The total cryptocurrency market shrank by almost 3%, even though overall volume spiked by 65% over the past 7-days. The Tether sell off led to a price spike as traders bought bitcoin and other cryptocurrencies to exit the rapidly devaluing USDT. The move was short lived and Tether is now trading closer to $1. Several positive regulatory developments have occurred last week and most notably Fidelity will launch crypto custody and brokerage solutions for institutional investors.

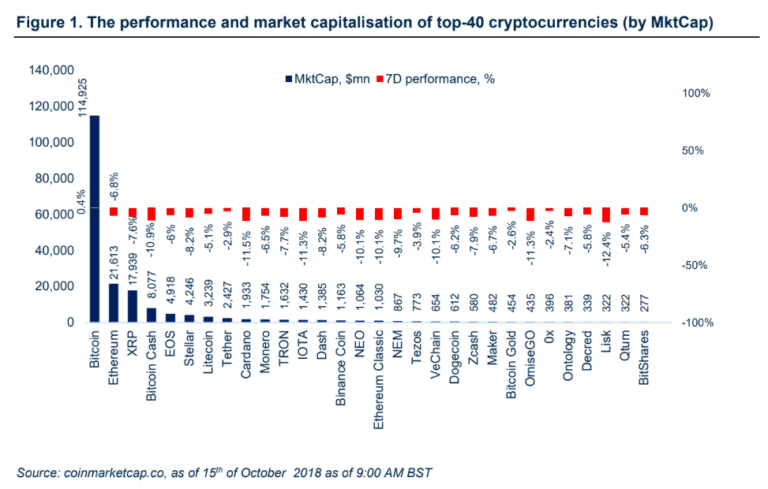

Cryptocurrencies recorded a turbulent week where the total market cap fell from $217 to $197 billion and bounced back in a wild movement to $221 billion earlier this morning. Market leader Bitcoin is up 0.4%, Ethereum is down by 6.8%. The best performer among the top-40 crypto is Aeternity (10.5%), and Bitcoin (0.4%) and the rest of the top-40 group assets are all showing negative. This week’s worst performers from the top-40 assets were Bytecoin (-34%), Siacoin (-13.5%), both cryptoassets have a rating of CCC from TokenInsight.

Crypto Regulatory News

ESMA Regulators to Report on ICO Rules by 2019

European Securities and Market Authority (ESMA) regulators, are debating which ICOs are securities on a case-by-case basis. According to ESMA’s chair, Steven Maijoor ,“Some of these ICOs are like a financial instrument. Once it is a financial instrument it comes under a whole regulatory framework. The subsequent question is what do we do with those ICOs that are outside the regulatory world. We will assess that as a board. We expect to report by the end of the year.”

UAE Allows ICOs as Form of Corporate Funding and Declares it as Securities

Intended for introduction in 2019, the United Arab Emirates plans to introduce new rules which would allow domestic companies to raise capital via token sales as an alternative to traditional methods such as IPO. Head of UAE‘s securities watchdog said Said al-Zaabi stated that “the board of the Emirates Securities & Commodities Authority has approved considering ICOs as securities. As per our plan we should have regulations on the ground in the first half of 2019.”

FINMA Issues License to Swiss Crypto Fund Swiss

Financial Market Supervisory Authority (FINMA) has issued a license to Zug-based Crypto Fund AG, which acts as a cryptocurrency investment fund. With the license, Crypto Fund AG is now allowed to manage and distribute both domestic and foreign funds for investing in crypto-related projects and is also authorized to provide investment advice to corporate investors. Founder and former UBS banker Jan Brzezek has commented: “the importance of crypto assets is growing and our aim is to accelerate maturity in these markets. Regulatory recognition remains highly sought after by participants, as seen in recent press and company statements.”

Advocacy vs. Skepticism in Testimony for the Hearing of US Senate Committee

Economist Nouriel Roubini and Coin Center Director of Research Peter Van Valkenburgh, has testified about the blockchain and crypto ecosystem before the U.S. Senate Committee on Banking, Housing and Urban Affairs. The hearing was entirely educational and is certainly worthwhile reading speeches from both perspectives – “Dr. Doom” (Roubini) vs. “Captain Coin” (Valkenburg)

Crypto Market News

Coinbase lists 0x

Prominent US-based cryptocurrency exchange Coinbase, has listed the first Ethereum token, 0x, on its professional trading platform Coinbase Pro. The token has reacted prior to the listing news with a 32% intraday spike. 0x is an open protocol for decentralized trading of tokens on Ethereum.

Bithumb sells its own 38% stake for $350m

Bithumb, the largest crypto exchange in South Korea, announced that it has sold over 38% stake of its shares to a Singapore-based blockchain consortium BK Global Consortium for 400bn won or $350m. BK Global Consortium is a blockchain investment firm founded by BK Global, a plastic surgery medical group in Singapore. BTC Holdings Company, which currently owns 76% of Bithumb’s equity, has agreed to sell 50% plus one share of 76% ownership to BK Group. That will make BK Group, controlled by the plastic surgeon Kim Byung Gun, the largest shareholder of the crypto exchange once the deal is complete. The deal valued Bithumb at c. $880m. The revealed figures show Bithumb net profit of c. $35m in 1H18, despite a hack in June this year. The exchange also had a rough 3Q18 when new account openings were suspended due to a bank contract issue. Bithumb has c. $1.1bn 24h trading volume.

CryptoCompare Publishes ‘Cryptoasset Taxonomy Report 2018‘

On Tuesday (16 October 2018), CryptoCompare, a leading cryptocurrency market data provider, released its impressive “Cryptoasset Taxonomy Report 2018”, which surveys the cryptoasset landscape, and looks at various ways in which crypto tokens can be categorized.

The taxonomy compiled by CryptoCompare Research represents a detailed analysis of over 200 cryptoassets, based on more than 30 unique attributes, covering a range of economic, legal and technological features. CryptoCompare’s analysis considers a variety of perspectives, including “existing natural cryptoasset groupings; regulatory classifications; access and governance; market cap and volume data; level of decentralisation; generation, distribution and supply concentration, to name but a few.”

Bitwala and Solaris Bank Aiming for First Blockchain Bank Account in Germany

Blockchain banking service startup Bitwala, in partnership with Berlin-based Solaris Bank, is aiming to launch Germany’s first blockchain bank account by the end of November. Founded in 2016, Visa-backed solarisBank closed a €65.6 million Series B earlier this year, and Bitwala recently raised €4 million last month, in order to support its efforts. Thus far, 35,000 users have already pre-registered for the upcoming service.

Coinbase to Shutdown its Crypto Index Fund

After just couple of months, Coinbase has announced that its institutional-focused index fund will be shut down at the end of this month. Current customers will instead be redirected to the recently announced Coinbase Bundle product which is a basket of cryptocurrencies, based on the current market capitalization, of the coins offered by the company, that investors can buy for as little as $25.

Auction House Christie’s to Record Art Sale on Blockchain

London-based leading auction house Christie’s, with over 250 years of history, will register its upcoming autumn sale of $300 million, privately-held collection of 20th century Modernist American art, into blockchain-powered digital art registry Artory, to pilot the encrypted recording of auction transactions.

Yen and Yuan-pegged Stablecoins on the Horizon

According to CN Finance, a bi-weekly magazine and a mouthpiece of the Chinese central bank, PBoC researcher and a professor from Fudan University, Li Liangsong, China should increase its research efforts on the topic of stablecoins and consider backing domestic institutions issuing yuan-pegged cryptocurrencies. The authors go on to argue that the development of USD-pegged cryptocurrencies will strengthen the dominant role of the dollar in the global monetary system, but could have a negative effect on other major fiat currencies. “If the U.S. dollar-pegged stablecoins can eventually be widely recognized by the market and can prove their use in the real economy, we should double down on our research efforts [on the issue] and learn from relevant experience to support domestic institutions to issue yuan-pegged crypto stablecoins,” the authors state.

In the same week, Japanese IT giant GMO Internet is jumping on the stablecoin bandwagon, planning the launch of a yen-pegged cryptocurrency in 2019.

Big School Endowments Joining Yale

Multiple Ivy League and other prestigious U.S. universities are following Yale endowment, which as the first university, entered the crypto world with a $300 million investment into a new fund. Harvard, Stanford, Dartmouth, MIT and the University of North Carolina are said to have made investments in at least one crypto fund, according to this report.

Crypto Security News

First Tokenized Real Estate Fund Brickblock, in partnership with Peakside

Capital Advisors AG, has announced a launch of the world’s first tokenized real estate fund, which will merge institutional real estate investment management with the blockchain technology. This partnership will see Peakside Capital utilize Brickblock’s proprietary software and legal framework for evidencing and databasing a real estate fund on the blockchain, in other words – tokenization.

Security Token Market Launches Beta

Security Token Group has officially launched a beta version of its security token offering (STO) listing site, which can be used to discover, search, track, learn and discuss STOs. “We believe investing in Security Tokens remains a mystery to investors today. Security Token Market will help bridge the gap between investors and STO opportunities . We are excited to be working with the industry to make STOs a new global standard for investing”, Founder of of Security Token Group, Herwig Konings stated.

Netcoins and Polymath to Offer OTC Services for Digital Securities

Netcoins Holdings Inc. has announced a partnership with decentralized security token issuance platform Polymath, where Netcoins will act as an OTC provider to Polymath platform issuers. Netcoins CEO, Mark Binns commented, “Polymath is an industry leader and visionary, and we have complimentary services that can benefit both of our organizations while bringing liquidity options to Polymath’s clients.”

CEZEX to Start Trading Services in Hong Kong by Q1 2019

Philippines security token exchange CEZEX, has obtained a license from Taiwan-based adviser Inbase Partners and will start offering its trading services in Hong Kong within the first quarter of 2019. Apart from freshly minted tokens, CEZEX aims to tokenize stocks, bonds and derivatives and will work with three listing sponsors to help projects list on its exchange.

Comistar Launches STO Service Platform TokenizEU

Estonian firm Comistar is launching their security token offering platform TokenizEU, where projects can issue and sell their security tokens under EU regulatory framework.

Elevated Returns Raised $18 million in STO

Elevated Returns, the owner of St. Regis Aspen luxury resort, has raised $18 million via STO. Investors have received an ownership stake in the Aspen resort via so the called Aspen tokens, which were created on Ethereum ERC-20 standard and which are available for purchase on Indiegogo platform through a partnership with Templum, which is a FINRA and SEC registered operator.