U.S. stocks pulled back on Tuesday, November 12, 2024, with all major indices closing in negative territory despite some notable bright spots in the technology sector.

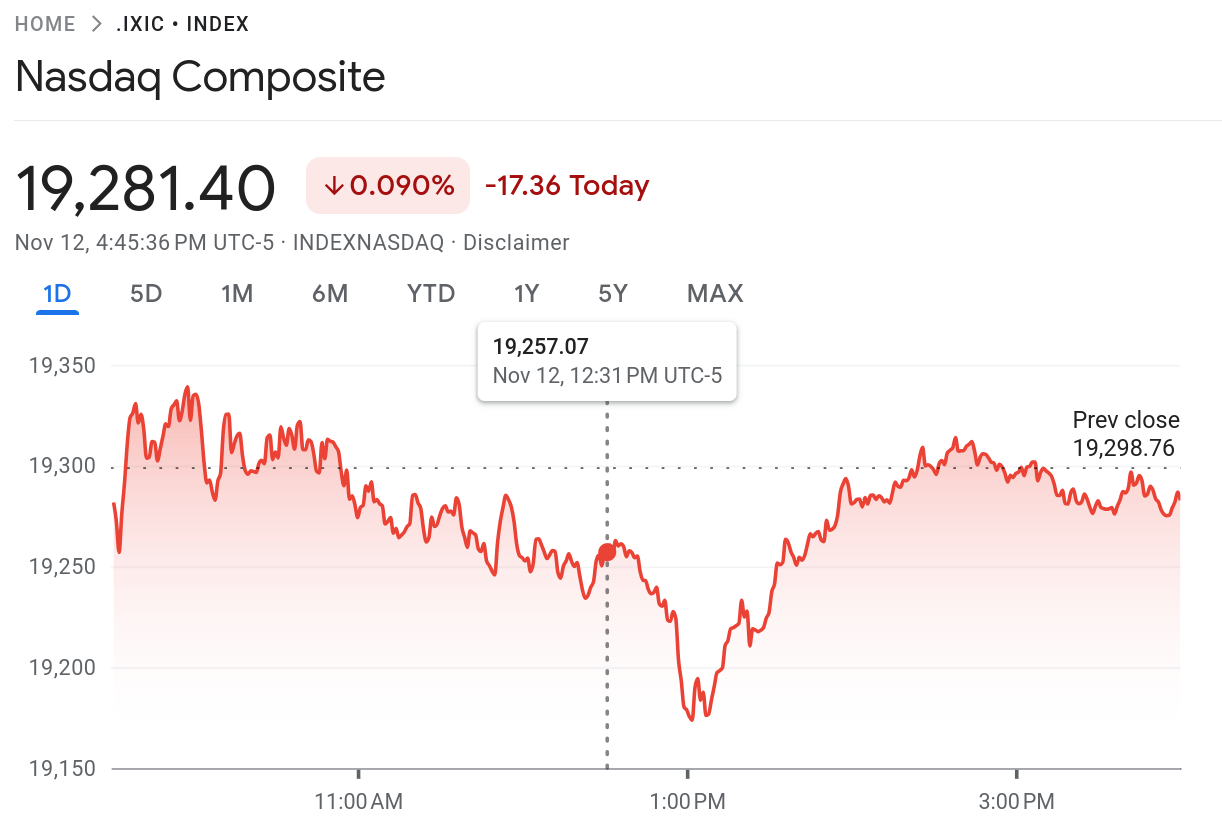

The Dow Jones Industrial Average led the decline, dropping 382.15 points, or 0.86%, to close at 43,910.98. The S&P 500 fell 17.36 points, or 0.29%, to end at 5,983.99, while the tech-heavy Nasdaq Composite showed more resilience, slipping just 17.36 points, or 0.09%, to finish at 19,281.40.

Among individual stocks, Amgen Inc. was the day’s biggest decliner on the Nasdaq, falling 7.14% to $298.84. Other notable declines came from Super Micro Computer Inc., down 6.59%, and Tesla Inc., which dropped 6.15% to $328.49. The semiconductor sector showed particular weakness, with Micron Technology, Microchip Technology, and Intel all posting losses of over 3%.

However, there were bright spots in the market, particularly among software and technology companies. Dexcom Inc. led the gainers, rising 5.73% to $74.34, while cybersecurity firm Zscaler Inc. jumped 4.76%. Adobe Inc. also had a strong showing, gaining 4.35% to close at $526.42. Tech giants NVIDIA and Netflix showed resilience, with gains of 2.09% and 1.75%, respectively.

The market’s downward trend was consistent throughout most of the trading session, with a brief attempted recovery in the early afternoon that failed to hold. The VIX, known as Wall Street’s fear gauge, dropped 1.74% to 14.71, suggesting relatively subdued volatility despite the day’s declines.

The market’s downward trend was consistent throughout most of the trading session, with a brief attempted recovery in the early afternoon that failed to hold.

The day’s cautious trading came ahead of several crucial economic indicators and Federal Reserve speeches scheduled for the remainder of the week. Markets will be closely watching Wednesday’s Consumer Price Index report, where economists expect a 2.6% year-over-year increase for October, which would mark the first monthly uptick since March 2024 after six consecutive months of declines. Core CPI, which excludes volatile food and energy prices, is projected to come in at 3.3%.

The inflation theme continues Thursday with the Producer Price Index report, expected to show a 2.3% annual increase, up from September’s 1.8% rise. Investors will also be parsing commentary from multiple Fed officials throughout the week, culminating in Fed Chair Jerome Powell’s speech on the economic outlook Thursday afternoon in Dallas. The week rounds out with Friday’s release of import and export price data, providing further insight into inflation trends.

The Russell 2000 small-cap index underperformed the broader market, falling 1.87% to 2,389.42, indicating increased pressure on smaller companies.

Featured Image via Unsplash