The cryptocurrency market has seen a $200 billion drawdown over the last 24-hour period as the prices of major digital assets including bitcoin, ether, and BNB plunged between 3% and 5.6%.

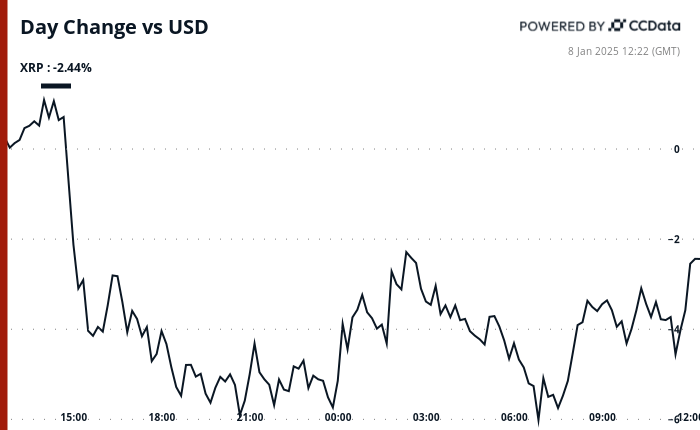

Among the top digital assets XRP appears to be one of the best-performing ones, having taken a 2.4% hit over the same period to now stand around $2.353 per token, down from a high near $2.5 seen earlier this year.

The recent crypto market drop, which helped 24-hour liquidations top $690 million according to CoinGlass, and seemingly comes as a result of several factors that include a drawdown in traditional markets, with the S&P 500 losing around 1.1% of its value in yesterday’s session, while the NASDAQ went down by more than 1.8%.

Treasury yields have meanwhile risen significantly, with the interest rate on the U.S. 10-year Treasury surging by around 5 basis points t0 now stand at 4.683%. The drawdown came as job openings in the U.S. rose more than expected in November in a potential sign the labor market is tightening.

The crypto market crash has seen bitcoin drop back down to the $95,000 level, while Ethereum’s ether is now trading art $3,350. The space’s total market capitalization is now around $3.33 trillion.

Featured image via Pexels.