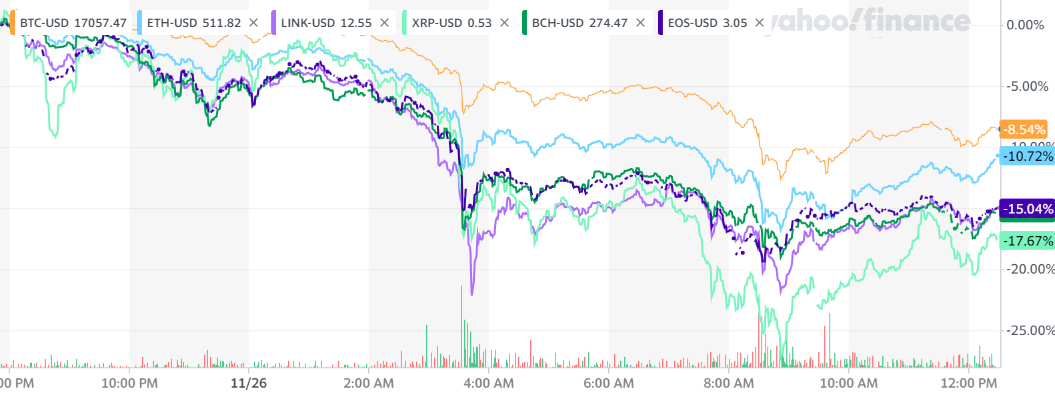

As the price of BTC fell, so did that of most top cryptoassets including BCH, XRP, LTC, LINK, TRX, EOS, and others. Most saw double-digit percentage losses, up to 5% in the case of Stellar (XLM). Market data shows the cryptocurrency space as a whole lost around $70 billion.

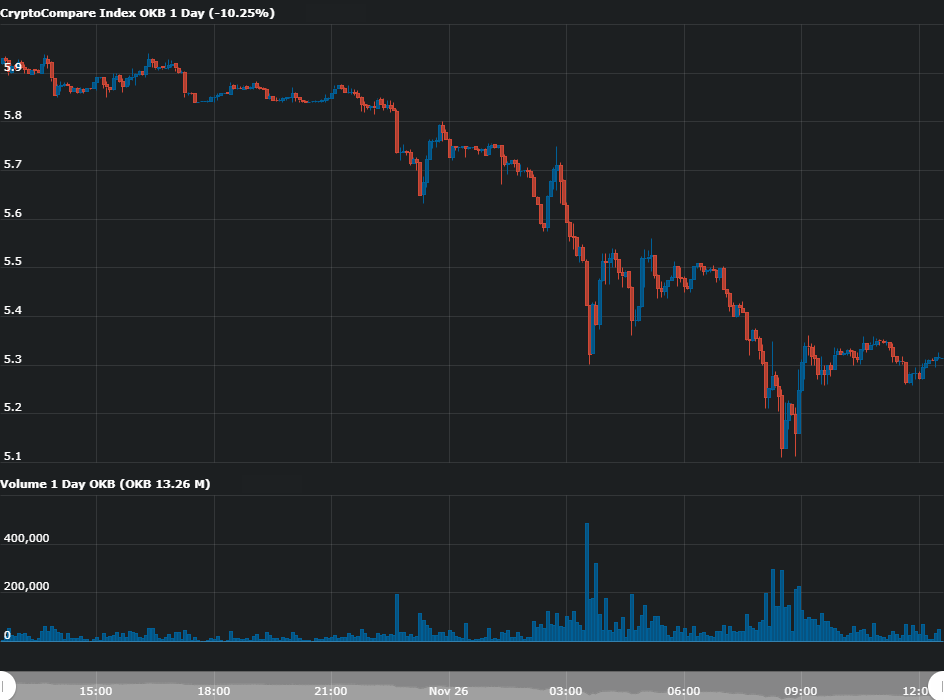

OKEx’s native token OKB, which would be expected to have dropped sharply following the outflows from the cryptocurrency exchange, dropped in line with most top cryptocurrencies, going from about $5.8 to $5.3 at press time, according to CryptoCompare data. In the last 30 days, the token is still up around 13%.

In a separate tweet, Ki-Young revealed that although BTC inflows to cryptocurrency exchanges did increase earlier today, “long-term on-chain indicators say the buying pressure prevails.” The analyst assured his followers he believes it’s still possible to “break 20k in a few days.”

Featured image via Unsplash.