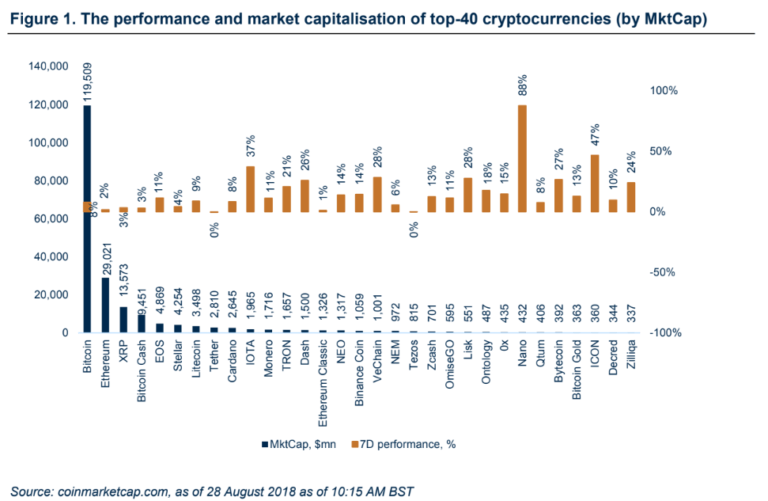

The 7-day performance was good, with no value lost, despite rather negative newsflow from China signalling they will block access to 124 foreign crypto exchanges and the US SEC rejecting 9 ETFs. It looks like the market has already priced in most of the negative scenarios and is forming a bottom. Bitcoin short positions were at 2018 highs last week and this is thought to have caused a ‘short squeeze‘ rally that we are currently witnessing.

Cryptocurrrencies demonstrated positive performance on the whole. Bitcoin added 8%, Ethereum 2%, XRP 3%, EOS 11%. Best performers among the top-40 crypto were Nano (+88%), ICON (+47%), IOTA (+37%). All top-40 digital assets added some value over the week.

Regulatory News

SEC rejected 9 bitcoin ETF proposals

The U.S. SEC has released rejections to bitcoin ETFs proposals submitted by ProShares, Direxion and GraniteShares. The rejection for the three applications came before the deadline. The reason the Commission mentioned its disapproval of the decision of the ProShares case is that the Exchange „has not met its burden to demonstrate that its proposal is consistent with the requirements of the Exchange Act Section 6(b)(5), in particular, the requirements that a national securities exchange’s rules be designed to prevent fraudulent and manipulative acts and practices“, and similar in the case of Direxion’s proposals and Granite rejection. The SEC cited a letter from CBOE, saying that “the current bitcoin futures trading volumes on CBOE Futures Exchange and CME may not currently be sufficient to support ETPs seeking 100% long or short exposure to bitcoin.” One proposal remains under consideration – VanEck and SolidX for physical bitcoin ETF, which was mentioned by commentators as being the strongest candidate of the batch, leaving room for speculation. The deadline on this last case is 30th September 2018.

Singapore authorities may create a secure platform for selling tokenized securities

The Monetary Authority of Singapore (MAS) and the Singapore Exchange (SGX) are looking at blockchain to create a secure platform for selling tokenized securities. Anquan, Deloitte and Nasdaq will work with MAS and SGX to develop a Delivery versus Payment (DvP) platform for tokenized assets, including tokenized digital currencies and securities assets. The DvP platform will be able to simultaneously transact the security assts being traded with the funds being used to pay for it. The money for assets swap will be built using a smart contract network. The swap will be able to occur across different blockchain platforms.

India Central Bank forms new unit to develop regulatory framework

India’s central bank has formed a new unit which will be researching regulatory frameworks for blockchain, cryptocurrencies and other technologies. The Reserve Bank of India (RBI) launched the new unit a month ago. The new entity will probably draft rules. The RBI has to explore new emerging areas to check what can be adopted.

Chinese regulatory agencies issued warning against crypto fundraising and trading

The Chinese regulatory agencies, including the People’s Bank of China and the Banking Regulatory Commission, issued a warning against any cryptocurrency fundraising and trading activities. Tencent, the parent company of WeChart (the messaging app with over 1 billion active users) announced that it will prohibit users from using WeChat payments to make any virtual currency-related transactions. It will conduct both real-time monitoring of daily transactions and risk assessment of any suspicious transactions. Alibaba Group, the owner of Alipay, will restrict or permanently ban any personal Alipay accounts that are involved in cryptocurrency transactions. China provided $3 billionencouragement to fund blockchain startups just a couple of weeks ago.

China may block access to 124 foreign crypto exchanges

Chinese regulators are considering blocking 124 foreign crypto exchanges from offering trading services to domestic investors. The China National Fintech Risk Rectification Office has identified 124 trading platforms with overseas IP addresses that are still available in China. The office plans to monitor commercial use of cryptocurrency and to block internet access to these trading platforms. In September 2017, the People’s Bank of China banned initial coin offerings (ICOs) and crypto trading platforms in the country. That resulted in major exchanges based in China moving their businesses overseas. Currently, the services of Binance, OKEx and Bitfinex are unavailable in China. The agency will shut down domestic websites and official accounts on the WeChat messaging app if they are providing crypto trading services and ICO services.

Market News

Tech and Telecoms plan to invest millions in blockchain, according to Deloitte

According to the Deloitte survey, 40% of executives from telecom, media and technology sectors want to invest millions in blockchain research during the course of the next year. The survey includes 1,053 executives in seven countries, including 180 from TMT companies. 84% of respondents answered that the blockchain will broadly scale and reach mainstream adoption. Some 59% of respondents said that blockchain could disrupt their specific industries and 29% have already joined a blockchain consortium. Deloitte predicted that revenue for blockchain companies would grow from $340m in 2017 to as much as $2.3bn in 2021. According to the report, venture capital invested $1.3bn in blockchain startups in 1H2018. In 2016, developers produced 27,000 new projects, according to Deloitte.

ADAB Solutions launches first Islamic Crypto Exchange

UAE-based financial firm ADAB Solutions is reportedly set to launch the very first Islamic Crypto Exchange (FICE), which will be fully compliant with Sharia Law. The firm intends to operate on a global scale and wants to attract the users of Islamic finance and Muslims into the cryptocurrency market. According to the company’s web page, there are at least approximately 250 digital currency exchanges worldwide without a single one which is operating in accordance with the Quran. The company has made a comment that “many cryptocurrencies, due to their characteristics, are haram (forbidden in Islam). On FICE there will be no speculative deals, margin trading or operations not corresponding to the norms of Shariah.”

The Formation of The Virtual Commodity Association

According to a statement released on Monday, Gemini Trust, BitStamp, BitFlyer USA and Bittrex have joined forces to create the Virtual Commodity Association to address the issues that are increasingly acknowledge as a main reason why the cryptocurrency industry is having a hard time transitioning to the next stage of growth. The VCA intends to develop a self-policing industry regulator which will create a harmonization of industry standards, promote transparency across the whole ecosystem and moreover to work with regulators to prevent fraud on the markets. A CFTC commissioner Brian Quintenz has stated that “Given the absence of federal oversight jurisdiction in the crypto market, in February and again in March of this year, I called on the crypto platform community to come together and develop a self-regulatory organization-like entity that could develop and enforce rules. Today’s announcement is a positive step towards that realization.”

Huobi may acquire a public firm, potentially for the reverse takeover

The crypto exchange Huobi is seeking to become the largest shareholder of a publicly listed firm on the Hong Kong Stock Exchange (HKSE) potentially for a reverse takeover. The company Pantronics Holdings disclosed on HKSE the transfer of 221m of common shares to Li Lin, the chairman of Huobi Group. Li became the owner of 73.73% of Pantronics and the largest substantial shareholder. The transaction was priced at HK$2.72 ($0.35) per share with the total amount c. $77m. The deal will be approved by HKSE, and after that it may provide a reverse takeover opportunity for Huobi, Pantronics is an electronics manufacturing service provider. Pantronics halted the trading of its shares on the exchange from 22nd Aug. The news resulted in Huobi’s token price jumping by 8% in few hours. There are several Chinese firms looking for the IPO in Hong Kong, including Canaan Creative, Ebang and Bitmain.

Bitcoin’s daily volatility has hit a 13-month low

On Friday, the spread between daily low and high was seen at the lowest level since July 2017 when the spread hit $68. The drop in the volatility is often a precursor to high volume price moves which can go either way. On July 8th, when the spread hit a yearly low of little over $97, the daily volume jumped to $389 on 10th July. Similarly on June 7th, after $107 spread lows, the daily range spiked to $850 two days later. According to the data, which is being used in technical theory, “the longer the period of consolidation, the more violent the breakout tends to be.”

Russian S7 airline tests blockchain for fuel payments track

The Russian S7 airline has tested a blockchain-based application that tracks data and paperwork connected to the process for refueling planes. The company trialled the application with its fuel supplier Gazpromneft-Aero and Alfa Bank on a domestic flight based out of the Tolmachevo International Airport. The application shares data about the fuel demand on a shared ledger, a copy of which is managed by each of the parties. Payments for the fuel can be conducted on the network with digital invoices created via smart contract during each transaction. The payment process, previously requiring advance payments and bank guarantees, can be processed in 60 seconds.