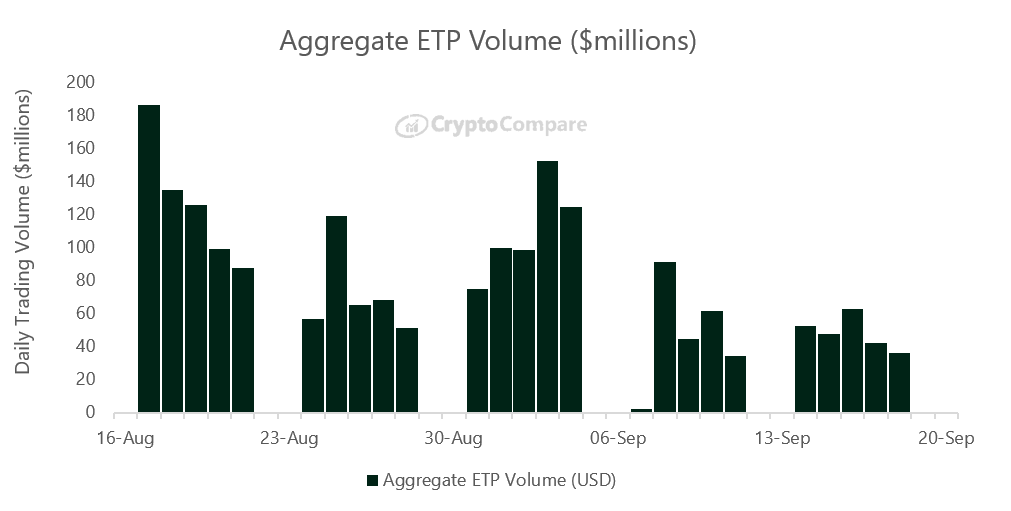

Cryptocurrency exchange-traded product (ETP) trading volumes have plunged over 74% in the last month, as the prices of these products have also been dropping.

According to cryptoasset data aggregator CryptoCompare, in its newly launched The Digital Asset Management Review, exchange-traded products dropped 74% over the last month from $186.5 million in mid-August to an average of $48 million in mid-September.

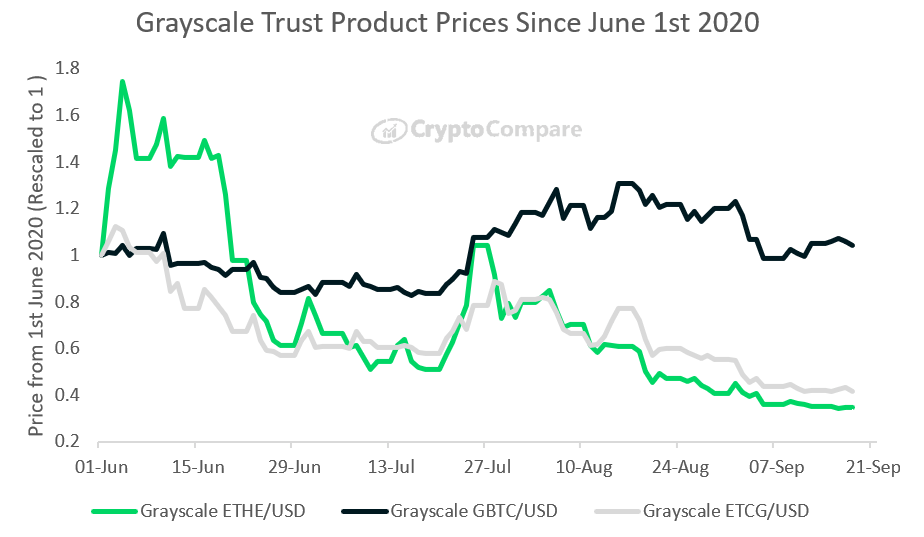

An exchange-traded product, it’s worth noting, is a type of security that tracks other underlying securities or an index. The document notes that Grayscale’s Bitcoin Trust product, GBTC, represented the “vast majority” of ETP volume and as such accounts for most of the decrease in trading activity.

The top three ETPs were Grayscale’s Bitcoin product, and its Ethereum Trust (ETHE and Ethereum Classic Trust (ETCG), and traded a combined $180 million per day in mid-August, and just over $40 million per day in mid-September.

Throughout the last 30 days, CryptoCompare adds, crypto ETP trading activity generally declined. If we exclude over-the-counter products – like GBTC, ETHE, and ETCG – the largest product was ETCGroup’s Bitcoin ETP (BTCE), which traded o Deutsche Boerse XETRA. Other large cryptocurrency ETPs include 3IQ’s QBTC product which trades on the Toronto Stock Exchange and BTCW by WisdomTree which trades on Six Swiss Exchange.

Over the last 30 days, Grayscale’s BTC and ETH products represented the largest average daily trading volumes at $49 million and $7.4 million respectively. These experienced significant losses over said period, dropping 20.4% and 43.4% respectively.

After Grayscale’s products, which often trade at a premium compared to their underlying assets, BTCE saw average trading volumes of $864,000 and experienced a near 9% drop over the last month.

It’s worth noting that the price of most top cryptocurrencies, including bitcoin and ether, dropped significantly over the last 30 days after BTC saw a breakout above $12,000 get rejected.

Featured image via Pixabay.