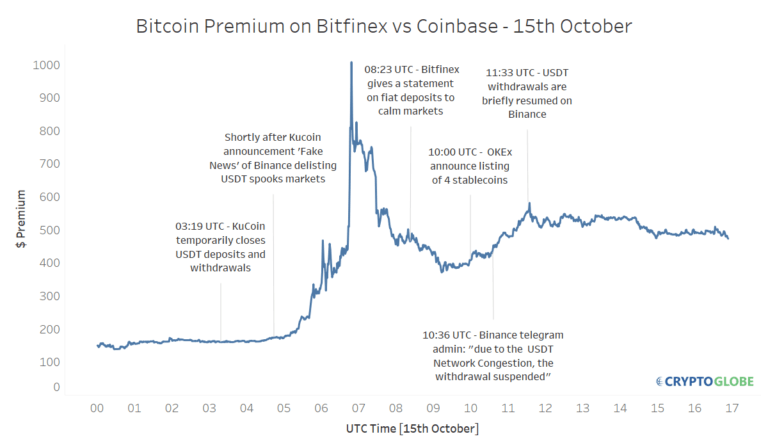

Cryptocurrency prices surged earlier today with Bitcoin (BTC) briefly surpassing the $7,000 mark in what appeared to be a massive Tether (USDT) selloff. Although crypto prices have now dropped, the digital currency market capitalization had increased by over $14 billion within hours. Worries over Tether and Bitfinex have been manifested in a huge bitcoin price premium on Bitfinex and other USDT markets that peaked at $1000 earlier on Monday.

“Fiat Deposits Paused For Certain Groups”

On October 11th, Bitfinex had also suspended fiat deposits which led many to believe or speculate that the exchange might have become insolvent. However, after the wild fluctuations in crypto prices today, Bitfinex clarified on Medium that all crypto and fiat withdrawals had been processing “as usual without the slightest interference.”

However, “fiat deposits have been temporarily paused for certain user groups”, Bitfinex wrote – while not specifying which groups these were. Soon after this announcement circulated, the market seemed to have reacted positively with USDT’s price recovering and the price of BTC and other major cryptos losing some of their gains.

On October 15th, 03:19 UTC, KuCoin temporarily closed USDT deposits and withdrawals and soon following the fake/false news that Binance would be delisting Tether, these events seem to have led tot eh panic selling of Tether and the resulting bitcoin price premium which reached over $1000 per bitcoin between Bitfinex and Coinbase.

OKEx Adds Four New Stablecoins

At 08:23 UTC, Bitfinex issued a statement, as mentioned, which appeared to have calmed the markets, but then at 10:00 UTC OKEx announced the listing of 4 additional stablecoins: TrueUSD (TUSD), USDCoin (USDC), the Gemini Dollar (GUSD), and the Paxos Standard Token (PAX). Analysts believe that with the wide array of alternative regualted stablecoins traders will be inclined to leave Tether.

However, market prices remained fairly stable after this announcement and then at 10:36 UTC, the Binance Telegram admin announced that due to USDT network congestion, its withdrawals had been suspended.

USDT withdrawals briefly resumed on Binance at 11:33 UTC and then the exchange paused them again at 11:48 UTC. Commenting on the recent price movements of cryptocurrencies, Argentina-based economist and trader, Alex Krüger said (via Twitter):

Whoever started last night's run against $USDT was a very large market participant. The kind that is unlikely to stay in $BTC and would want to go back to a stable coin. Some retail funds will likely permanently stay in BTC. Yet would expect some others to permanently exit crypto.

“A Lot Of Volatility Ahead”

Vijay Ayyar, the head of business development at crypto exchange, Luno, said: “If traders start to flee Tether, it’s a potentially precarious situation. It basically implies a lot of volatility ahead.” Notably, there has been considerable debate and speculation regarding whether Tether is actually backed by as much USD as the number of USDT in circulation.

Early on Monday it seemed the market’s confidence, or faith, in Tether might no longer be as strong – which may be attributed to concerns and/or rumors that Bitfinex was becoming “insolvent.”

Although Bitfinex denied these allegations, Noble bank had revealed that it was no longer profitable and would have to shut down its operations as Bitfinex and Tether, both Noble’s former customers, have ended their banking relationship with the institution and reportedly withdrawn large amounts of funds from the Puerto Rico-based bank.