Positive news this week around the launch of Fidelity’s custody solutions in March and the resubmission of VanEck’s ETF application have not materially affected the market.

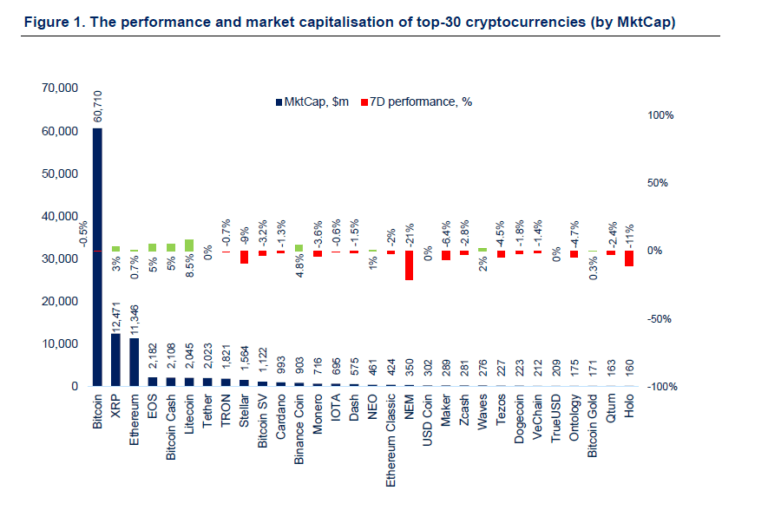

Digital assets were trading within a tight 5% range last week, with total market cap lows and highs at $111bn and $116.5bn respectively. Overall volume is down by more than 30%, from the week’s high of $22bn, currently at the $15bn mark. Bitcoin has found support at $3,400 after a small plunge at the beginning of last week with a quick recovery back to a ~$3,460 range. Bitcoin saw some activity towards the end of the week, with an attempted breakout stopped at $3,550 but is now back at $3,450 at the time of writing. Similarly Ethereum, trading in a 5% range, has found support at $104 and resistance at $110 and is down by 1.5% compared to last Monday. The second largest digital asset Ripple had spiked by almost 15% on Wednesday, however the bullish momentum only lasted a couple of hours and XRP is now back above the $0.3 mark, 3% higher since last Monday. Fourth and fifth largest assets EOS and Bitcoin Cash are both up by 5%.

Crypto Market News

Polkadot Seeks Additional $60m via ICO

Blockchain protocol Polkadot is raising an additional $60m at a fully-diluted token supply valuation of $1.2bn via a second token sale. The project, which aims to solve an interoperability problem, raised $145m in October 2017, of which $98m has been frozen in its wallet due to a bug.

Four Major South Korean Exchanges Team Up to Protect Customers

The four largest South Korean-based crypto exchanges Bithumb, Upbit, Corbit and Coinone, have set up a hotline to tackle money laundering and other suspicious activities, in order to protect customers.

ICE Partners with Blockstream to Launch Tracking Tool

Intercontinental Exchange (ICE), the operator of NYSE and anticipated crypto exchange Bakkt has partnered with blockchain data firm Blockstream to launch a cryptocurrency data feed, which will enable the traders to see real time and historical data, price discovery and other in-depth information about the market.

Fidelity to Formally Launch Custody Service in March

Fidelity Investment is aiming to launch its Bitcoin custody services in March. Fidelity’s solution, designed for big institutional players is “currently serving a select set of eligible clients” only.

SWIFT Wants to Integrate R3 Blockchain Technology

Global payments network SWIFT, which facilitates transactions for a network of 10,000 banks, has formally announced its plans to integrate Ripple’s R3 technology to SWIFT’s Global Payments Innovation (GPI) platform for cross-border payments.

Genesis Capital Processes $1.1bn in Lends and Borrows

Market making trading firm Genesis originated more than $1bn crypto loans over the period of the last 10 months.

Binance Allows Customers to Buy Crypto with Credit Card

Binance, the largest cryptocurrency exchange by volume, now allows its customers to buy crypto via credit cards and effectively has become the biggest competitor of Coinbase, which already has a fiat on-ramp.

NEM Foundation Restructuring

Singapore-based blockchain protocol startup NEM will be laying off staff, cutting budgets and restructuring its business in order to avoid bankruptcy. The 18th largest cryptocurrency by market cap has requested a funding of ~$7.5m from the community.

VanEck Resubmits Bitcoin ETF Application

VanEck has resubmitted its proposal for the VanEck/SolidX Bitcoin ETF with the SEC after the initial proposal was withdrawn earlier in January due to a government shutdown.

More Than 60% of Crypto Hacks Caused by Only Two Groups

According to Chainanalysis, of $1.7bn worth of crypto hacks, more than $1bn has been orchestrated by only two groups of highly sophisticated cyber criminals.

Crypto Exchanges Liqui and QuadrigaCX Shut Down Operations

Ukrainian exchange Liqui is shutting down its services due to a lack of liquidity, while Canadian exchanges QuadricaCX owes its customers $190m after its founder died, and the team is unable to access most of the funds.

Last Week in Funding

Software firm BitTorrent raised $7m via ICO in just 15 minutes; Crypto lending firm BlockFi raised a $4m extension from Coinbase and Able; Crypto compliance startup TRM Labs raised $1.7m in a round led by Blockchain Capital; Staking-as-a-service startup Staked, raised $4.5m from Pantera, Coinbase and others, and Crypto data startup Graph raised $2.5m in seed round led by Multicoin Capital.

Security Token News

TokenSoft Launches Custody Wallet for Security Tokens

Security token platform TokenSoft launched a beta-version of their Knox Wallet, which offers support for a variety of security token standards. Knox Wallet offers three layers of protection – offline storage, role-based access control and cryptographic authentication.

tZERO is Live

The US-based security token trading venue is live from Thursday, matching first orders for its tZERO tokens. The first trade saw 10 tokens bought at $8, which is two dollars less than the STO price (not considering pre-sale). The platform, for now, only operates during normal market hours between 9:30 – 16:00 EST.

Polybird Exchange Launched Beta

Another US-based security token issuance & exchange platform, Polybird, has launched a beta-version.

Agenus Launches First Healthcare Security Token Offering

Nasdaq-listed, immuno-oncology company Agenus, announced the launch of its $100m Biotech Electronic Security Token (BEST) offering, the first security token in the healthcare industry. Agenus has introduced a structure, which allows for targeted investment of a specific product, while preserving shareholder equity.

Securitize, Coinstreet Partners and STO Global-X Collaborate to Bring STOs to Asia

Security token issuance platform Securitize, crypto investment firm Coinstreet Partners and security token exchange STO Global-X have announced a partnership to bring security token services to the Asian market.

Iran Launches Gold-backed Cryptocurrency

A gold-backed token, called Peyman, is a joint project of four Iranian banks Parsian, Pasargad, Melli Iran and Bank Mellat. Peyman’s launch comes amidst speculation that Iran is working on a state-backed cryptocurrency to avoid U.S. sanctions. Peyman will function to tokenize banks’ assets and excess properties.

Regulatory News

UK Firm Approved to Offer Crypto Derivatives

UK financial watchdog FCA has approved the first crypto derivative contract. London-based OTC trading firm B2C2 can now offer crypto contracts for difference (CDFs), which allow long short trading without the need for custody.

South Korea Maintains ICO Ban

South Korea’s Financial Services Commission (FSC) has decided not to lift its domestic ICO ban after the FSC has conducted a survey, which indicates that companies were circumventing the ban by setting up paper companies in Singapore, while still raising money in Korea.

Wyoming Passes Cryptocurrency Bill

The Senate of Wyoming has passed a law which effectively recognize cryptocurrencies under the same regulations and attributions as fiat money. Digital assets are further classified into three categories: digital consumer assets, digital securities and virtual currency. Additionally the Senate is introducing a new set of rules which allow banks to provide custody services.