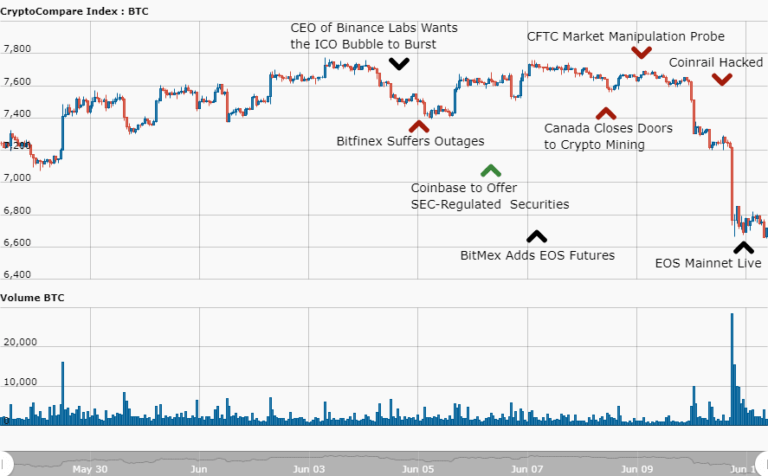

A major trend in this week’s news was crypto security – with Bitfinex suffering a DDoS attack early in the week and South Korean exchange Coinrail experiencing an expensive hack that might have led to a tumble in crypto prices. In more positive news for exchanges, Coinbase announced acquisitions that are a major step towards offering SEC-regulated crypto securities, while BitMex announced EOS futures contracts – ahead of the EOS Mainnet Launch – given the go-ahead by the community over the weekend. Here are the top stories in crypto last week.

CEO of Binance Labs Wants the ICO Bubble to Burst

Ella Zhang, CEO of Binance Labs – the cryptocurrency exchange’s blockchain incubator, has said that the ICO bubble needs to burst for the industry to move forward sustainably.

Talking to Bloomberg, the head of Binance’s new initiative – set up to invest in and nurture young blockchain projects, remarked:

“We’d like the bubble to break. We still see a lot of hype in the market, valuations are high and unreasonable. We really think if the bubble bursts, it’s a good thing for the industry.”

While the CEO sees some positives to the extreme bullishness in the ICO space in that it attracts new users, she believes that only when the bubble bursts will the legitimately valuable projects emerge.

Bitfinex Exchange Suffers Outages Amid Cyber Attack

Tuesday saw major cryptocurrency exchange Bitfinex hit with several outages as it suffered a cyber attack, in one of the latest of several hacks to plague the crypto industry in recent weeks.

The exchange was down during the morning as their trading engine suffered problems, with the site identifying the problems with its infrastructure provider.

Shortly afterwards however, the platform was down again after it was hit by a DDoS – Denial of Service Attack, with normal operation returning in the afternoon.

MVIS CryptoCompare Digital Assets Index: Markets Falter

MVIS CryptoCompare Digital Assets Index: Markets Falter

Coinbase on the Path to Offering SEC-Regulated Crypto Securities

On Wednesday, Coinbase – one of the largest crypto exchanges in United States – took a major step on the path to becoming the first SEC-regulated crypto exchange.

Currently in the U.S., crypto exchanges that are not registered with the Securities and Exchange Commission (SEC) may only buy or sell cryptoassets that the SEC does not consider to be securities e.g. Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH), but may not trade many ICOs – deemed securities by the SEC.

With its acquisition of Venovate Marketplace Inc, Keystone Capital Corp, and Digital Wealth LLC. – all three of which have SEC and FINRA registration, the move represents a significant step forward for Coinbase and the US industry as a whole.

Crypto Exchange BitMex Adds EOS Futures Contracts Ahead of Mainnet Launch

BitMex, a popular cryptocurrency exchange that allows traders to enter leveraged positions, has recently added EOS futures contracts to its platform, giving its users the ability to short or long the cryptocurrency with up to 20x leverage.

The crypto exchange has in the past offered EOS futures contracts, but ultimately removed them in order to offer BTC, ETH, BCH and other contracts in a high-quality trading platform that would be more reliable. Its announcement notes that now, given significant performance improvements, its ready to relaunch them due to popular demand.

Canada Closes Its Doors to Crypto Mining

Canada’s Quebec province has halted all licenses for new currency mining projects while it reviews their power usage and fees.

Quebec’s energy ministry has said it has ordered state-owned power generator Hydro Quebec to hold off on connecting new digital currency mining operations as it wants regulators set new roles for the industry.

The generator will also have to limit the total power available to all existing digital currency miners to a block of 500 megawatts – a fraction of the 17,000 megawatts in capacity requested so far by miners looking to operate in Quebec.

With a surge in applications from global crypto mining companies looking to capitalize on the country’s low electricity costs, the energy ministry deemed the demand to exceed the utility’s short and medium-term capacity.

Dispute Between CME, Crypto Exchanges Prompts CFTC Market Manipulation Probe

A report recently published by the Wall Street Journal claims that a dispute between the Chicago Mercantile Exchange (CME) and four cryptocurrencies exchanges prompted the Commodities Futures Trading Commission (CFTC) to probe crypto markets for potential manipulation.

Starting after CME launched bitcoin futures contracts, the report explains that the probe saw government investigators demand the exchanges hand over trading data to find out whether cryptocurrency prices are being manipulated.

After the CME was denied trading data from BitStamp, ItBit, Kraken, and Coinbase who argued “the request was intrusive,” the company attempted to get the data via third-party London-based firm. This move which caught the attention of the CTFC – as the CME didn’t have in place agreements that could compel the four exchanges to hand over trading data tied to its futures contracts.

The CTFC has now launched its own investigation into bitcoin price manipulation, reportedly subpoenaing the four exchanges in the process.

South Korean Exchange Coinrail Gets Hacked as Crypto Market Tumbles

Coinrail, a lesser-known South Korean cryptocurrency exchange, has recently revealed an a “cyber intrusion” on its platform, but has reportedly managed to contact other exchanges before the hackers cashed out.

While precise details of the hack are unclear, Bloomberg reported that Coinrail has secured its remaining reserves, said to be 70 percent, in cold storage, with its website reading:

“Two-thirds of the coins confirmed to have been leaked are covered by freezing / recalling through consultation with each coach and related exchanges. The remaining one-third of coins are being investigated with investigators, relevant exchanges and coin developers”

With various cryptocurrency analysts attributing Sunday’s market tumble to the breach, this is the latest in a cycle of hacks in recent weeks.

EOS Mainnet Goes Live After Launch Group Gives Green Light

The EOS Mainnet Launch Group (EMLG) members unanimously decided to go ahead with the launch of the EOS blockchain.

With the official “launch sequence” process starting later in the day and scheduled to be completed within the next few days, this latest move forward comes after the EOS project has received a lot of criticism amid a number of setbacks in the past few weeks. Notably, the EOS mainnet launch had to be postponed, partly because critical security vulnerabilities pointed out by a Chinese cybersecurity company, as well as what seemed to be protocol violation issues.