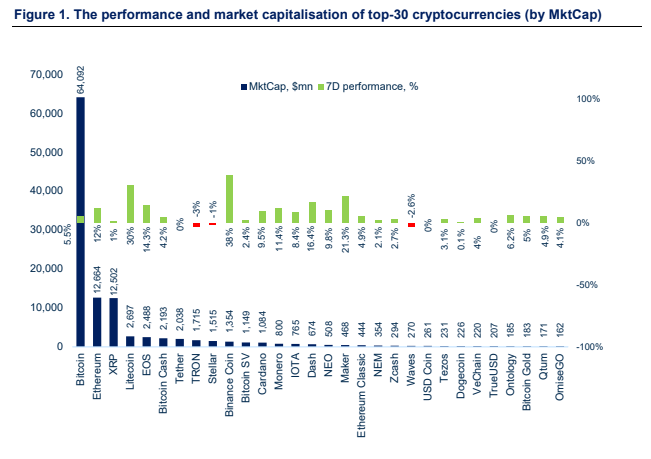

Digital assets recorded an impressive end of the week with a $10bn injection pumping into the total crypto market, a 9% change from the previous week and a 66% increase in volume. A Bitcoin 10% rally towards the $3,750 level, has spiked from the bottom of the falling wedge pattern, and is currently oscillating around the upper trend line formed at the end of Nov 2018, at $3,650. Ethereum has once again jumped over Ripple to second position in market cap ranking, gaining 19% from $105 to a high of $125. Ripple is up by 8% and Litecoin has gained a massive 44%, which pushes EOS into the fourth place largest crypto asset.

Major News Last Week

Kraken Acquires UK Crypto Futures Exchange

US-based crypto exchange Kraken has acquired crypto futures exchange Crypto Facilities in a deal valued at a minimum of $100m. Crypto Facilities is FCA registered, and the only regulated crypto derivative platform in Europe.

Facebook Buys Blockchain Startup

Social media giant Facebook has made its first blockchain-related acquisition in order to boost its blockchain development. Acquired firm Chainspace is a London-based company, focusing on improving the speed of transactions in smart contracts using sharding technology, which Ethereum is also heavily focused on.

Coinbase Launches PayPal Withdrawal Support for EU Users

Coinbase’s EU customers can now instantly withdraw their crypto balances to PayPal accounts.

Abra Launches Stocks and ETF Buy Options

Users of cryptocurrency wallet app Abra can now buy stocks, commodities, indexes and ETFs using bitcoin. Crypto Collateralized Contracts (C3s) is a model which allows investors to convert their bitcoin into different investment options without having to move money from one wallet to another.

Zcash Discloses Vulnerability in its Network

The Zcash foundation has disclosed a bug which would have permitted an attacker to mint infinite number of Zcash tokens. This vulnerability has been successfully fixed. You can read the full disclosure here.

Bitcoin Volume at All Time High in Venezuela

Inflation and sanctions-stricken Venezuelans are posting the highest level of bitcoin volume in history. P2P exchange LocalBitcoins data shows more than 2,000 BTC volume last week.

Bitffury to Launch Bitcoin Mining Facility in Paraguay

Large crypto mining firm Bitfury and R&D firm Commons Foundation will be launching a series of bitcoin mining centres in Paraguay. The project is backed by the government of Paraguay and will be powered by hydroelectric power plants.

Binance Records $446 Million in Profits in 2018

Investigative crypto portal The Block has published an analysis which indicates $446m profit made by crypto exchange Binance in 2018, despite the bear market.

Cryptocurrency Regulation

SEC Commissioner Says Bitcoin ETF is Inevitable

The SEC commissioner Robert J Jackson Jr has expressed his positive outlook on bitcoin ETF approval in an interview with Congressional Quarterly. Jackson’s view is that SEC-approved Bitcoin ETF is inevitable.

Philippines Announces New Crypto Regulatory Framework

The Cagayan Economic Zone Authority (CEZA) has unveiled a new set of Digital Asset Token Offering (DATO) regulations, which essentially require all ICO projects to have detailed whitepapers, including issuer information, advice, certification of experts and DA agents and in addition all tokens have to be listed on the licensed “Offshore Virtual Currency Exchange (OVCE). Moreover, new regulations are dividing DATOs into three tiers, where each tier has a specific set of rules.

Italian Parliament Approves Blockchain Bill

The Italian parliament has approved a bill defining blockchain technology. The next step for the Italian Digital Agency is to define the technical criteria which smart contracts have to comply with, in order to have legal validity.

Mauritius to License Crypto Custodians

The Mauritius Financial Services Commission has finalized a framework which sets out the rules which allow for regulated custody of digital assets. This move is part of Mauritius’s plan to become Africa’s fintech hub, as prime minister Pravind Kumar Jugnauth stated:

“In revolutionizing the global FinTech ecosystem through this regulatory framework for the custody of Digital Assets, my Government reiterates its commitment to accelerating the country’s move to an age of digitally-enabled economic growth.”

Security Token News

Swiss Stock Exchange Aims to Launch Blockchain Platform and STO

The operator of Swiss Stock Exchange SIX Group, plans to launch its SDX security token trading platform in the second half of 2019. SDX will run parallel to the existing SIX platform and will offer trading of stocks, bonds, ETFs, and even assets which are not securities, like vintage cars and art. The Exchange wants to start with trading their own token issued via STO.

Harbor Launches STO Platform 2.0

US-based STO platform Harbor is launching the second version of its platform for compliant fundraising, investor management and liquidity for companies who aim for tokenization of their equity.

Neufund to Release Equity Tokens and First Payouts

German security token investment and issuance platform Neufund has released its tokens to investors who participated in last year’s sale. Investors are also entitled to a first payout of €101k and 60ETH, from proceeds generated from success fees charged for the finalized STO fund raise (3%) and the total number of security tokens sold (2%).

CityBlock Capital to Launch Trading on SharesPost

Venture fund CityBlock will launch trading of its tokens representing ownership interest in the NYCQ Fund on SharesPost’s Alternative Trading System (ATS).