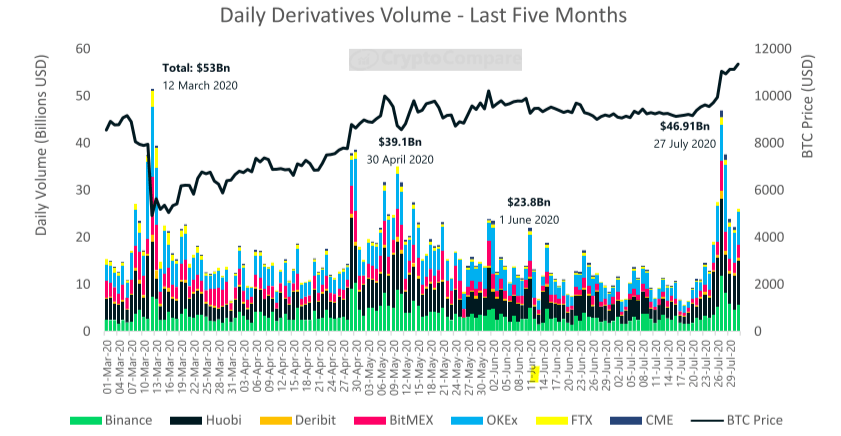

On July 27, after bitcoin surpassed the $10,000 mark, $46.91 billion worth of derivatives were traded. The day’s volume was second only to March 12, the day the price of bitcoin crashed nearly 50%.

According to CryptoCompare’s July 2020 Exchange Review, Deribit’s options volumes stood out last month, as they set a new all-time high, tripling their previous high after a total of $585 million were traded in a single day. Deribit’s monthly options volume hit an all-time high of $4.07 billion, up 81.9%, last month.

The trading platform’s previous monthly record was of $3.06 billion in May of this year, while its previous daily record was on May 10, of $196 million. Deribit, it’s worth noting, trades European-style cash-settled options.

Options are a derivative that gives the buyer the opportunity – and not the obligation – to buy or sell the underlying asset at a set date in the future. Being European style option, they can only be exercised at expiry, and being cash-settled means that upon expiry, the writer of the options has to pay any profit due to the holder, and not transfer the underlying assets.

According to CryptoCompare’s report, derivatives volumes went up 13.2% in July to $445 billion, while spot volumes dropped 0.5% to $639.1 billion. Huobi, OKEx, Binance, and BitMex represented most of the derivatives’ trading volumes. Most of these platforms saw large increases last month. BitMEX, however, saw its volume drop 2.2%.

On the Chicago Mercantile Exchange (CME), futures contracts volumes increased 16.7% since June to reach 149,626 contracts being traded last month. Daily futures contracts hit a new daily high of 25,493 last month as well.

CME options contract volumes, on the other hand, dropped 70.3% last month to 2,504 contracts traded. In June, the exchange traded 8,444 bitcoin options contracts.

Featured image via Pixabay.