Recently revealed data shows that 20% of all hedge funds launched this year are cryptocurrency-focused, meaning they “invest largely, or exclusively,” in cryptocurrencies like bitcoin and ethereum.

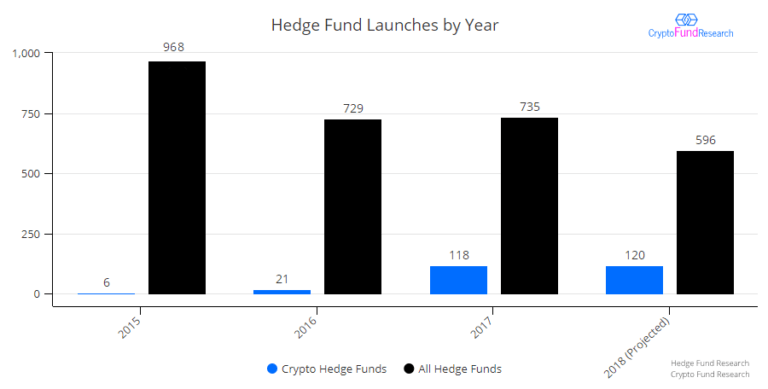

According to a press release shared with CryptoGlobe, data from Crypto Fund Research (CFR), a leading market-intelligence provider, shows 90 cryptocurrency hedge funds launched in the first three quarters of this year, which puts the market on track to see 120 by the end of it.

The release notes that, overall, about 600 hedge funds are expected to launch this year, which means about 20% are cryptocurrency hedge funds. The figure is up from a total of less than 3% in 2016, and about 16% last year. The rise has been caused by a skyrocketing number of crypto funds, as two-thirds of all those operational were launched in “the last seven quarters.”

The document points out these figures defy “traditional thinking that hedge funds tend to launch most frequently in bull markets.” Commenting on the trend Joshua Gnaizda, the founder of Crypto Fund Research, noted the market’s conditions haven’t deterred the launch of new funds, but added:

While we don’t believe the rate of new launches is sustainable longer-term, there are currently few signs of a significant slowdown.

Despite the increasing number of crypto hedge funds, these still make up a small percentage of the industry, as there are a total of 303 crypto hedge funds, comprising 3% of the over 9,000 currently operational hedge funds.

Moreover, crypto hedge funds have less than $4 billion under management, while the global hedge fund industry manages over $3 trillion. Nevertheless, the document adds crypto hedge funds “constitute just under half of the broader class of crypto funds,” as crypto venture capital and private equity funds see the numbers of crypto-focused funds swell to 622.

CFR’s data shows that half of all crypto funds launched this year are US-based, although countries like Australia, China, Malta, and the United Kingdom have seen multiple funds launch within their jurisdictions.

Notably, some crypto hedge funds have been struggling. Pantera Capital, one of the world’s largest, is rumored to be down 72.7% on its investments this year, according to a leaked screenshot.

The crypto hedge fund of TechCrunch co-founder Michael Arrington is set to leave the US in response to subpoenas from the Securities and Exchange Commission (SEC). Via Twitter, Arrington noted the legal costs of dealing with the SEC’s subpoenas “are not insignificant.”