MicroStrategy Inc.’s meteoric rise in recent weeks has placed its leveraged ETFs in the spotlight, sparking both investor enthusiasm and operational challenges for fund managers, according to a report published earlier today by Vildana Hajric for Bloomberg News. The T-Rex 2X Long MSTR Daily Target ETF (MSTU), launched by Matt Tuttle, has faced capacity limits from its prime brokers due to the inherent volatility of MicroStrategy’s stock, which is heavily tied to Bitcoin. At its debut, MSTU quickly gained traction, becoming one of the most volatile ETFs ever introduced on Wall Street.

The ETF, designed to deliver double the daily returns of MicroStrategy shares, saw surging demand as the stock skyrocketed. However, prime brokers—specialized bank units facilitating securities lending and other activities—soon reached their risk thresholds, limiting the amount of swap exposure they were willing to extend to the fund. At one point, Tuttle needed $100 million in exposure to meet investor demand but was only able to secure $20 million through swaps. To maintain the ETF’s leverage mandate, Tuttle turned to call options as an alternative strategy.

A similar scenario played out for Defiance ETFs, which launched its Defiance Daily Target 2X Long MSTR ETF (MSTX) in August. Shortly after its debut, the firm began using options to supplement its leverage strategy. Initially offering 1.75x leverage, the fund increased this to 2x after Tuttle’s MSTU entered the market.

MicroStrategy’s stock, known for its sharp price swings, rebounded on 22 November 2024, just a day after Citron Research announced a short position that caused a steep 22% drop. The bounce can likely be attributed to a combination of factors, including investor sentiment that the selloff was overdone and a subsequent rally in Bitcoin, which underpins much of MicroStrategy’s valuation. Traders may have also seized the dip as a buying opportunity, anticipating a recovery amid strong market interest in cryptocurrencies following Donald Trump’s pro-crypto stance and Bitcoin’s recent record highs.

Per Bloomberg’s report, the volatility of MicroStrategy shares has stretched Wall Street’s capacity to support these high-octane ETFs. Prime brokers involved in swaps for the ETFs, including Cantor Fitzgerald, Marex, and Clear Street, have faced rising margin requirements due to the risks associated with the underlying stock. Market-makers have noted that the rapid growth of these funds is testing the risk tolerance of broker desks, especially given the funds’ massive margin demands.

The rise of single-stock leveraged ETFs, which first became available to U.S. investors in 2022, has attracted scrutiny from regulators due to their inherent risks. These products, often appealing to retail investors seeking quick profits, come with significant challenges for issuers. Managing such funds requires careful monitoring of derivatives, such as options, to maintain targeted leverage while navigating fluctuating stock prices. For Tuttle, this process now consumes a significant part of his daily operations.

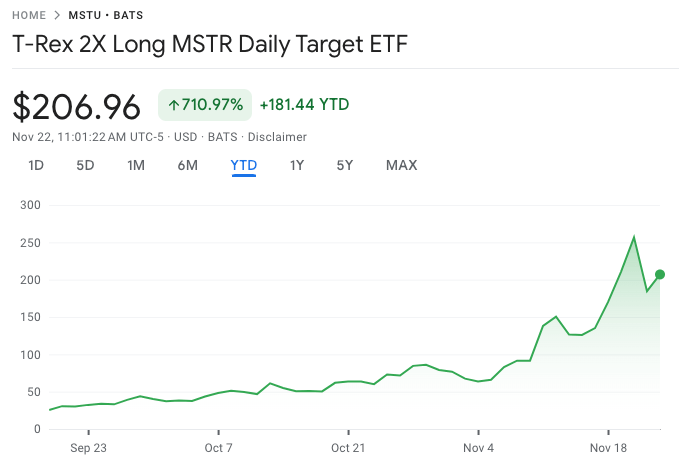

With combined assets of nearly $4 billion, MSTU and MSTX have delivered staggering returns since their inception—MSTU has climbed over 710%, while MSTX has gained 543%. However, their explosive growth raises questions about the sustainability of such products and the broader implications for financial markets. Some industry experts argue that the success of these ETFs may signal the limits of what the marketplace can accommodate, as they amplify the stock’s movements far beyond its underlying fundamentals.

Featured Image via Pixabay