The previous week has reacted positively on the whole despite lows of $170 being seen in ETHUSD markets. Some analysts are claiming that a bottom is finally forming for bitcoin. There are promising signs of institutional interest with regulators approving crypto-related products together with major Wall Street players planning to contribute to the cryptocurrency ecosystem. Three new stablecoins have been announced, two of which are regulated by New York regulators – Paxos and Gemini Dollar. Ethereums long awaited technological developments have been the subject of much debate and Tezo’s mainnet launch announcement caused a strong 30% rally.

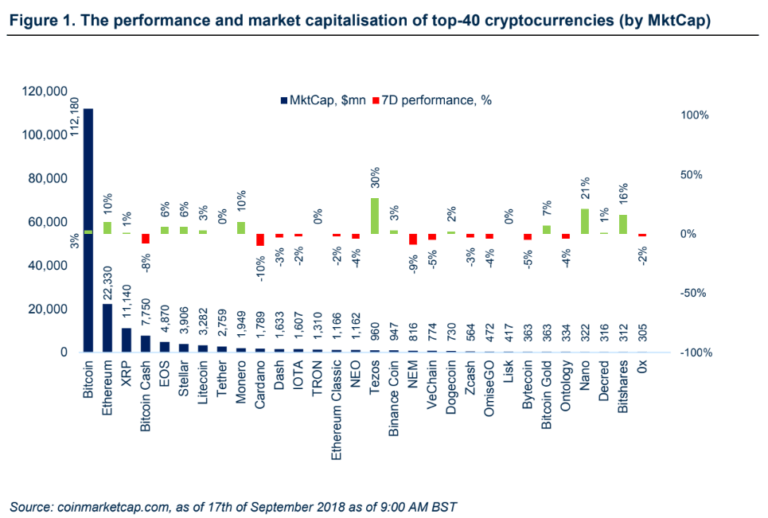

The cryptocurrency market reacted positively to last week’s overall positive news, although total volume fell by almost 11%, and the total market cap rose a little over 2%. Bitcoin gained 2.5%, Ethereum 10%, XRP 1.3%, EOS 6%. Best performers among the top-40 crypto were Tezos (30%), Nano (20%), Bitshares (16%).

Bitcoin’s price reached almost $6,600 highs, gaining 6.5% from the past week’s lows. At the time of writing, BTC has drifted back below $6,500 on a $6,480 price tag. It’s important to point out the probability of 90DMA and 20DMA crossover, which may indicate a stronger price movement.

Ethereum spiked over 30% from last week’s lows of $170 to over $226 with an impressive 41% volume increase in just 48 hours. Positive news from Ethereum core developers about sharding progress were much needed for bleeding ether.

Cryptocurrency Regulatory News

European Union lawmakers pro-crypto approach

After last week‘s suggestions of establishing a new crypto regulation standard for the member states of the EU, proposed by the European Parliament, European Commission Vice President, Valdis Dombrovskis added to the topic that member states are supportive of moves to chart regulations governing the cryptocurrency industry in the economic region. Dombrovskis further sees the potential of ICOs as an alternative form of financing, and stated he can “see that crypto-assets are here to stay, despite the recent turbulence, this market continues to grow.” In the regulatory context, the European Commission is currently exchanging views with the European Supervisory Authorities on regulatory mapping of digital assets, in order to decide on next steps.

Major Firms forming Blockchain lobbying group in DC

A consortium of major crypto players intends to establish a new lobbying organisation which will focus on education and the legal changes of lawmakers in Washington D.C. The Blockchain Association wants to initially focus on tax law and KYC/AML policies. Among the founding members are Coinbase, Circle, Polychain Capital, DCG and Protocol Labs. According to Mike Lempres, Chief Legal and Risk Officer of Coinbase, “The Blockchain Association is an effort to get the preeminent companies in the space together so [policymakers] know they’re hearing from companies that welcome regulation when it’s appropriate … We’re not companies looking to game the system, but trying to develop a legal and regulatory system that’ll stand the test of time.”

BitGo receives U.S. regulatory approval for custodian services

Digital currency storage company BitGo has received the green light from The South Dakota Division of Banking to be the qualified custodian for Bitcoin and 74 other cryptocurrencies for institutional investors. The Palo Alto-based company promises features such as 100% cold storage technology in bank-grade Class III vaults, support for 75+ coins and tokens, institutional-grade policy controls, multi-user accounts, 24/7 support and more. BitGo‘s intention to launch a regulated custodian service started earlier this year in January, when they were trying to acquire another digital assets custodian firm The Kingdom Trust Company.

Cryptocurrency Market News

Bitmain has a serious rival

Chinese crypto mining (over 40% of hashing power) and chip manufacturer (85% market share) hegemon Bitmain is facing serious competition in the form of Bitewei. The Shenzen-based company, founded by Bitmain’s former Director of Design Yang Zuoxing, has raised around $20 million from notable figures in the Chinese bitcoin mining community. According to Tyler Xiong, who is a COO of Bixin and has participated in the Bitewei funding, Bitewei’s WhatsMiner M10 (mining chip) is the “game changer”. Based on Bitewei’s test results, WhatsMiner M10 is roughly 30% more efficient in terms of electricity consumption than AntMiner S9 Hydro, which is the flagship product of Bitmain. Bitewei started a pre-sale of the new miners in August 2018, and has already received over 1,000 orders, with an average of $1,600/per miner. The official launch of the product is scheduled for Wednesday.

Two Dollar-backed coins were approved by New York Regulators

The New York Department of Financial Services (NYDFS) reviewed and approved 2 dollar pegged digital coins on Monday. US-based crypto exchange Gemini is launching a stablecoin built on Ethereum which is essentially designed for the user intending to send or receive U.S: dollars via the Ethereum network. The Gemini Trust Company will hold fiat, which backs the stablecoin in The State Street Bank and the money will be insured by The Federal Deposit Insurance Corporation. According to Gemini’s co-founder Tyler Winklevoss, “The Gemini dollar is part of our mission to build the future of money … It is the missing link between the traditional banking system and the crypto economy”. However, it is important to add the the latest GUSD code review, conducted by Alex Lebed and Alexey Akhunov, points out that Gemini has the ability to freeze any account or to make all tokens non-transferable.

On the same day, blockchain startup Paxos announced the launch of their ERC-20, dollar- backed coin (PAX), which is approved and will be regulated by NYFDS. According to Paxos CEO, Charles Cascarilla, “in the current marketplace, the biggest hindrances to digital asset adoption are trust and volatility. As a regulated trust with a 1:1 dollar-collateralized stablecoin, we believe we are offering an asset that improves on the utility of money”. Paxos is already regulated by the SEC as a qualified custodian.

Ethereum claims breakthrough in sharding

Ethereum core developer Vlad Zamfir, with the help of other team members, claims to have successfully coded a proof-of-concept to illustrate how Ethereum shards may communicate on the blockchain. The sharding experiment has been proposed in order to address the scaling problems. As of now, each participating node in the Ethereum network, has to store and process every transaction individually, which incurs high cost and longer transaction confirmation.

The current state of the Ethereum blockchain is known as the global state, sharding would essentially break the database (blockchain) into bunch of little partitions which contain their own independent piece of state and transaction history, which would help the system to process a great number of transactions in parallel, thus significantly increasing throughput. To simplify the explanation, “the concept of fragmenting the network into more efficient pieces allows the network to function as the sum of its parts, rather than being limited by the speed of each individual node”. If you want to learn more about the sharding, this link is helpful. According to Zamfir, although the code is fundamental to the deployment, the proof-of- concept is not even close to product-ready.

Tezos launches Mainnet

On Friday, the Tezos Foundation announced their mainnet launch, scheduled for today. The largest ICO of 2017, which raised $232 million, can be seen as a direct competitor to Ethereum, as it is a decentralized blockchain which hosts dApps and smart contracts, and it uses delegated proof-of-stake consensus, which is its main point of difference to Ethereum. Prior to the launch of the mainnet, core member of Tezos Foundation, Ryan Jesperson told CoinDesk, “We have been happy to see the network operating smoothly and efficiently over these last few months. The community has been actively engaged, with more than 400 validators (‘bakers’) scheduled for an upcoming cycle and the community has been developing an array of exciting technologies”. With an almost $1 billion market cap, Tezos is currently ranked as number 16 and saw an almost 30% spike in price of the XTZ token in past 7 days.

Institutional adoption of crypto-related products on the rise

According to Business Insider, Citigroup is planning to offer cryptocurrency custody solution for institutional clients and a new trading mechanism called The Digital Asset Receipt (DAR) for Bitcoin, which will serve as virtual certificates for investors, while the actual Bitcoin will be held in bank custody.

Another Wall Street giant, Morgan Stanley is reportedly planning to offer crypto exposure to their clients by non-custodial Bitcoin swap, which essentially allows investors to go long or short on Bitcoin price return swaps, with the bank charging a spread for each transaction.

Goldman Sachs CFO, Martin Chavez has confirmed the firm’s intentions to offer another type of Bitcoin derivative called non-deliverable forwards, which are OTC derivatives settled in U.S. dollars.

The second largest stock exchange in the world, NASDAQ, is developing a suite of crypto-prediction tools to help investors analyze the price movements and sentiment of 500 cryptocurrencies. The firm plans to launch the final product later in November.