Bitcoin’s Kimchi Premium has surged in South Korea, reaching its highest level since March 2009 amid the country’s deepening political crisis and economic uncertainty.

This premium, which refers to the price difference between Bitcoin on South Korean exchanges such as Upbit and global exchanges like Coinbase, has risen to a range of 3-5% this week, according to data from blockchain analytics firm CryptoQuant. A similar trend has been observed in the premium for the stablecoin Tether, reflecting heightened demand for digital assets.

The Kimchi Premium is a term that captures the price gap between cryptocurrencies traded on South Korean exchanges and those traded on global platforms. It emerges when demand for Bitcoin and other cryptocurrencies in South Korea exceeds the supply available on domestic exchanges. This phenomenon is driven by factors such as local market isolation, strict capital controls, and high retail interest. Historically, the Kimchi Premium has spiked during periods of heightened uncertainty, either in financial markets or the broader economy.

Capital controls in South Korea make it challenging for investors to arbitrage the difference between domestic and international markets. This allows the premium to persist, as traders cannot easily buy Bitcoin at lower prices elsewhere and sell it at higher prices in South Korea.

South Korea is currently experiencing significant political instability, which has rattled financial markets and contributed to economic challenges. On Dec. 3, President Yoon Suk Yeol declared martial law, a controversial move that was rescinded on Dec. 4 following widespread backlash. The National Assembly responded by impeaching Yoon on Dec. 14, temporarily transferring presidential powers to Prime Minister Han Duck-soo.

The political situation escalated further when, on Dec. 27, Han was also impeached by parliament, marking the first time in South Korea’s history that an acting president has faced such action. The impeachment votes were driven by opposition to Han’s decision not to appoint three new justices to the Constitutional Court, leaving the court with only six members to decide on Yoon’s impeachment. Finance Minister Choi Sang-mok has now assumed the role of acting president.

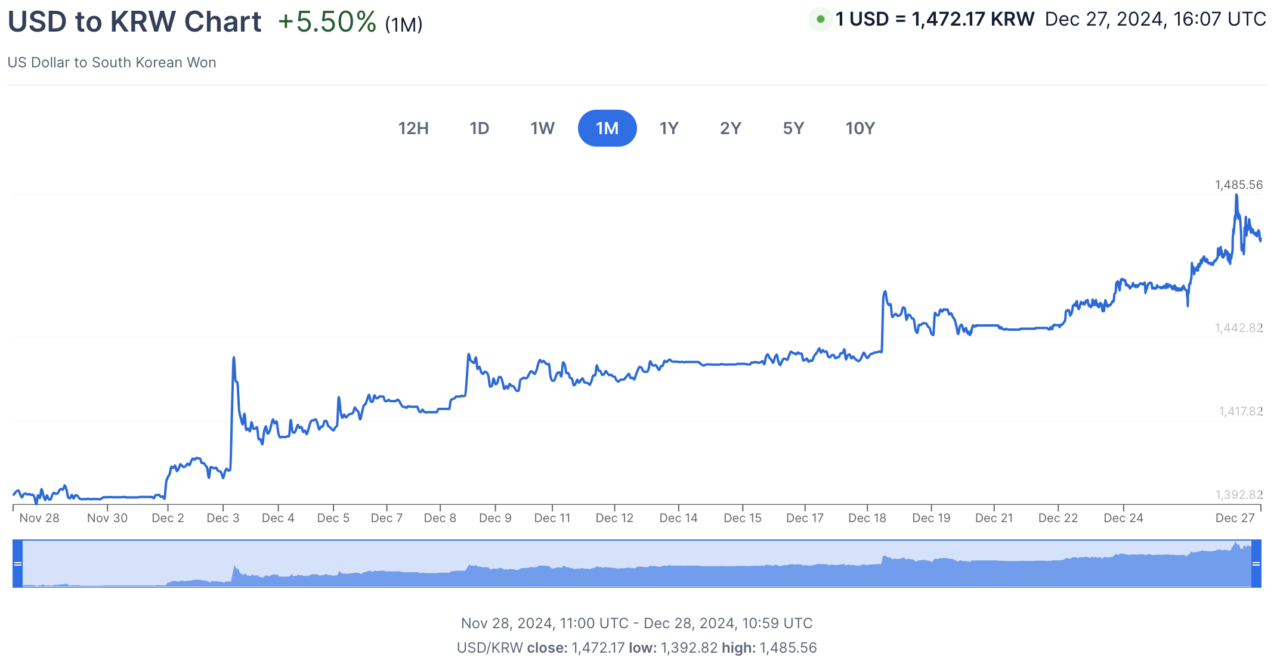

These events have amplified uncertainty in South Korea, with the South Korean won losing 0.35% against the U.S. dollar this week. Since the martial law declaration on December 3, KRW has reportedly declined by 5% against USD. Economic challenges, including a declining birth rate and slowing growth, have exacerbated the situation, pushing investors toward alternative assets.

The surge in the Kimchi Premium reflects heightened demand for Bitcoin and other cryptocurrencies among South Korean investors. CryptoQuant CEO Ki Young Ju told Bloomberg that political turmoil, inflation fears, and economic instability have led to an outflow of wealth from South Korea. Investors are increasingly converting won-denominated assets into alternatives such as U.S. stocks, Bitcoin, gold, and dollars. Many South Korean crypto investors prefer exchanges over traditional banking systems, which has contributed to the increased premiums for Bitcoin and Tether.

South Korea is recognized as one of the most active retail markets for cryptocurrencies. Crypto trading volumes on local exchanges often surpass those of stock exchanges. Additionally, South Korean regulations prohibit corporate accounts on domestic crypto exchanges, making the activity largely retail-driven.

The Kimchi Premium is not a new phenomenon. It has been observed during previous market cycles, particularly when local factors such as economic uncertainty, geopolitical tensions, or regulatory changes drive demand for cryptocurrencies. For instance, during Bitcoin’s bull run in late 2017, the Kimchi Premium soared to as much as 50%, highlighting the unique dynamics of South Korea’s crypto market.

Featured Image via Pixabay