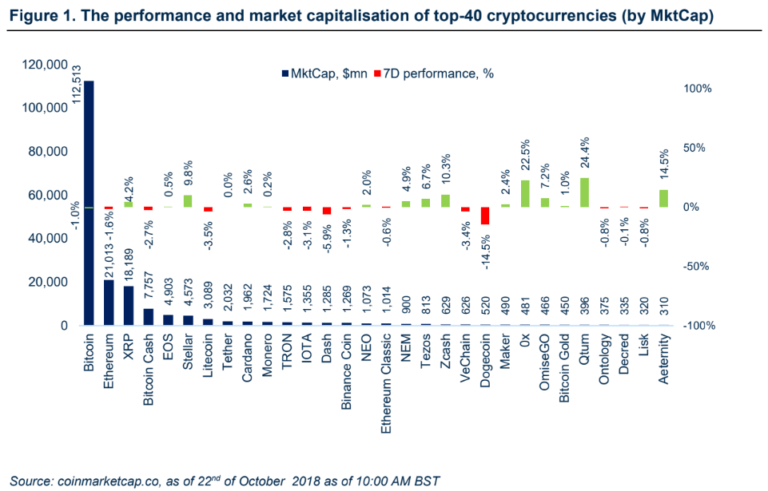

The cryptocurrency markets calmed down after a turbulent week, Bitcoin is down 1% and Ethereum is down by 1.6%. The best performers were Basic Attention Token (55%), Qtum (24%) and recent Coinbase addition 0x (23%). Cryptoassets did not react to the very bullish news around Fidelity and BitGo, CME bitcoin futures volume increased 41% from Q2-Q3 and stablecoin competition remains fierce.

Regulatory Developments

Global AML Watchdog to Draw Regulations By Next Summer

The Financial Action Task Force (FATF), which is the France-based intergovernmental body founded in 1989 to develop policies for tackling money laundering, said that global jurisdictions will have to bring into force licensing schemes or regulations for crypto exchanges and possibly digital wallet providers, under the new rules. Companies offering financial services for initial coin offerings will also be included, the report states. “By June, we will issue additional instructions on the standards and how we expect them to be enforced”, announced FATF’s president Marsall Billingslea, after the FATF plenary meeting with officials from 204 global jurisdictions who were discussing crypto regulations.

The SEC Is Setting Up an ICO Startup Division

The U.S. Securities and Exchange Commission (SEC) is launching the Strategic Hub for Innovation and Financial Technology (FinHub), which will act as a central point for the securities regulator to interact with entrepreneurs and developers in the financial technology world, in particular with groups focusing on distributed ledger technology, digital marketplace financing and AI. FinHub will be run by Valerie Szczepanik and other members who have previously worked in several internal groups which have worked on similar issues. “By launching FinHub, we hope to provide a clear path for entrepreneurs, developers and their advisers to engage with SEC staff, seek input and test ideas”, Szczepanik commented.

Binance Launching a New Software Tool in Partnership With Chainalysis

Binance, the biggest cryptocurrency exchange by trading volume, will be working with crypto compliance and investigation software provider Chainalysis to implement a new global compliance solution. As part of the partnership, Chainalysis will provide access to its “Know Your Transaction” compliance software, enabling the exchange to monitor cryptocurrency transactions in real-time, in particular, the tool will look for potentially criminal or other illicit activity.

The Crypto Markets

Fidelity to Launch Trading Platform and Custody Solution

One of the largest asset management firms, Fidelity ($7.2 trillion AUM), will provide cryptocurrency custody and trading services for institutional clients. According to Tom Jessup, Fidelity’s head of crypto division, Fidelity hopes to attract other institutions including hedge funds and family offices. “In our conversations with institutions, they tell us that in order to engage with digital assets in a meaningful way, they need a trusted platform provider to enter this space. These institutions require a sophisticated level of service and security, equal to the experience they’re used to when trading stocks or bonds”, Jessup added.

CME’s Bitcoin Futures Volume Grew 41%

Chicago Mercantile Exchange published quarterly Bitcoin futures contract stats on twitter. Average daily volume hit 5,053 contracts in the third quarter, representing a 41% increase from 3,577 contracts in the second quarter. The figure also marks a 170 % increase from the first quarter’s 1,854 contracts.

US Marshals Auctions $4.3 Million in Bitcoin

Scheduled to start on Nov. 5, the U.S. Marshals have announced a plan to auction off about 660 Bitcoins (currently worth nearly $4.3 million) that were forfeited in criminal cases. Based on the announcement, the auction consists of two parts with six blocks of 100 bitcoin each and one remaining block with 60 bitcoin. Bidders will not be able to view other bids or change their bid once submitted, the U.S. Marshals added.

Ethereum Upgrade Is Being Postponed Until 2019

Announced by core developers on Friday, Ethereum’s Constantinopole hard fork will be postponed until early 2019 after several bugs were found in the code. Constantinopole contains five changes with the most notable one, that which will cut the amount of new ETH created with each block from 3 to 2. This code change was initially targeted for implementation in November.

North Korean Hackers Stole $571 Million in Crypto

An annual report published by cybersecurity firm Group-IB indicates that a North Korean hacking group called Lazarus was behind 14 hacks on several crypto exchanges from January 2017, which in total represents $571 million. More from the same report claims that $882 million worth of cryptocurrency was stolen from exchanges from 2017 to date.

Directions to Improve Tezos From Arthur Breitman

The co-founder of Tezos, Arthur Breitman, has revealed some thoughts about the protocol amendments. Beginning with nodes, the requirement for running a node remains undisputed, however, some people can retain a full history of blocks, but that doesn’t necessarily need to be a set rule for everyone and there should not be any restrictions for nodes implementing a light client. The consensus algorithm, which includes POS machinery and uses roll-tracking and randomness generation, may use a better randomness which is proposed by Chia protocol regarding computation in a group of unknown order. Another change might be the BFT agreement which could be used and which would require the bakers to achieve Byzantine fault tolerance on each block before processing. The privacy in Tezos is another discussion point, with proposed zero-knowledge proofs used in Zcash to participate in proof-of-stake, if possible. And further discussion around mempool, smart contracts, governance and vote system, and thoughts on constitutionalism can be found here.

Last week Tezos got a listing at Kraken. Tezos is set to be trading in the following pairs: XTZ/USD, XTZ/EUR, XTZ/CAD, XTZ/XBT, XTZ/ETH.

State of Stablecoins

After Bitcoin’s Monday rally, all of the stablecoins were trading either above or below its $1 peg. It all started with the controversial Tether (USDT) which was spotted at $0.85 on Kraken, the recently announced regulated Pax (PAX) at $1.03 and Gemini’s GUSD at $1.19, TrueUSD (TUSD) $1.11 and finally Circle’s USDC at $1.10. The situation with stable coins resulted in the market premiums, how much an investor pays for one bitcoin is fluctuating depending on which stable coin they are using. At one point on Tuesday, purchasing one bitcoin in USDT was roughly $700 more expensive than purchasing one bitcoin in GUSD. On the very same day, Malta-based crypto exchange OKEx announced a fresh addition to its portfolio, four dollar-pegged stable coins. Four days later Singapore-based cryptocurrency exchange Huobi, launched a solution that enables users to switch between different types of stablecoins, in the event of market fluctuations. PAX, TUSD, USDC and GUSD are being supported at the moment. On Thursday Binance announced that it is actively looking to enrich its list of stable coins too.

Cryptocurrency Custodian BitGo Raised $59 Million

US-based Bitcoin custodian BitGo raised $58.5 million in a Series B round, led by Goldman Sachs and Galaxy Digital, who together contributed around $15 million. BitGo was founded in 2013 and currently holds about $2 billion under custody.

Crypto Security News

First Company to Tokenize Shares

Swiss-based Mt Pelegrin Group SA announced that the new company’s shares are, for the first time in history, issued digitally on blockchain in the form of tokens, where a token de-facto represents one share of the company, and which entitles the shareholder to all of his rights protected by Swiss law, notably voting and dividend rights.

Swarm Introduces Security Protocol Marketplace

Swarm has created a tangible and regulatory compliant marketplace that, according to the company’s blog post, efficiently resolves many of the complexities of issuing and trading security tokens. Market Access Protocol (MAP) aims to help token issuers raise capital from a new set of investors, remove the barriers around regulatory compliance, and accelerate the adoption of blockchain in finance. MAP protocol intends to tackle these challenges by allowing for an open and freely accessible marketplace and its participants, enable token issuers to leverage a pre-qualified investor pool, and connect investor qualification process with exchanges.

Sharpe Ventures Invests in OpenFinance

Sharpe Ventures, the investment arm of Sharpe focusing on the expansion of decentralized technologies, announced today in their press release their investment in OpenFinance Network (OFN), the trading platform for tokenized securities.

Solidified Becomes Official Audit Partner of Polymath

Polymath and Solidified have closed a partnership that will see Solidified as Polymath’s Official Audit Partner.“The technical team at Polymath truly understands the importance and multi-tiered nature of blockchain security and always seeks to use the best methods to protect their smart contracts”, as Eduard Kotysh, Founder and CEO of Solidified stated.

NKBs Head of Brokerage Ben Sebley reports on the weekly news:

Our Head of #Brokerage Ben Sebley provides you with the recent #crypto #market updates#blockchain #btc #usdt #fidelity #goldmansachs #bakkt #coinbase #cme #futures pic.twitter.com/WgM7fI4dR4

— NKB Group (@theNKBGroup) October 22, 2018