On 27 November 2024, the U.S. Bureau of Economic Analysis (BEA) released its “Personal Income and Outlays” report for October, revealing steady income growth, modest consumer spending increases, and inflation that continues to exceed the Federal Reserve’s long-term target. These figures are key to understanding the Federal Reserve’s next steps on interest rate policy and their implications for financial markets.

In October, personal income rose by $147.4 billion, or 0.6%, from the prior month, driven by increases in employee compensation, asset income, and government transfer receipts. Disposable personal income (DPI), which accounts for taxes, climbed by $144.1 billion (0.7%). Meanwhile, personal consumption expenditures (PCE) increased by $72.3 billion (0.4%), reflecting higher spending on services such as healthcare and housing, even as spending on goods declined.

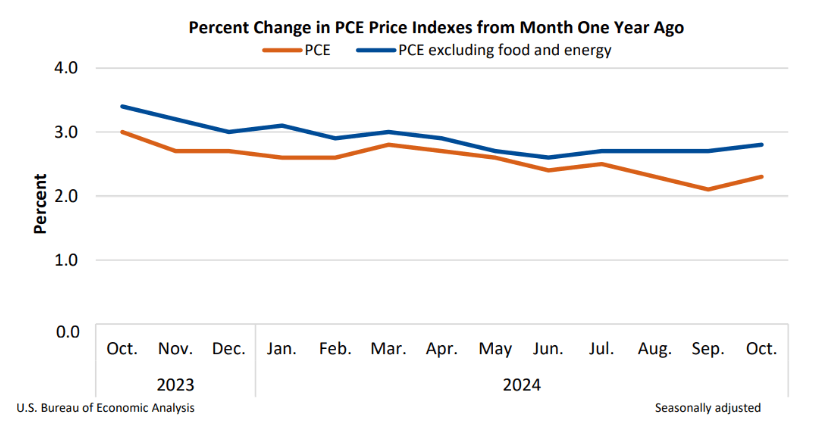

The inflation story remains critical. The PCE price index, the Federal Reserve’s preferred measure of inflation, rose by 0.2% in October and 2.3% over the past year. Core PCE, which excludes food and energy, increased by 0.3% for the month and 2.8% on an annual basis, both slightly higher than the September figures. Housing costs and service prices were significant contributors to inflation, while goods prices fell. Energy prices dropped by 0.1%, and food prices remained nearly flat.

Markets have reacted to this data with caution. As of 11:07 a.m. ET, the Dow Jones Industrial Average was slightly higher, gaining 44 points (+0.10%), while the S&P 500 and Nasdaq Composite fell by 0.37% and 0.97%, respectively. The Russell 2000 index edged up 0.24%. Volatility also crept higher, with the VIX rising by 2.34% to 14.43. These mixed movements suggest investors remain concerned about the persistent inflation pressures, which could complicate the Federal Reserve’s plans for further rate cuts.

Interest rate traders reflected a growing expectation of a 25 basis-point cut at the Federal Open Market Committee (FOMC) meeting on 18 December. According to the CME Group’s FedWatch Tool, as of November 27, the probability of a rate cut has risen to 69.7%, up from 59.4% just a day earlier. This increase in expectations comes despite inflation figures that remain above the Fed’s 2% target, underscoring the central bank’s challenge of balancing price stability with economic growth.

While consumer spending remained robust, with current-dollar expenditures up 0.4% in October, it showed some signs of slowing compared to September. Real spending, adjusted for inflation, rose by just 0.1%. Goods spending stagnated, while services spending increased by 0.2%, led by recreational goods and healthcare services. The personal saving rate fell to 4.4%, matching its lowest level since January 2023, suggesting that households may be feeling pressure despite strong income growth.

The October inflation data highlights the tension between persistent price pressures and the Federal Reserve’s easing trajectory. The slight uptick in annual core PCE inflation to 2.8% suggests that the Fed’s path toward rate cuts may not be as straightforward as markets hope. While the data has spurred optimism about a December rate reduction, investors remain wary, as seen in the mixed performance of risk assets like equities.

As for the crypto market, it does not yet seem to have reacted to this news, with Bitcoin currently trading at around $95,534, up 2.24% in the past 24-hour period.

Featured Image via Pexels