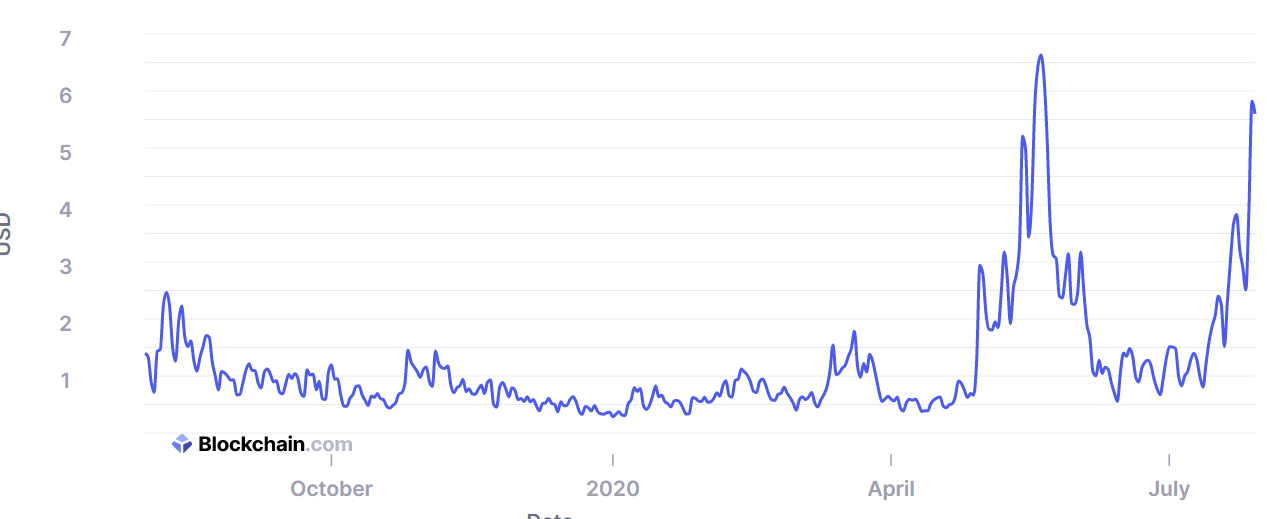

The average transaction fee paid per transfer on the Bitcoin network has surged over 580% after the flagship cryptocurrency broke out of its range between the $9,000 and $10,000 marks.

According to data from Blockchain.com, the average transaction fee earlier this month was between $0.8 and $1.2, while the cryptocurrency traded close to the $9,000 in a tight range. Once it broke out of that range and moved towards the $10,000 resistance, fees started going up as well.

On July 28, they hit a $5.8 high and have since dropped to $5.5, as demand to enter transactions on BTC’s limited block space remains high. Transaction fees rose higher after BTC moved to $11,000, and at press time CryptoCompare data shows it’s trading at $10,900.

In May, transaction fees rose above $6 on average after the cryptocurrency testes the $10,000 mark and was rejected. This led to a downward movement that saw its price test the support at $9,000 before recovering.

Transaction fees go up when there are too many transactions to fit on the network’s blocks, generating what’s known as the mempool – a backlog of unconfirmed transactions. Mempool data, as Decrypt reports, peaked at around 80 megabytes worth of transactions waiting to be processed on July 24.

Fees go up as BTC users compete to get their transactions into a block, as miners are more likely to process transactions with higher fees. Blockchain data shows that on July 29 the total miners received from transaction fees was $1.2 million, up from $300,000 to $350,000 before the fees went up.

It’s worth noting that transaction fees on the Ethereum network are also going up, as the decentralized finance (DeFi) space has been driving demand from users trying to interact with protocols as much as possible to earn governance tokens from them, in what’s known as yield farming.

Featured image via Pexels.