Heading into the weekend, Bitcoin (BTC) is having real trouble getting past a key resistance zone, and leaving a sideways ranging zone.

A few days ago, on March 20, it seemed as if Bitcoin might break higher after a weeklong consolidation in what resembled a bear flag or pennant, within the range roughly between $3,940-4,000 against USD (not USDT).

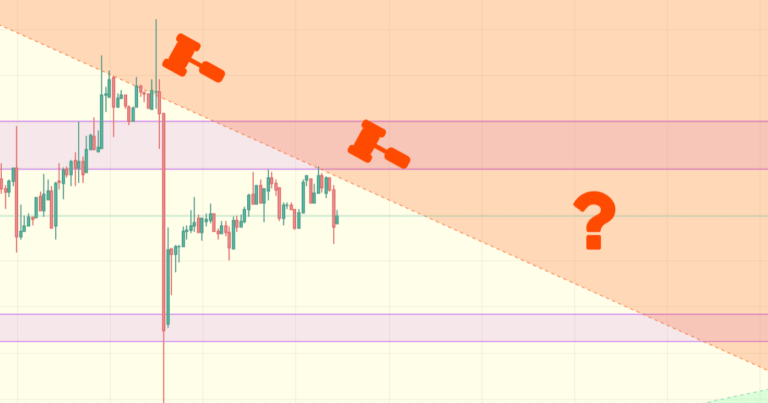

But the break up came more like a slow grind up, on unimpressive trading volume. What’s more, Bitcoin was put on a collision course with an extremely robust downtrend resistance zone – with no less than a full year of deflecting of the leading crypto.

Against this obstacle BTC failed to hold the meager gains above the key $4,200 point – crashing back all the way through previous support and down toward the next support, in the mid $3,800’s. But this dump was quickly bought up, leaving BTC ranging in the exact same consolidation zone from last week.

The renewed sideways ranging is again colliding with the downtrend, unable as of yet to push or break through – already being rebuffed once as of morning (UTC) of March 23 (see below).

(source: TradingView.com)

(source: TradingView.com)

Should Bitcoin continue to be rebuffed at this downtrend, it could continue to be squeezed into the local uptrend support (the green field), and break up or down. The recent uptrend has been fueled by the powerful buying strength whenever BTC has dumped in previous weeks, seen in the blue circles below.

(source: TradingView.com)

(source: TradingView.com)

The full magnitude of this downtrend cannot be taken lightly, as it can be traced back all the way back to March, or even January of 2018. A failure to break it now will only mean a re-confrontation with this trend, in a month or so, as Bitcoin’s current ascending triangle pattern – a bullish pattern – is tested. As mentioned in yesterday’s analysis, this seeming ascending triangle could just as easily turn into a giant bear flag, and break down to new lows for a final (hopefully) BTC capitulation.

(source: TradingView.com)

(source: TradingView.com)

(The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research)