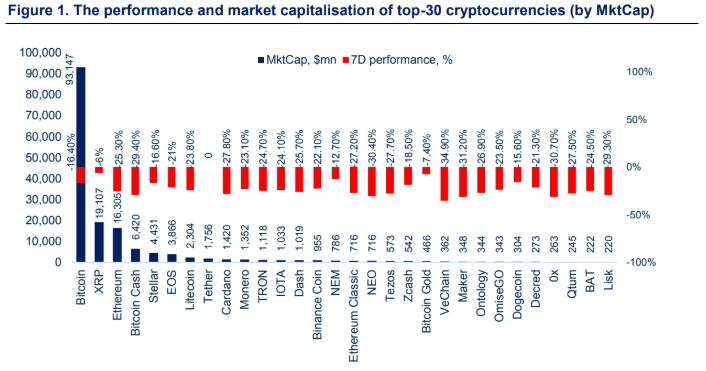

A bloody week indeed for cryptoassets, where the total market cap has lost more than 19% as of today. Starting on Wednesday, Bitcoin’s 16% intraday sell off pushed the price to a new yearly low, followed by the 17.5% decline of Ethereum, and the rest of the herd followed. Massive losses have been supported by the 95% increase in volume. Ripple, on the other hand has been dealing with the general market pressure exceptionally well, where the initial 12% sell off recovered by the end of the week and due to this, XRP overtook ETH as the second largest asset.

For a while last week, Bitcoin was forming the support around $5,600, however European traders woke up to another 6% decline this morning. Reasoning behind the sharp price decline is not clear yet, some naming the Bitcoin Cash fork as a trigger, while more experienced traders stating that they aren’t seeing enough new buyers. At the time of the writing, BTC sits at $5,290, ETH at $156 and XRP is at $0.48.

Cryptocurrency Regulation

SEC Settles Charges against Two ICOs

Two ICOs which conducted token sales last year – Airfox and Paragon have agreed to register their initial coin offering (ICO) tokens as securities after settling charges with the SEC. In addition to registration, both companies will refund investors, file periodic reports to the SEC and each will have to pay $250,000 in penalties. You can continue reading here if you are interested in how these two cases are creating a template for future law enforcements, article by Stephen Dalley.

SEC Investigates SALT Lending

According to the Wall Street Journal, crypto loans startup Salt Lending is under SEC investigation as to whether its $50 million ICO was in fact a securities offering which should be registered with the regulators.

Statement on Digital Asset Securities Issuance and Trading by SEC

With recent actions against Salt, Airfox, Paragon, EtherDelta and many other crypto projects on the regulator’s radar, the SEC published a report on Friday, explaining its roadmap for the regulation of ICOs, exchanges and other entities which facilitate token transactions. According to many experts from the industry, the “ICO party is over”; Nic Carter, partner at Castle Island Ventures, has publicly recommended to ICOs to “get ahead of the game and close up shop, delist the token, get everyone their money back and pursue a normal business model that doesn’t require a token.”

There are three important items the SEC paper outlines: 1. The agreements with Airfox and Paragon, according to the U.S. SEC “demonstrate that there is a path to compliance with the federal securities laws going forward, even where issuers have conducted an illegal unregistered offering of digital asset securities.” 2. The SEC paper also emphasises the importance for investment vehicles to follow the Investment Company Act of 1940 (“Investment Company Act”), which “establishes a registration and regulatory framework for pooled vehicles that invest in securities. This framework applies to a pooled investment vehicle, and its service providers, even when the securities in which it invests are digital asset securities.” 3. The marketplace or platform, which brings buyers and sellers of digital assets together, including exchanges like EtherDelta, should be registered with the U.S. SEC, which states “Commission actions and staff statements involving secondary market trading of digital asset securities have generally focused on what activities require registration as a national securities exchange or registration as a broker or dealer, as those terms are defined under the federal securities laws.”

China Shuts Down Mining Farms in Two Provinces

Crypto mining farms in Xinjiang and Guizhou provinces had their power shut off due to government tax inspections and real-name registration checks. The mining farms were required to sign an agreement promising that their mining data centers will implement “higher standards for the company’s business real-name system,” as mandated by China’s Public Security Department. The farms estimated losses are more than $143,000 per day.

New York Issues 14th BitLicense Approval

The New York State Department of Financial Services (DFS) has granted New York Digital Investment Group (NYDIG) its virtual license (BitLicense) which allows them to offer liquidity, asset management and custodial services (BTC, BCH, ETH, XRP, LTC) to New York citizens.

Crypto Markets

HODL: World’s First Multi-Asset Crypto Index ETP to Launch in Switzerland on November 21

Amun AG, a Swiss company based in Switzerland’s famous Crypto Valley, is launching this Wednesday the world’s first multi-asset cryptocurrency index exchange-traded product (ETP) on the SIX Swiss Exchange, Switzerland’s main stock exchange. This index uses a custom MVIS CryptoCompare Digital Assets index.

Amun’s product has two features that make it unique and a significant contribution to the crypto space:

- It provides exposure to a basket of five of the most popular and liquid cryptoassets rather than a single cryptocurrency such as Bitcoin (BTC).

- It is required by law to hold as collateral the five underlying cryptoassets.

Galaxy Digital Announces Strategic Changes

The Founder and CEO of the crypto merchant bank founded by Mike Novogratz, has announced that the firm is shifting its focus from small ICO advisory activities towards institutional clients in the space. “The company is adapting to the regulatory framework and the opportunities it is currently seeing, and therefore repositioning its advisory business from focusing on small ICO advisory and blockchain consulting to instead larger, more institutional clients in the space”. As a part of the shift, Novogratz has shut down the offices in Vancouver and some of the major executives are also leaving. Most notably David Namdar, who convinced Novogratz to enter the space a couple of years ago, and worked as a co- head of trading, joined the list of leavers. Former president of GD, Richard Tavoso, will continue to serve as an advisor and member of the board.

69% of Central Banks Study Digital Currencies

Speaking at the Economist of Payments IX conference, European Central Bank executive board member Benoît Cœuré said that 69% of central banks have already begun exploring digital assets, in particularly the concept of central bank-backed digital currencies (CBDCs), which however won’t “be issued within the next decade”. Cœuré also stated that Bitcoin “was a clever idea”, but “sadly, not every clever idea is a good idea”.

The exploration of Central Bank-backed digital currencies was mentioned again last week in Singapore, where Christine Lagarde, Managing Director and Chairwoman of the International Monetary Fund, has encouraged the research of CBDCs in the light of decreasing demand for cash and rising preference for digital money, saying that “I believe we should consider the possibility to issue digital currency. There may be a role for the state to supply money to the digital economy.”

Bitcoin Cash Fork War

On Thursday, the code for Bitcoin Cash’s hard fork was activated and separated into two blockchains. Our Portfolio Manager, Jamie Farquhar, covered the story in detail in NKB’s blog. Meanwhile, hash rate war among BHC ABC and BHC VS camps has begun, as ABC, supported by the world’s biggest miner Bitmain, took the lead with 54%, compared to 46% hash rate of BCH SV supported by CoinGeek mining firm. The man behind BCH SV, Dr. Craig Wright, has threatened BCH ABC backer Roger Ver via email and the Bitcoin community, claiming that if they switch to mine BCH ABC he will sell his BTC in order to support funding of BCH SV, which, according to him, will ride Bitcoin to $1000. At the time of writing, BCH ABC is sitting at $284 vs. BCH SV’s $93, according to Poloniex data. No matter which coin wins this race, for the ecosystem as a whole, forks may significantly weaken institutional interest from entering this nascent market.

Kik is Leaving Ethereum for Stellar

Canadian-based messenger app Kik, which has issued its KIN tokens on the Ethereum blockchain via a $100 million ICO, is quitting Ethereum and will switch to Stellar blockchain due to scaling issues on the Ethereum blockchain.

Oil Industry Giants Forming Blockchain Platform to Automate Post-Trade Processes

Firms like Shell and BP are among the members of VAKT Global, the consortium which intends to launch a blockchain platform to automate post-trade processes in order to modernize commodities trading by the end of 2018. Blockchain might effectively replace paper-based documentation with smart contracts, which would reduce cost, risk and make post-trade processes more efficient.

Despite Price Decline, Crypto-Related Job Demand Is Still Strong

According to a report conducted by CoinDesk and indeed.com, the number of crypto-related job postings has increased by more than 25% in the period October 2017 to October 2018.

Last Week in Funding

Bitcoin reward platform Lolli, which allows users to earn Bitcoin while shopping via partner brands, has raised $2.25 million in seed funding from investors including Bain Capital Ventures and Digital Currency Group. Singapore-based crypto exchange KuCoin, has raised $20 million in Series A funding backed by IDG Capital, Matrix Partners and Neo Global Capital. A crypto gaming startup has raised $833,000 in a seed round from BlockTower Capital and Horizon Digital for its game Neon District. And lastly, Mythical Games Studio raised $16 million from Galaxy Digital’s EOS VC Fund, Fenbushi, OkCoin and others, to create the “next generation game technology studio”.

Security Token News

Singapore Develops Settlement System for Tokenized Assets

The delivery versus payment system (DvP) which has been developed by the Monetary Authority of Singapore (MAS) and Singapore Stock Exchange (SGX), will utilize smart contracts to simplify post-trade processes and shorten the settlement cycle of digital tokens and securities.

Gold and Silver-backed Security Tokens on Malta Exchange

Canadian company Canamex Gold Corp. has signed an MOU with the Malta Digital Exchange in order to list gold and silver-backed security tokens GOLDUSA/SILVERUSA. Canamex is a publicly listed and traded company on the Canadian Securities Exchange (CSE).

First Tokenized Condominium in Manhattan is Almost Finished

A $36.5 million condominium is the first tokenized real estate property in New York and Bloomberg has visited and interviewed people around this project.

iHub Partners with Raise to Tokenize StartUps

Kenya-based technology companies iHub, startup incubator, and Raise, which is a blockchain platform for creation and management of digital securities, has announced a partnership where Raise will help the incubator’s projects raise capital in the form of security offerings.

Atomic Capital Release Digital Securities Standard

Atomic Capital has joined other security market participants by developing its own ERC-20 compatible security token standard, Atomic Digital Security Standard (DSS). This new standard has already been put into use, as Atomic issued its first digital security.