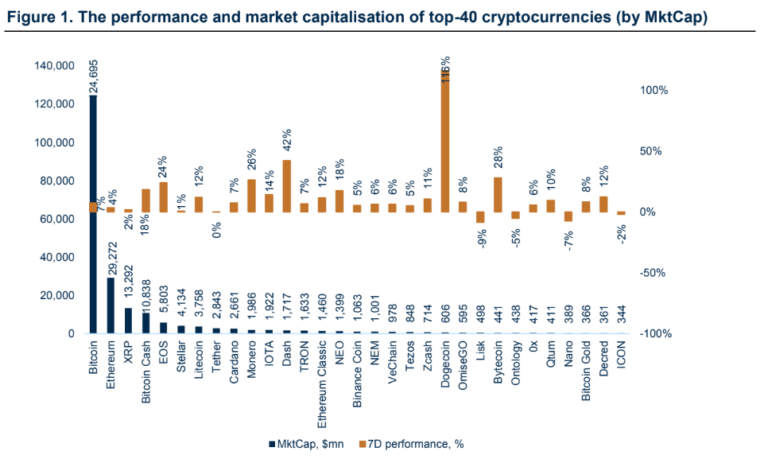

Cryptocurrency markets have rallied over the past week with total market cap increasing by almost 9%. Bitcoin posted a strong gain of 7% with EOS and DASH rallying 24 and 42% respectively. There has been a smattering of relatively small but bullish developments in the space such as Yahoo! finance supporting Bitcoin, Ethereum and Litecoin trading. CBOE said they have plans to launch Ether futures, however, Wall Street analyst, Tom Lee, sees this as bullish for bitcoin but potentially bearish for Ethereum. Satis research released a report on cryptocurrency valueations that had some optimistic 5 year price predictions: Bitcoin $96k, XMR $18k, DCR $535, however, Bitcoin Cash was given a bearish prediction of $268.

Cryptocurrencies had a promising week with volumes increasing and the market cap gaining almost 9%. Bitcoin added 7.4%, Ethereum 4.2%, XRP 2.2%, EOS 24.6%. Best performers among the top-40 crypto were Dogecoin (+116%), Dash (+42%), Bytecoin (+28%). Weakest performance was seen in Lisk (-9%), Nano (-7%)and Ontology (-5%).

Cryptocurrency Regulation

NASAA is involved in over 200 Crypto probes

The North American Securities Administration Association (NASAA), which is composed of regulators from the U.S., Canada, Puerto Rico, the U.S. Virgin Islands and Mexico, has expanded their Operation Cryptosweep from 70 (May 2018) to over 200 investigations in the U.S. and Canada alone. The operation has already resulted in 47 different enforcement actions ranging from securities fraud to new crypto projects failing to register their products properly.

Guangzhou City follows Beijing with Crypto-Promotion ban

One of the biggest Tech Hubs in China, established in the 1980s in order to boost the technological development and economy in Southern China, is following Beijing’s lead on banning crypto-related promotions and activities from the last week. According to the Guangzhou agency, the restriction’s goal is to “strengthen the position of Chinese yuan as the legal currency in China and to stabilize the country’s financial system.”

India eyes rupee-backed digital currency

As we mentioned in our previous Market Update, the Reserve Bank of India (RBI) has formed an inter-departmental unit, which now reveals their initial purpose is to study the “desirability and feasibility to introduce a central bank digital currency”, in response to the rapidly changing landscape of digital payments and the rising cost of printing and managing fiat money, which in 2018 exceeded $90 million. The RBI did not, however, reveal if the state-backed digital currency will be based on blockchain technology.

Russian Agency is seeking to track cryptocurrency wallets

The Russian government agency Rosfinmonitoring, which is responsible for monitoring and preventing financial crimes within Russia, is seeking to expand their services into cryptocurrencies. The BBC has indicated that, with significant help from the Moscow Institute for Security and Information Analysis, Rosfinmonitoring is developing a system, which allows the monitoring of data tied to individuals‘ crypto wallets with a price tag of $2.8 million. Unsurprisingly, the Russian agency has declined to reveal any details.

Japan’s NPA to fund cryptocurrency criminal tracking tool

The Japanese National Police Agency (NPA) will budget $315k to fund development software, which will track the flow of suspicious blockchain transactions and further “locate and visualize” the criminals. The effort comes in response to to 669 money laundering reports from Japanese crypto exchanges and the $6.2 million worth of cryptocurrencies, stolen by hackers in 2017.

Cryptocurrency Markets

OpenFinance launches regulated alternative trading system for Security tokens

US accredited investors are now able to buy, sell or trade digital assets on a regulated trading platform called OpenFinance Alternative Trading System (ATS). Any token which falls under a Regulation D, S, A+ or CF exemption can now trade on ATS. Currently, the first and only token available on the platform is SPICE VC, but the ATS has already announced additions such as Science, Protos, MintHealth, Corl, Bloxroute and Property Coin in the very near future.

CBOE plans to launch Ethereum futures trading

The Chicago Board Options Exchange is supposedly planning to launch ETH futures in cooperation with Gemini, with whom the CBOE previously partnered on launching the BTC futures. Business Insider stated that the futures and options exchange is waiting on the Commodities Futures Trading Commission (CFTC) to give the project a green light before they can officially launch. After the SEC’s announcement regarding Ethereum not being a security, Chris Concannon, the CBOEs Global Markets president, hinted at their plans as he said that,”This announcement clears a key stumbling block for Ether futures, the case for which we’ve been considering since we launched the first Bitcoin futures in December 2017”. The CBOE intends to finalize the whole process by the end of 2018.

Yahoo Finance now supports trading of 4 Cryptocurrencies

Yahoo Finance, the world’s most popular financial news site, now gives you the option to buy and/or sell Bitcoin (BTC), Litecoin (LTC), and Ether (ETH) right from the screen that provides you with market data (provided by CryptoCompare). Although Yahoo provides information on other cryptocurrencies also, currently it only displays only “Buy” and “Sell” for these three.

Ethereum Devs cut block reward by 33% and delay Difficulty Bomb

On Friday’s first “Ethereum Core Devs Meeting Constantinople”, 15 core developers covered a variety of topics including the consensus algorithm, Asic resistance, future hard-forks, difficulty bomb and other topics which are subjects of October’s Constantinople upgrade. Surprisingly, the attendees decided to confirm a 33% block reward reduction from 3 ETH to 2 ETH as an EIP-1234 protocol change. Currently the Ether inflation stands at 7.4% annually, which is exactly 7,378,402 new ETH. With this reduction, inflation will drop to 4.7% or 4,918,935 ETH per year (by way of a comparison, BTC annual inflation stands at 4.11% until the 2020 halving). Along with reducing the block rewards, the EIP-1234 intends to delay the Ethereum difficulty bomb, which gives developers some extra time to implement Casper, which is essentially a switch in the network consensus from Proof-of-work to Proof-of-stake.

Insurance Giant makes entrance into Crypto Space

Lloyd’s of London, the UK insurance company with over 200 offices spread across the globe will reportedly insure a crypto custody platform of another major player in the custodial business, Kingdom Trust. Kingdom Trust has $12 billion AUC, serves more than 100,000 customers and provides cryptocurrency custody to over 30 digital assets. Lloyd’s will protect investors against theft and loss due to natural disaster.

Coinbase survey shows rising popularity of crypto among US Students

According to Coinbase’s survey of 675 students, 18% claimed, they owned some cryptocurrency. The survey also covered off the level of interest among the top 50 US-based Universities, where 21 of them now offer a cryptocurrency/blockchain tech class and 11 colleges now offer more than one.

Dfinity’s $102 million funding round led by Top funds

Swiss-based decentralized “super-computer” Dfinity completed a second round of funding on Wednesday led by Andreessen Horowitz’s a16z crypto fund, Polychain Capital, Multicoin Capital and others. In the previous round, Dfinity had secured $61 million, which in total comes to just over $200 million. The startup plans to launch their open-source network later this year.