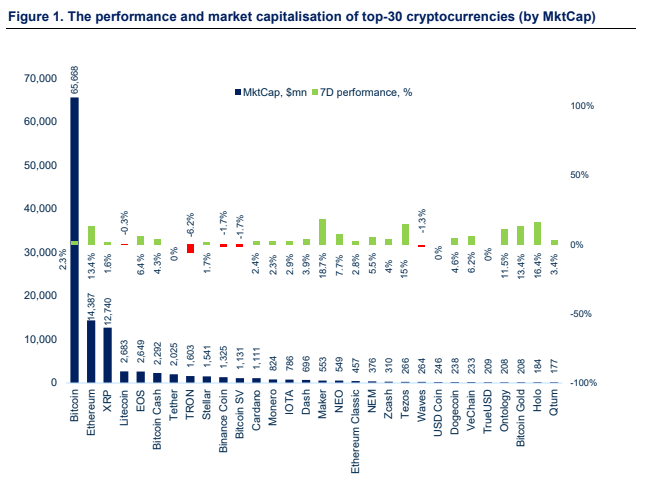

The crypto market woke up to green shoots, with gains for the top-20 assets ranging from 0.5% to 13%. The total market cap surged by more than 4% from $121bn to $126bn, with overall volume increasing more than 30%. Market leader Bitcoin has moved from a week-long consolidation channel to a morning high of $3,750, representing almost a 4% gain. Ethereum is up by a solid 13% as a best performing asset among the top tier crypto, nearing $140 resistance level. XRP is up by more than 4% at $0.31.

JP Morgan Creates Own Cryptocurrency

New York-based major bank JP Morgan is launching its own stable coin, dubbed “JPM Coin”, pegged to the price of 1 USD and built on an enterprise iteration of Ethereum, Quorum. The JPM Coin will be used for settling international payments, securities transactions and for corporations using the bank’s treasury services. Bloomberg editor Joe Weisenthal sees the JPM coin as a direct threat to the other cross-border focused coin, XRP.

Binance Delisting of Low-Liquid Tokens

The largest crypto exchange Binance announced the delisting of five crypto assets on Friday. Cloak, Salt, Substratum, Wings and Modum will be delisted due to low liquidity. This may set an example for other major exchanges to delist the tokens in order to hedge the risk of losing credibility if any of the tokens end up being criminally prosecuted.

Grayscale Q4 Report Reveals 66% of Clients are Institutional Investors

The world’s largest digital currency firm ($1.5bn AUM) has revealed its Q4 2018 report, which caps the total 2018 capital inflow at $330m, from which more than 60% has come from institutional players.

Coinbase Wallet Eyes Private Key Backup

Users of the largest US-based crypto exchange Coinbase will soon have the option to back-up their private keys on cloud storage platforms Google Drive and iCloud. With cloud storage back-up, users will only have to remember a password to recover their funds.

Nasdaq to Add Indices for Bitcoin And Ethereum

Stock exchange Nasdaq in partnership with blockchain data firm Brave New Coin, will offer information on two new indices starting from February 25th. The Bitcoin Liquid Index (BLX) and Ethereum Liquid Index (ELX) will offer “real time spot or reference rate” on 1 BTC and 1 ETH, refreshed every 30 seconds.

First US Pension Funds Invest in Crypto

Crypto VC, Morgan Creek Digital, has attracted the first US pension plans funds in a $40m raise; the Police Officer Retirement System ($1.43bn AUM) and the Employee Retirement System ($3.9bn AUM), both based in Virginia, led the round.

Last Week in Funding

Cryptocurrency transaction analysis Chainanalysis raised $30m in Series B;

Regulatory News

SEC Commissioner Comments on Utility Tokens

The SEC Commissioner Hester Pierce spoke about what she believes is the optimal level of regulation in crypto. Pierce emphasized that any token sale must be conducted in accordance with the existing securities laws, however she said that “tokens that are sold for use in functioning network, rather than as investment contracts, fall outside the definition of securities.”

US Court Reconsiders Blockvest Decision

After additional briefings and reviewing the evidence, the SEC has scored a legal victory after a US district judge placed a preliminary injunction against Blockvest, reversing a previous decision made in November 2018. Blockvest has been accused of violating securities laws in a sale of unregistered securities.

Luxembourg Passes Blockchain Framework Bill into Law

Luxembourg’s Chamber of Deputies has passed a bill which provides a legal framework for blockchain-issued securities and intends to provide investors with legal certainty for issuing tokenised securities.

Indonesia Officially Recognises Cryptocurrencies as Commodity

Indonesian regulators have recognized cryptocurrencies as commodities and trading of virtual assets is now legal in the country.

CFTC 2019 Examination Reveals Major Focus on Cryptocurrencies

CFTC’s first examination this year revealed a major focus on cryptocurrency surveillance practices as well as other market and trading surveillance, including real- time monitoring. Its Division of Market Oversight (DSO), Division of Swap Dealer & Intermediary Oversight (DSIO) and Division of Clearing & Risk (DCR) have been specifically tasked with overseeing this.

Cryptocurrency Markets

Security Token News

US STO Issuers Should be Aware of 1934 Security Exchange Act

US-based STO issuers are required to register with Section 12(g) of the Exchange Act, if offered equity security (i.e. common stock and preferred stock), has more than $10m of total assets and more than 2,000 registered or 500 unregistered investors. A Crowdfundinsider article further explains, that issuers which meet the above mentioned criteria are de facto required to become reporting companies, registered with the SEC.

Elevated Returns Will Transition Aspen Coins to Tezos Blockchain

Real estate investment firm Elevated Returns (ER), which has recently tokenised a luxury resort in Aspen into Aspen Coin, is transitioning coins from Ethereum to the Tezos Blockchain. ER claims to have a $1bn pipeline of real estate assets ready for future token issuances and believes that Tezos is better suited to asset tokenization.