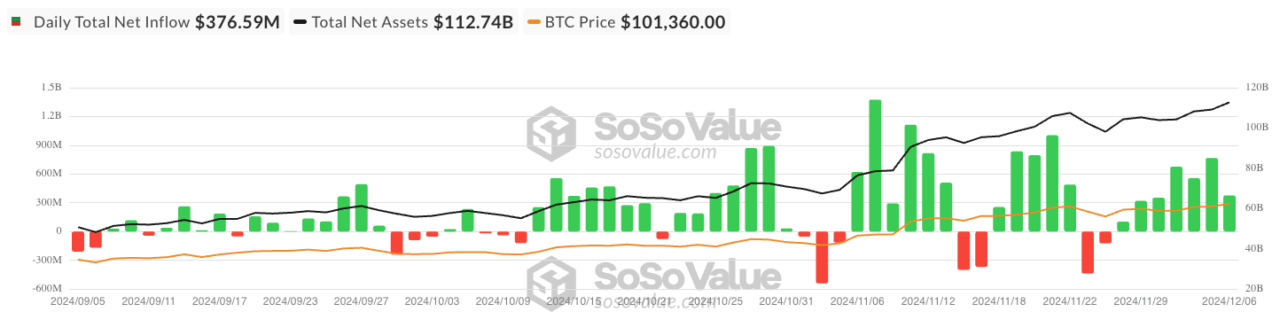

Spot Bitcoin exchange-traded funds (ETFs) have seen nearly $10 billion inflows since Republican presidential candidate Donald Trump won the US elections, as investors flocked into the cryptocurrency sector since the results were revealed.

The 12 spot Bitcoin ETFs from various major asset managers, including BlackRock and Fidelity Investments, attracted $9.9 billion in net inflows following Election Day on November 5, according to Bloomberg, lifting their assets to around $113 billion.

According to data from SoSoValue, spot Bitcoin ETFs currently have $112.7 billion in total net assets, equivalent to around 5.62% of the flagship cryptocurrency’s total market capitalization. These inflows came amid a wider cryptocurrency market rally, which saw the price of Bitcoin briefly top the $100,000 mark before correcting to now trade at $98,000.

Over the last 30 days, the price of the flagship cryptocurrency is nevertheless up by more than 28.5%. The total market capitalization of the cryptocurrency space, over the same period, rose by around $1 trillion.

Trump notably picked David Sacks, a former PayPal chief operating officer, as the White House’s new AI and Cryptocurrency czar. Sacks, according to Trump, is set to “guide policy for the Administration in Artificial Intelligence and Cryptocurrency, two areas critical to the future of American competitiveness.”

Bitcoin’s price rise saw various investors step up their accumulation efforts with Nasdaq-listed business intelligence firm MicroStrategy, the largest corporate holder of Bitcoin, earlier this month adding an additional 15,400 coins for $1.5 billion, at an average price of $95.976 per coin.

The move saw MicroStrategy’s Bitcoin holdings top the 400,000 mark for the first time, with the company achieving a BTC Yield of 38.7% so far this year, and 63.3% year-to-date. It now holds 402,100 BTC that were acquired for $23.4 billion.

The move comes at a time in which Bitcoin whales have been taking advantage of the flagship cryptocurrency’s recent price dip to keep on accumulating BTC after short-term holders moved nearly $4 billion in the cryptocurrency to exchanges.

According to CryptoQuant analyst Cauê Oliveira, Bitcoin whales took advantage of the “panic selling” to accumulate, with 16,000 BTC worth nearly $1.5 billion entered whale reserves in a single day after short-term holders’ sales.

In a post, the analyst noted that the figure was “reflected in institutional addresses on the network” but suggested more BTC was accumulated, as the funds that weren’t withdrawn from cryptocurrency exchanges and remain in users’ accounts aren’t counted.

Per his words, the whale accumulation hasn’t been sufficient to demonstrate a “more widespread buy-the-dip” pattern,” which he said remains concentrated among institutional investors.

Featured image via Unsplash.