Decentralized finance (DeFi) investors have locked in over $67 million worth of stablecoins in a new yield farming project called APY.Finance within one hour of its launch.

APY.Finance uses smart contracts to help uses generate as much interest as possible from liquidity provided to various other DeFi platforms using DAI, USDC, and USDT. Users are also rewarded with the platform’s APY governance token for adding liquidity.

In a blog post, the project reveals the first month will see liquidity miners earn 900,000 APY tokens, with “incentivization details” varying month-to-month. In total, 31.2 million APY tokens will be mined, and these represent 31.2% of its total supply.

As Cointelegraph reports, the APY token distribution model has raised concerns in the cryptocurrency community, with some arguing regular users will not be able to compete with whales and venture capitalists on the project, which raised $3.6 million in a private sale with investments from Arrington XRP Capital, Alameda research, and others.

While it isn’t clear how many tokens were sold at what prices on this private sale, the project’s token distribution model sees 20% of the tokens going to seed round investors at $0.09, and 16,5% going to strategic investors at $0.135 per token. A further 20% are reserved for the team and its advisors. These are vested for one year.

DeFi Pricing Out Other Ethereum Players

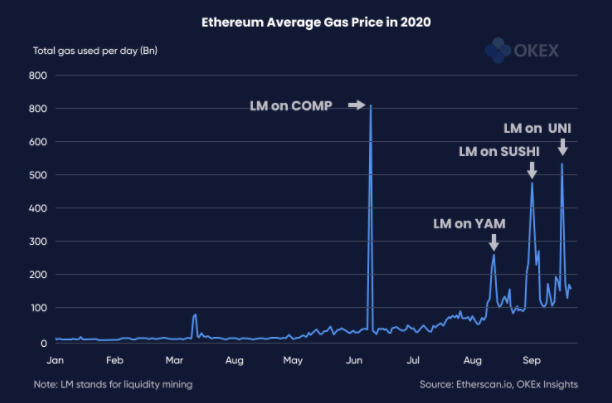

The DeFi yield farming trend has led to an increase in gas fees on the Ethereum network. Gas fees on ETH are measured in gwei, which equals 0.000000001 ether. The trend started after lending protocol Compound launched its COMP governance token, which was distributed to users who interacted with the protocol.

This led to a gold rush, as more projects launched their own governance tokens to attract liquidity miners. The gold rush saw transactions on the Ethereum blockchain surge, to the point the daily gas used reached an all-time high of 80.18 billion in early September.

OKEx Insights reports that spikes of average gas fees occurred when new DeFi tokens for liquidity mining were launched, with gas prices hitting a high of 709 gwei in mid-June during the launch of COMP. Gas prices also spiked when YAM, SUSHI, and UNI were launched.

This flurry of activity and high gas prices priced out other players on the Ethereum network UniLogin, a provider of Ethereum onboarding solutions, announced it was shut down last month over the high gas fees on ETH.

Speaking to OKEx its co-founder, Alex Van de Sande, said reasonable gas fees were crucial for the project to survive. He noted the cost of onboarding one user was now above $130 per user, the equivalent of setting up a new hardware wallet for each.

Nonfungible tokens, and decentralized autonomous organizations are among those getting priced out, as data shows DeFi protocols and decentralized exchange make up the majority of the daily transaction volume on Ethereum over the last 30 days.

While some protocols are looking at layer-two scaling solutions for Ethereum to help reduce gas fees for users Ilya Abugov, lead analyst at DappRadar, pointed out that DeFi project teams may shift from Ethereum to other blockchains. He told OKEx Insights:

Project teams compete to lower their gas fees in order to attract users and developers. Apart from Ethereum, other blockchains like IOST and NEO are launching their own DeFi initiatives.

Abugov added that while ETH layer-two scaling solutions present huge potential to lower gas fees, users and projects may migrate their liquidity if Ethereum 2.0 “cannot effectively solve the problem.”

Featured Image by “Free-Photos” via Pixabay.com