The Federal Reserve has cut interest rates by 25 basis points yesterday in a widely expected move, yet markets crashed after its Chair Jerome Powell suggested a potential easing of the interest rate-cutting cycle next year.

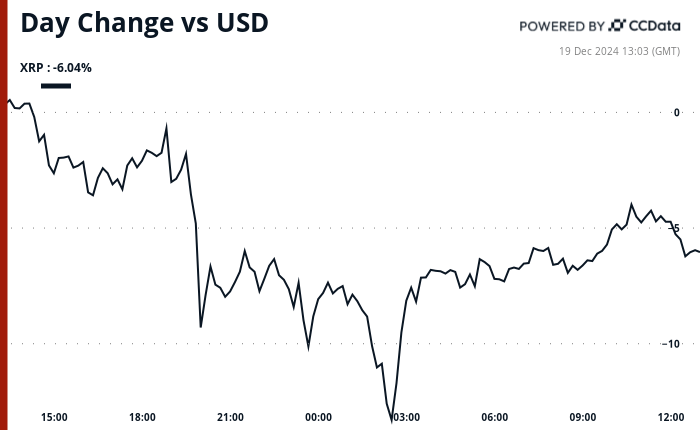

Powell’s comments led to a wide sell-off in risk assets across both the cryptocurrency market and traditional finance. The sell-off saw Bitcoin briefly drop below $100,000 before recovering, while Ethereum is still below $3,700. XRP was affected by the sell-off and lost 6% of its value today, to now stand at $2.37.

Despite the sell-off, XRP is still up more than 360% since the beginning of November, when the cryptocurrency was trading at around $0.513.

Several catalysts were behind its surge, including Republican candidate Donald Trump winning the U.S. presidential elections and various spot XRP exchange-traded fund filings, along with Ripple’s launch of its RLUSD stablecoin.

The recent market sell-off was so significant that the CBOE Volatility Index (VIX), a widely used measure of the market’s volatility expectations known as its “fear gauge,” saw its second-largest spike in history.

XRP has experienced significant volatility since its price exploded upward in early November, leading to various natural corrections as holders take profits and readjust their positions.

Featured image via Unsplash.