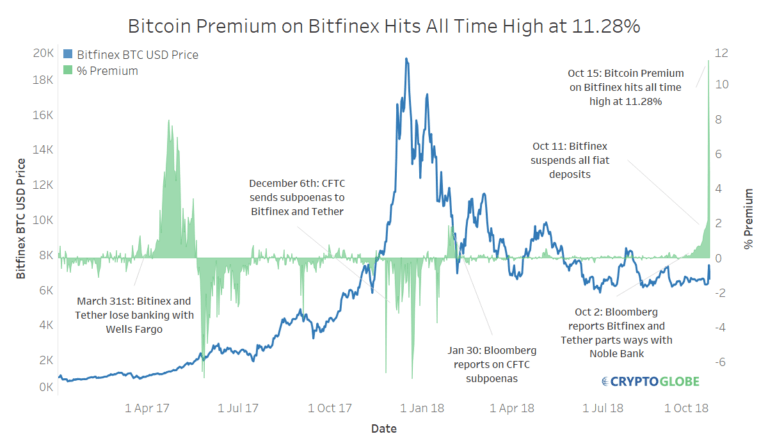

Major cryptocurrency exchange Bitfinex has today (Oct 15th) released a statement addressing the pausing of fiat deposits on the exchange last Thursday (Oct 11th). The statement comes amid an all-time-high Bitcoin price premium on Bitfinex of 11.28% – as the lead image shows.

Explaining that on Thursday the exchange decided to pause fiat deposits for “certain customers in the face of processing complications,” Bitfinex reiterated that fiat withdrawals remained open for the entire period and continue to operate as normal.

Emphasising that the deposits were only temporarily suspended, Bitfinex explained that they are working to put in place a “new and increasingly robust fiat deposit system” to be available by Tuesday (Oct 16th) and thanked users for their patience while the problem was being addressed.

Banking Problems

Following previous reports of banking problems with Noble Bank and Wells Fargo, research from TheBlock last week suggested that Bitfinex had lost its banking relationship with HSBC – a development which many connected to the exchange’s suspension of fiat deposits on Thursday.

Responding to CryptoGlobe last week, Bitfinex commented:

Bitfinex has temporarily paused the depositing of fiat to customer accounts. We expect full trading capabilities to resume as normal within a week. All other service and business features on the platform remain unaffected and are operating as normal.

Tether Premium

These apparent banking problems have been reflected in the market’s attitude to the Hong Kong-based exchange recently, with the BTCUSD ‘risk premium’ – that is – the premium customers attach to what they perceive to be riskier trading on Bitfinex – increasing to over 11.28%, as the title chart shows. This is even higher than the premium reached when Bitfinex lost Wells Fargo as banking partner on March 31st 2017.

Today’s frantic market action – with bitcoin surging over 10% amid a massive Tether (USDT) selloff – will no doubt complicate the market’s attitude to the exchange, which is closely linked to Tether, particularly as a host of regulated stablecoins present a lower-risk alternative to Tether.