On Friday (August 7), the U.S. Dollar Index (ticker: DXY) went up 0.60 (or 0.65) to close at 93.39 due to better-than-expected U.S. jobs growth in July.

On Friday, a press release (titled: “Employment Situation Summary”) by the U.S. Bureau of Labor Statistics, which is part of the U.S. Department of Labor, revealed that “total nonfarm payroll employment rose by 1.8 million in July, and the unemployment rate fell to 10.2 percent.” This report went on to say that “these improvements in the labor market reflected the continued resumption of economic activity that had been curtailed due to the coronavirus (COVID-19) pandemic and efforts to contain it.”

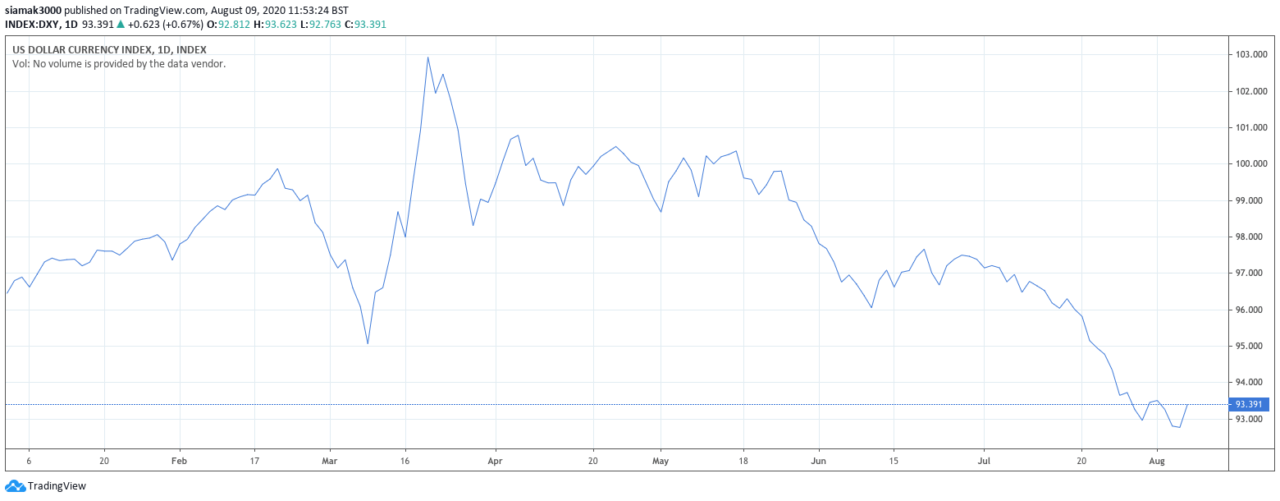

According to a report by Reuters, despite the dollar’s bounce on Friday, last week marked “a seventh straight week of declines” for the world’s reserve currency. In fact, since March 19, the U.S. Dollar Index has fallen 9.17%, as you can see in the chart below by TradingView:

The Reuters report says that Ronald D. Simpson, who is Managing Director for Global Currency Analysis at Action Economics, wrote in a note to clients:

The employment report allayed the market’s downside job fears, allowing the Dollar to rally broadly through the N.Y. session.

It seems reasonable to assume that this slight strengthening of the U.S. dollar could have been at least partly responsible for the small declines in the prices of gold and Bitcoin that we witnessed on Friday, with gold closing 1.38% lower at $2,034.80 and Bitcoin currently (as of 11:10 UTC on August 9), trading around $11,685, down roughly 0.75% since just before the release of the U.S. jobs report for July.

However, it appears that most analysts are not worried by small price pullbacks for either of these asset classes, and they seem content to remain bullish on both precious metals and Bitcoin as long as we continue to have the current macro environment.

Daniel Pavilonis, a senior commodities broker at RJO Futures, provided the following explanation to Kitco News for why gold and silver are going up (and his explanation also applies to Bitcoin which more and more people are starting to view as “digital gold”):

“One of the reasons why the metals are going up is due to the printing up of money. It pushed the real yields into the negative territory down the road. Investors are looking at precious metals as a piece of a longer-term puzzle. As interest rate go lower or negative, investors have money in the bank that will be essentially taxed as they’d have to pay interest on it. What’s the another alternative? This is why people are buying gold, taking delivery of gold bars, and buying futures.”

Interestingly, it is not just that precious metals and bitcoin that have been performing very well since around mid March: U.S. Treasuries, oil, and U.S. stocks have also recorded impressive gains during the past few months, with the S&P 500 up 49.8% since March 23.

Christopher Stanton, Chief Investment Officer at Sunrise Capital Partners, told Reuters that we are in a “bull everything” market:

There are very few losers. Only laggards.

And with the amount of money printing that is going to be needed to fight economic impact of the raging COVID-19 pandemic, it does not seem surprising that investors worried about the debasement of fiat currencies and the increasing potential for high inflation in the future would want to hold almost any asset class except cash.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.