Tesla’s (TSLA) stock is not holding steady in trading, after news came late yesterday that the company was reversing course in its decision to send workers back to work at its Fremont, CA car factory. The stock is down about 2.7% at time of writing, after being up 10% yesterday.

Tesla’s original direction was in spite of Fremont’s standing order that only “minimum basic operations” were allowed within the municipality’s remit. Tesla’s reversal came as Fremont extended this condition until the end of May, whereas it had before been slated to expire in early May.

A number of companies are set to released their Q1 earnings reports this week – Google, Facebook, Amazon, Apple for example – with Tesla among them, on Wednesday.

Tesla saw its all-time-high stock price in early 2020, after a parabolic runup in prices up to nearly $1,000. The majority of these gains were sold off in March as the Coronavirus hit, with price falling down below $400 briefly.

CryptoGlobe recently reported that popular analyst Jim Cramer still sees Tesla as a viable investment, owing to its popularity among younger people. Others believe the company is overvalued and belongs far lower.

The argument in between, voiced by one FT columnist, is that Tesla’s head start on electric vehicle tech was already (potentially) showing signs of erosion before the COVID-19 outbreak; although he admits that, with the liquidity crunch wrought by COVID, the equation is somewhat changed and perhaps re-emphasizes Tesla’s R&D lead.

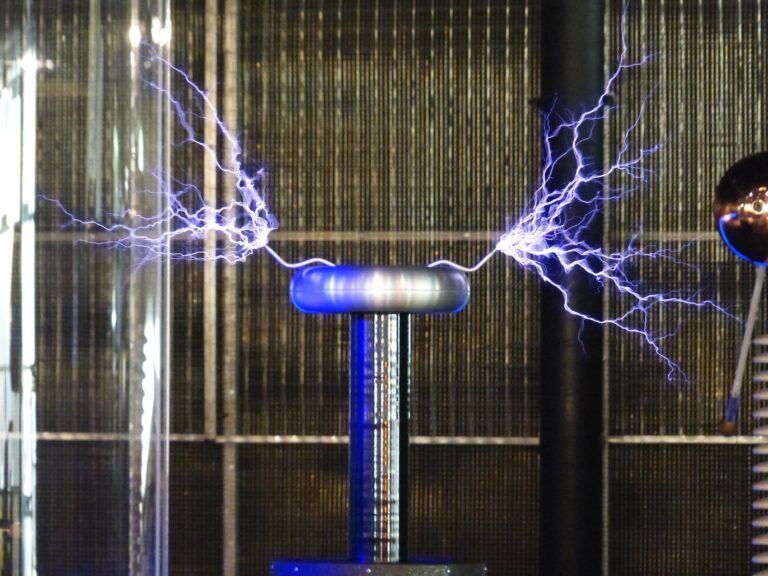

Featured Image Credit: Photo via Pixabay.com