The price of Tether’s USDT stablecoin, which is supposedly backed 1:1 by US Dollars, has recently dropped on top cryptocurrency exchanges. Market analysts are debating if the price discrepancy is merely coincidence, a product of inefficient markets or traders factoring in risk – otherwise known as ‘risk premia’.

If you have any posts/evidence or any info on the recent Tether FUD can you please post it below ⬇️

Curious why everyone is talking about this again…seems to come up every few months.

— Luke Martin (@VentureCoinist) October 3, 2018

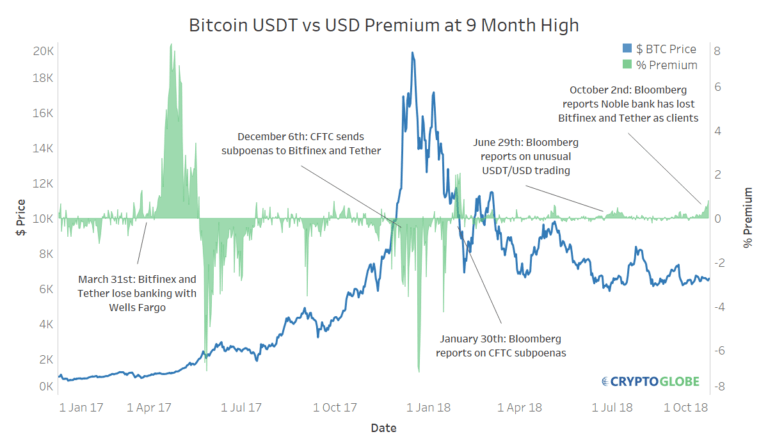

According to CryptoCompare data, Tether’s price recently dropped to $0.955, and at press time is trading at $0.993, having seemingly lost its peg to the USD. Although the current difference may seem small, it means BTC/USDT is trading $55 higher than BTC/USD and this gap just reached a 9-month high, but is there real risk?

If USDTUSD trades lower BTCUSDT must trade higher than BTCUSD to keep markets in line. Otherwise there would be risk free money for arbitrageurs. #Tether pic.twitter.com/TTAUJrl1l4

— Alex Krüger 🇦🇷 (@Crypto_Macro) October 3, 2018

Controversy Surrounding Tether

Some critics argue that the company does not publish transparent or timely audits it is impossible to determine whether they have a 1:1 reserve of USD. Meanwhile, the circulating supply of USDT tokens has grown to 2.8 billion. As a result, Tether has been under scrutiny for months, as some critics even believe its USDT tokens have been printed out of thin air, and used to inflate bitcoin’s price, as a study conducted by University of Texas professor John Griffin suggested.

As CryptoGlobe covered, an analysis published by Bloomberg revealed what appeared to be unusual trading patterns in Kraken’s USDT/USD trading pair. The exchange fought back against the analysis’ findings. Tether was subpoenaed by the US Commodity Futures Trading Commission (CFTC) late last year, as the regulator decided to look into whether the stablecoin is indeed backed by USD.

Looking at Tether’s website itself, it’s clear redeeming USD for USDT is seemingly impossible for new investors, as “registrations are temporarily offline.” Critics claim those who do have accounts can’t redeem the tokens as they have to go through never-ending steps.

Tether is the Hotel California of crypto: you can check out any time you like, but you can never leave.

You can’t redeem the damn tokens. What does it matter if they’re backed or not? There is no mechanism to redeem your Tethers FFS. You can’t get dumber than that.— Trolly McTrollface (@Tr0llyTr0llFace) August 19, 2018

Topping all of this off Nobel Bank, a financial institution in Puerto Rico that was found providing Tether and Bitfinex banking services, is now looking to sell itself after losing both as clients.

Reports have suggested that, as an international financial entity, it would’ve had to report suspicious activity to help US government agencies prevent money laundering. Since Tether and Bitfinex are registered on the British Virgin Islands, their accounts were likely protected as “on-Americans can remain anonymous if the assets are held through offshore companies or trusts.”

Shortly after news of Nobel Bank’s plans started circulating, Bitfinex announced “infrastructure maintenance,” which some claimed was the exchange preparing to pull an exit scam. Investors reacted with fear, which led to the price decrease. However, the maintenance upgrade went smoothly which may reduce premiums in the coming days.

The lead image shows that while today it’s currently more expensive to buy BTC with USDT over USD (% Premium), the difference only reached 0.801% or roughly $55. When it was revealed Wells Fargo turned its back on Bitfinex, the premium surged to as much as 8%, as Crypto News Review points out. The premium briefly rose to 2% when Bloomberg revealed the CFTC had sent Bitfinex and Tether subpoenas on January 30th.

A Digital Fiat Currency

In an attempt to answer the controversy surrounding it, Tether released an analysis of its bank accounts made by the law firm of a former FBI director in June. While the report claimed there was a US dollar to back every USDT in circulation, it stopped short of being a proper public audit.

Although some have claimed the supply increase of USDT tokens seems to be unreasonable, Kraken revealed it believes it’s plausible after analyzing its own fiat deposits. In a blog post, the cryptocurrency exchange revealed:

While our cumulative deposits are several multiples of the amount of USDT issued, we found a positive correlation of 0.78x with R^2 of 61%. Given that USDT has been sold through several high volume exchanges during this time period, we have no reason to believe that the token supply is artificially inflated.

Competitors are Welcome

At the end of the day, Tether’s USDT seems to be the digital equivalent of a fiat currency on a whole new level. The company claims it’s pegged to the USD and as such deems it has a specific value, but it’s only there as long as investors believe that promise. As recent events have shown, as soon as investor confidence wanes, USDT’s price drops.

Recently, various USDT alternatives have started appearing. As CryptoGlobe recently covered, Circle launched a USDC stablecoin, and the Winklevoss Twins’ Gemini exchange launched the Gemini Dollar (GUSD), which along with the Paxos Standard (PAX) is regulated by the New York State Department of Financial Services (NYDFS).