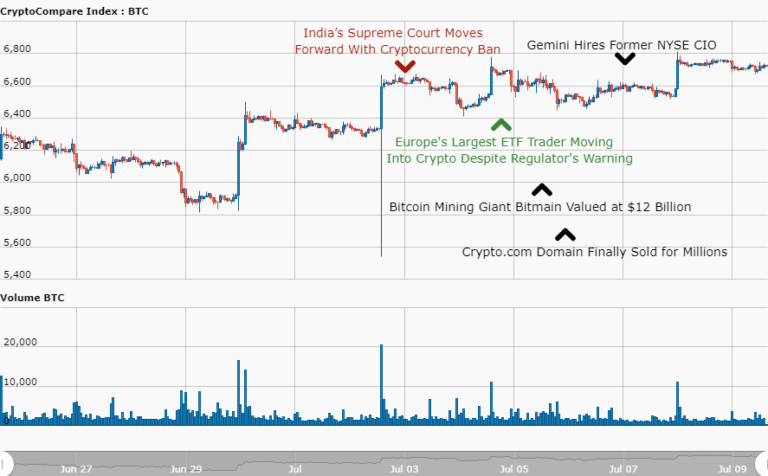

The news this week was a notable improvement upon recent weeks, with several positive developments for the industry. With Bitcoin jumping significantly in price, Europe’s largest ETF trader moving into crypto markets and bitcoin mining giant Bitmain reportedly valued at $12 Billion. India’s Supreme Court, however, moved forward with its crypto ban.

Bitcoin Jumps 8% in a Week as the Outlook Looks Bullish

This week saw a substantial jump in the price of Bitcoin (BTC) as the leading cryptocurrency rose markedly in price on Monday and managed to sustain an increase of over 8% in price from the previous week.

Currently trading around the $6,700 mark after beginning the week at $6324 (a c. 6% rise for the week), bitcoin was still unable this week to push past $7,000, however.

Offering some respite to worried investors after a prolonged bearish market, the price spike at least for now has put paid to some dire predictions made for the coin when it dropped below $6,000 at the end of last month.

India’s Supreme Court Moves Forward With Cryptocurrency Ban: Banking Services Denied To Crypto Companies

India’s Supreme Court early in the week announced that it will not be providing any type of relief to cryptocurrency exchanges from the restrictions placed on them by the Reserve Bank of India (RBI).

With the RBI on April 5th ordering all local financial institutions to end their banking relationships with crypto-related businesses within three months, this announcement from the supreme court was described by Rashmi Deshpande, an Indian lawyer for a local exchange, as “a win for the [reserve bank] and a big blow” to the crypto industry.

Europe’s Largest ETF Trader Moving Into Crypto Despite Regulator’s Warning

Perhaps the most significant news of the week came on Thursday as Europe’s largest ETF (Exchange Traded Funds) Trader moved into cryptocurrency markets, disregarding its regulator’s warnings to consumers and institutions not to engage in crypto trading.

Flow Traders NV – a ‘speed trading’ firm based in Amsterdam which traded $284 billion last quarter – announced that it is now making markets in Bitcoin and Ethereum ETNs (exchange traded notes).

With the Dutch Authority for the Financial Markets (AFM) saying they “discourage activities in cryptos both by consumers and professional license holders,” the news came as an encouragement to crypto investors as they look for signs of increasing institutional involvement in the industry.

Bitcoin Mining Giant Bitmain Valued at $12 Billion in Funding Round

Towards the end of the week reports surfaced that China-based Bitmain, a leading bitcoin mining hardware manufacturer which owns a large portion of the coin’s hashrate, has been valued at $12 billion in its latest Series B funding round.

According to local news outlet Caixin, the round brought in between $300m and $400m, and was led by various notable companies, including US-based hedge fund Coatue, Singapore government-backed investment fund EDBI, and Sequoia Capital China.

With the report again claiming hat the company is looking into conducting its own initial public offering (IPO), no specific details have yet been confirmed by the company itself.

Sought-After Crypto.com Domain Finally Sold for Millions

Friday saw the announcement that the highly sought-after domain crypto.com was finally sold.

Originally registered by computer scientist Matt Blaze in 1993, the University of Pennsylvania professor had until now been adamant that the domain was not for sale.

Bought by cryptocurrency credit card company Monaco, some reports claim the sale could have been worth up to $10 million, although Blaze has previously remarked that “if it was only about money [he’d ] have sold it a long time ago.”

Crypto Exchange Gemini Hires Former NYSE Chief Information Officer

Prominent cryptocurrency exchange Gemini, founded by the Twins Tyler and Cameron Winklevoss, announced this week that they have hired New York Stock Exchange’s (NYSE) former chief information officer (CIO) Robert Cornish.

Hired as the company’s chief technology officer, Cornish is set to help build up the cryptocurrency platform with institutional investors in mind, as the Winklevoss twins reportedly hope large hedge funds and other investors will get involved with the cryptocurrency space.