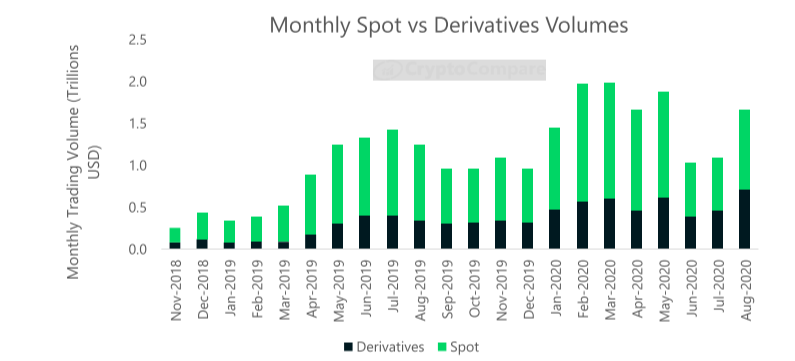

A total of $711.7 billion worth of cryptocurrency derivatives products were traded in August, as volumes went up 53.6% when compared to July. The figure represents a new all-time high for monthly derivatives trading volumes.

According to CryptoCompare’s August 2020 Exchange Review, derivatives volumes went up over 50% in August while spot volumes increased 49.6% to $944.9 billion over the same period, meaning derivatives still represent just over 40% of the market share.

The top crypto derivatives trading platforms saw significant increases in their trading volumes last month. Huobi saw its volume climb 44.7% to $208.5 billion, while OKEx’s volume went up 69.1% to $190.8 billion. Binance’s went up 74% to $184.6 billion, while BitMEX’s volumes went up 43.6% to $72.5 billion.

These four cryptocurrency exchanges, the report points out, represented over 90% of the derivatives volume throughout the month of August. Notably, OKEx, Huobi and Binance also represented 74% of the total spot volume out of the top 15 Top-Tier cryptocurrency exchanges.

CryptoCompare’s August 2020 report also points out Deribit’s options volumes remained steady compared to July, with $4.05 billion being traded last month, down 0.6%. Institutional trading volumes on CME’s futures contracts, however, increased by 36.3% in August to 203,867 contracts being traded.

CME’s options contracts also saw their volumes increased 8.4% in August to 2,715* contracts traded last month. The report further notes that in terms of total trading volumes last month, CME’s crypto derivatives volumes increased 55.7& in line with many crypto native competitors, to reach $12.02 billion.

Featured image via Pixabay.