Solana (SOL) has become the fourth-largest cryptocurrency by market capitalization after seeing its price surge by more than 7% over the past week, to now have a total market cap of $88.28 billion, above BNB’s $85.6 billion.

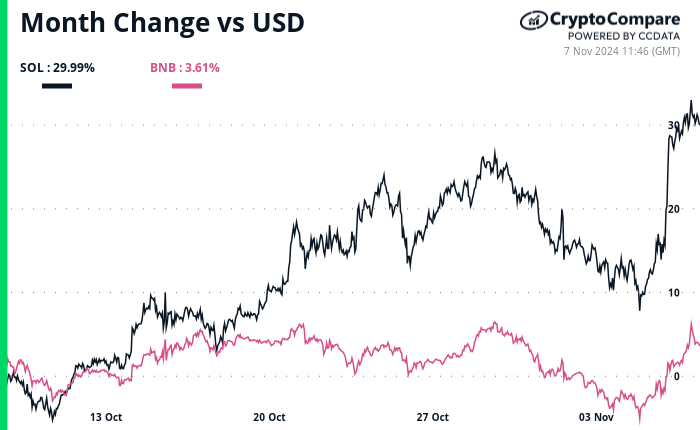

According to data from CryptoCompare, over the last 30-day period SOL’s price is up around 30% to now trade at around $187 per token, while Binance’s BNB saw an upward move of 3.6% to now stand at $594.

When it comes to decentralized finance, according to DeFiLlama data , Solana currently has $6.6 billion in total value locked on decentralized finance ecosystem, compared to $4.6 billion on the BNB Chain. The platform’s data also shows 5.15 million active addresses on Solana, compared to 871,000 on BNB.

Solana’s price has benefitted from Republican presidential candidate Donald Trump securing a victory in the US elections. A Trump victory was widely expected to help boost Bitcoin’s price, as the former U.S. President has expressed strong support for the cryptocurrency sector.

Trump has vowed to fire the Chairman of the U.S. Securities and Exchange Commission (SEC) Gary Gensler, who’s led a series of regulatory crackdowns on the cryptocurrency industry.

A Trump victory may also be boosting Solana’s price as the perceived odds of a spot Solana exchange-traded fund (ETF) being listed are likely to grow as a result. As reported Canary Capital Group has recently taken its first step to list a spot Solana ETF in the US.

It’s worth pointing out that both cryptocurrencies have very distinct supply mechanics, even though both are gas tokens used within their blockchains that power their decentralized finance ecosystems.

While BNB has a real-time burning mechanism that was introduced with BEP-95 and sees a portion of the collected gas fees get burned in each block in a bid to reduce its total circulating supply, Solana doesn’t have a maximum supply, but rather an inflation mechanism.

Solana is an inflationary token whose supply increases at a predetermined rate. At launch, it had a 500 million SOL supply allocated during the creation of the genesis block —the first block on a blockchain. The current total supply now stands at 587 million SOL.

Featured image via Unsplash.