This week saw news about crypto scams predominate, while weak summer activity seems to be preventing the market from recovering. With the ether price reaching record lows, concerns about scam DApps and DApp usage drove concerns about the future of the platform. Pantera Capital, however, this week looked beyond the bear market – launching a $175m crypto venture fund.

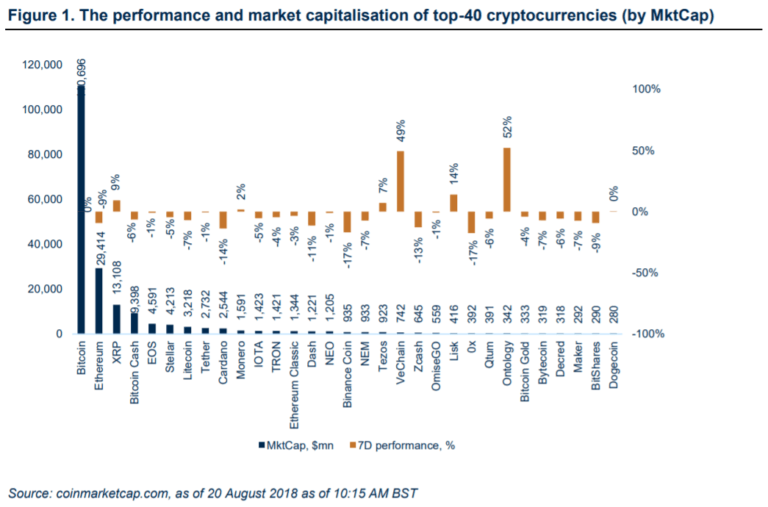

Digital assets demonstrated a mixed performance last week. Bitcoin was almost flat (-0.03%), as well as EOS (-0.9%). Ethereum and Cardano lost 9.3% and 14% respectively. XRP added 9.2% on the news about crypto exchanges partnering with xRapid. Best performers among top-40 crypto were Lisk (+14%), Ontology (+52%), VeChain (49%). Worst performers were Binance Coin(-17%), 0x (-17%), Zcash (-13%)

Regulatory News

US Senate to host a hearing on energy efficiency of blockchain

The U.S. Senate is going to examine the energy efficiency of blockchain during the Committee on Energy and Natural Resources hearing on 21st August. It will examine how blockchain technology might impact electricity prices and what benefits it provides. It will also ask the question how electricity prices will react to a rise in demand for electricity due to the demand from blockchain applications and whether blockchain might soon bring improvements to the online security of energy supply computer systems.

The UK FCA issues warning on cryptocurrency investment scam

The UK FCA has published a warning about cryptocurrency investment scams, some of which may involve regulated activities. The ads promoted on social media often use the images of celebrities or wellknown individuals to promote cryptocurrency investments and link to prefessional-looking websites. Consumers may be persuaded to make investments as a result of celebrity endorsement, with fiat or cryptocurrencies. Firms operating the scams are usually based outside of the UK but use some City of London addresses to claim a UK presence. The FCA does not regulate cryptocurrencies such as Bitcoin or Ether, but regulates certain cryptocurrency derivatives such as futures contracts, CFDs and options. A firm must be authorised by the FCA to advertise or sell these products in the UK, thus its details must appear in in the FCA register. The FCA also has a warning list of firms to avoid. The statistics from the Action Fraud national reporting centre showed that UK victims reported crypto-scam losses of $2.5m in Jun-Jul 2018.

Court ruling against the crypto startup Monkey Capital

The Southern District of Florida Judge D.Middlebrook entered a “final default judgment” against Monkey Capital LLC and Monkey Capital Inc after it found that the working product was never delivered after the token sale was completed. The funds were not returned to the plaintiff. Plaintiffs contributed cryptocurrency worth millions of dollars in advance of the scheduled ICO and suppposed launch of a private cryptocurrency exchange and decentralised hedge fund (the ‘Monkey Capital Market’). Plaintiffs are seeking c. $1.2m in combined damages. The court determined that the products sold in the ICO were “securities” and the defendants violated federal securities laws.

Market News

Ethereum-based Dapps are led by gaming and gambling, raising concerns

According to DappRadar, the most popular Dapps issued on the Ethereum platform, in terms of number of users and volume of use over a 24 hour period, are gaming and gambling Dapps, only overpaced in popularity by CryptoKitties. Many claim that these products resemble ponzi schemes, or fraudulent forms of investment promising high return, and so raises serious concerns over the risks consumers may face. Fomo3D’s clone, a Chinese mobile app called LastWinner, was mentioned as a Dapp created to “trick” users, displaying false bot-driven activity, consuming up to one-third of the network’s computational power. Amberdata.io, a blockchain analytics firm, confirmed that the clone of the Fomo3D gambling app caused the heavy load of the Ethereum blockchain. Allegedly, the LastWinner Dapp has a major vulnerability during airdrop, according to PeckShield blockchain security firm, where small amounts of user funds can be skimmed internationally from airdrop prizes.

UK crypto futures exchange adds Bitcoin Cash contract

The UK crypto futures exchange and CME partner Crypto Facilities will be adding a Bitcoin cash contract as of 17th August. The exchange is regulated by the UK Financial Conduct Authority. Crypto Facilities already has Bitcoin, Ethereum, XRP and Litecoin futures contracts. Investors may use futures contracts for more diversified strategies, hedging risk more efficiently. The exchange has reportedly seen volumes of up to $180m in a 24-hour period and has average daily volumes of $20-60m. Crypto Facilities has two Bitcoin price indexes – the CME CF Bitcoin Reference Rate and CME CF Bitcoin Real Time Index, created to underpin CME Bitcoin futures.

Ripple chooses three crypto exchanges as partners for xRapid payment service

xRapid, Ripple’s cross border payments product, announced that it is choosing digital asset exchange partners to create a healthy ecosystem. These exchanges will allow xRapid payments to move from one currency into XRP and back into another currency. xRapid announced that Bittrex will act as the preferred digital asset exchange for xRapid transactions that move through US dollars. Bitso and Coin.ph will be preferred for Mexican Pesos and Philippine Pesos respectively. For example, a financial institution, which has an account with Bittrex will initiate a payment in US dollars into Mexican peso via xRapid. The amount in US dollars is instantly converted into XRP on the exchange. The payment in XRP is settled over the XRP Ledger. Another exchange, Bitso, instantly converts the XRP into fiat, which is settled into a destination bank account. Ripple claims a 4-5 seconds transaction time. XRP can handle 1,500 transactions per second. Ripple claims that financial institutions may save 40-70% on traditional foreign exchange costs.

Zcash release v2.0.0

Zcash, the privacy-focussed digital platform, released Zcash 2.0.0, the first Sapling-compatible version of the Zcash node software. The Sapling network upgrade introduces “significant efficiency improvements for shielded transactions that will pave the way for broad mobile, exchange and vendor adoption of Zcash shielded addresses”. The first block of Sapling will be block 419200, which is expected to be mined on 28th October 2018. Sapling will activate the testnet at block 280000, which is expected during the week 20th-27th August. The new release contains experimental support for Sapling RPC functionality, with the full support to appear in the 2.0.1 release. Zcash released a list of changes included in this release.

The released version includes experimental support for remote procedure calls, to execute the code on a remote computer as if it were called locally and fixes a bug which slowed some nodes syncing to the network when banning peers, amongst other features. The Sapling upgrade planned to reduce the storage requirements for private transactions and update the cryptography to make it more secure.

Insurance association is turning to the IBM blockchain platform to support a reporting tool

The American Association of Insurance Services (AAIS) has chosen IBM’s Hyperledger Fabric to support a new automated insurance reporting tool. The open Insurance data Link (openIDL) system aims to simplify regulatory reporting allowing insurance carriers to store data on a permissioned blockchain for regulators to view on an as-needed basis. AAIS submits monthly or quarterly reports to each member insurer depending on state law. The new system will allow carriers to store their own data directly on the blockchain and the regulators will have direct access to this data.

Capital One files a patent for blockchain-based user authentification

The US bank Capital One has filed a patent application for the implementation of blockchain technology in user authentification. The proposed system is designed to receive, store, record, and retrieve authentication information for a user in multiple blockchain-based member platforms. The inquiry is a continuation of the previous application submitted in June 2017. The system will be used for KYC and other use cases. In 2016, Capital One partnered with the blockchain company Gem to solve the problem of health providers’ long wait of getting payment from insurance companies.

JD.com launches enterprise blockchain service platform

China’s largest retailer JD.com released the news that it is launching a new blockchain technology platform to “help enterprise customers build, host and use their own blockchain applications for more secure, transparent and convenient operations management.” JD Blockchain Open Platform (BaaS platform) is built on multiple underlying technologies and enables customers to create and adjust smart contracts on public and private enterprise clouds. The technology can help companies streamline operational procedures including tracking, tracing the movement of goods and charity donations, authenticity certification, property assessment, transaction settlements and digital copyrights. The ecommerce giant already uses JD’s Retail as a Service (RaaS) strategy, opening its infrastructure to other companies and industries. The first JD partner to use BaaS is the China Pacific Insurance Company (CPIC), which will use the platform to deploy a traceable system, for e-invoices. JD has already introduced its blockchain tracing platform that enables customers to track and trace the sources and development processes of the products and food they purchase. JD.com uses blockchain to trace more than 400 brands and 11,000 SKUs.

Nvidia reports decline in GPU sales for cryptocurrency

Nvidia, the inventor of the GPU graphic cards, which are used for cryptocurrency mining, has reported its second quarter earnings where cryptocurrency GPU sales fell massively short of expectations. Nvidia originally anticipated $100 million in revenue from crypto-specific product, but it actually came in at barely $18 million during the Q2 2018. According to Nvidia CFO Colette Kress, Nvidia had “previously anticipated cryptocurrency to be meaningful for the year, we are now projecting no contributions going forward.” Overall Nvidia saw a 40% spike in revenue to $3.12 billion last quarter.

Pantera Capital aims to launch $175 million third crypto venture fund

The San Francisco-based investment firm is looking to raise $175 million for its third venture fund. So far the firm has managed to raise more than $71 million from 90 investors, according to SEC filling.

Pantera’s debut venture fund, which closed in 2013, raised $13 million, and the second fund of $25 million is way below the projected $175 million for the third fund. Managing partner Paul Veradittakit commented that the target amount is a “function of how fast the space is moving, With more interesting latter-stage investment (on our radar) too, we want to be flexible and able to move with the market.” Veradittakit added that the latest fund is for the investors, who “are not sure that Bitcoin will remain the dominant cryptocurrency”, and want to build a “diversified portfolio.” The fund has already invested in Bakkt, which is a cryptocurrency trading platform backed by the New York Stock Exchange.

Swedish ETN already allows US investors to invest in Bitcoin

While the SEC is prolonging the decision regarding several ETFs in the US, Sweden’s CoinShares Holding offers an exchange-traded note (ETN), which is not tied to physical assets in the way ETFs are, but ETN is backed by an issuer, such as a bank. Bitcoin ETN, called Bitcoin Tracker One, is trading on the Nordic Nasdaq, the Stockholm stock exchange and is now available to US investors since it is now quoted in US dollars under ticker CXBTF. According to the words of the CEO of CoinShares, Ryan Radloff, “Everyone that is investing in dollars can now get exposure to these products, whereas before, they were only available in Euros or Swedish krona.”

Binance launches Fiat-to-Crypto Exchange in Lichtenstein

Binance LCX, a joint venture between the leading cryptocurrency exchange Binance and the Lichtenstein cryptocurrency exchange, has announced a fiat-to-crypto exchange in Lichtenstein. Binance LCX will offer trading between Euros and Swiss francs and major cryptocurrencies pairs. The technology role will be split among the Binance team, which will provide the whole trading infrastructure, and LCX will manage customer support, KYC/AML, legal requirements and government communication. “I hope Binance LCX will drive new standards for usability and compliance for the blockchain industry, and we are very excited to bring the relevant experience and best practices to grow our team in Lichtenstein”, said Changing Zhao, Binance CEO.

AT&T faces $224 million lawsuit over alleged cryptocurrency theft

On Wednesday, the U.S. District Court in Los Angeles received a lawsuit, where cryptocurrency investor Michael Terpin accused AT&T of fraud, negligence and other actions, which allegedly the thieves used to access Terpin’s device and to steal cryptocurrency worth $23.8 million. AT&T told CNBC, “We dispute these allegations and look forward to presenting our case in court.” Besides the lost $24 million, the investor is seeking another $200 million in punitive damages.

VeChain was asked to develop a blockchain-based solution for vaccine production data in China

VeChain announced that it had been “tasked to achieve” a blockchain-based solution for recording data related to vaccine production in China. VeChain is going to use highly sensitive IoT devices to record data during the vaccine production process and then store data on VeChainThor, the VeChain enterprise blockchain. VeChain is developing the solution in partnership with DNV GL, a Norwegian company which has a share interest in VeChain. Chinese government revealed a problem with vaccination in July, when it came to light that hundreds of thousands of children had received faulty vaccines manufactured by a Chinese drug company. The tracability of vaccines on the blockchain will help to achieve high level of ensurance that the quality of vaccines meets the standards.