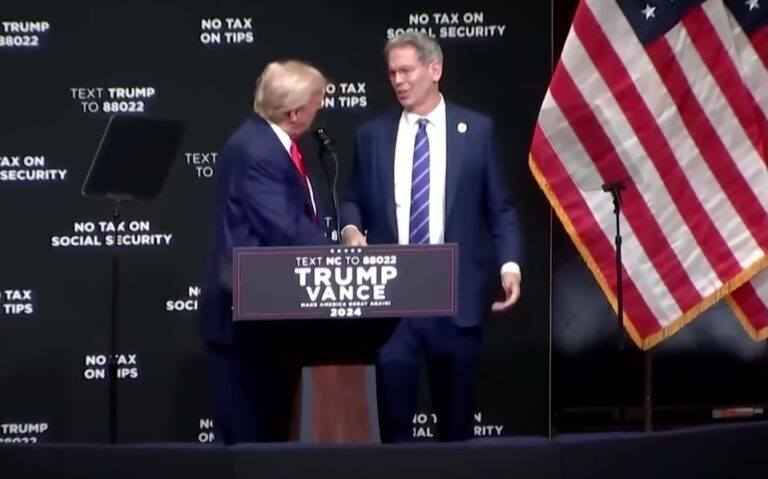

On Friday, President-elect Donald Trump announced hedge fund manager Scott Bessent as his nominee for Treasury Secretary, according to a report by The Wall Street Journal. Bessent, a seasoned investor and founder of Key Square Capital Management, is set to take on a pivotal role in shaping the administration’s economic policies.

Bessent, formerly Chief Investment Officer at George Soros’s fund, has been a vocal advocate for Trump’s economic vision, defending policies such as deregulation and tariffs. He proposed a bold “3-3-3” framework for economic reform: reducing the budget deficit to 3% of GDP by 2028, achieving 3% annual GDP growth, and increasing U.S. energy output by 3 million barrels per day. Trump has praised Bessent as a brilliant thinker and key ally in advancing his “America First” agenda.

Despite his credentials, Bessent’s nomination has faced scrutiny. Some critics within Trump’s circle questioned his past association with George Soros, while others, including Elon Musk, backed rival candidate Howard Lutnick for the role. Bessent responded to criticism by publicly defending tariffs as a strategic negotiating tool to secure trade concessions.

If confirmed by the Senate, Bessent will lead the Treasury Department in addressing substantial fiscal challenges, including managing trillions of dollars in national debt and shaping tax policy. His limited Washington experience may complicate efforts to build relationships on Capitol Hill, which will be crucial as lawmakers tackle expiring tax cuts and other key issues.

Around two weeks ago, Scott Bessent appeared on CNBC, where he addressed potential economic policies, inflation concerns, and the possibility of serving in a future Trump administration. During the interview, Bessent spoke extensively about the challenges of balancing fiscal policy with economic realities, particularly in the context of tax cuts and tariffs proposed by Donald Trump.

Bessent emphasized that while significant tax cuts might appeal politically, they would require negotiations with Congress. He shared that Republican lawmakers, particularly in the House, have a strong appetite for “pay-fors,” meaning they would insist on measures to offset the cost of any cuts. He noted that such negotiations would shape the implementation of Trump’s proposals.

On the topic of inflation, Bessent talked about the wage pressures and loss of purchasing power experienced during the Biden administration. He contrasted this with the wage growth observed under Trump, arguing that Trump’s return to power was largely driven by dissatisfaction with inflation and its effects on working-class Americans. Bessent added that Trump would likely avoid replicating policies that contributed to these economic pressures, such as expansive fiscal measures without proper offsets.

Regarding tariffs, Bessent described them as resulting in one-time price adjustments rather than ongoing inflationary pressure. He recommended phasing in tariffs gradually to minimize economic disruptions and suggested that Trump would take a similar approach. Additionally, he cited Trump’s focus on deregulation and reducing energy costs as measures that could contribute to disinflationary trends.

When asked about the potential for a formal role in the administration, Bessent expressed a willingness to serve in whatever capacity Trump deemed necessary. He mentioned that there had been no formal discussions about specific jobs but reiterated his commitment to supporting Trump’s agenda. He indicated that he would follow any directive from Trump, whether it involved advising from the outside or taking on a more active government role.

Bessent also discussed the broader political landscape, describing Trump’s reelection as a “real wave” that provided a clear mandate for his policies. He noted that Trump’s strong support among voters and in Congress would likely enable the administration to implement its agenda effectively, particularly in the early stages of the term.

The crypto industry seems excited about the possibility of Bessent becoming the next U.S. Treasury Secretary.

Blockchain Association CEO Kristin Smith made the following statement:

Ripple CEO Brad Garlinghouse had this to say: