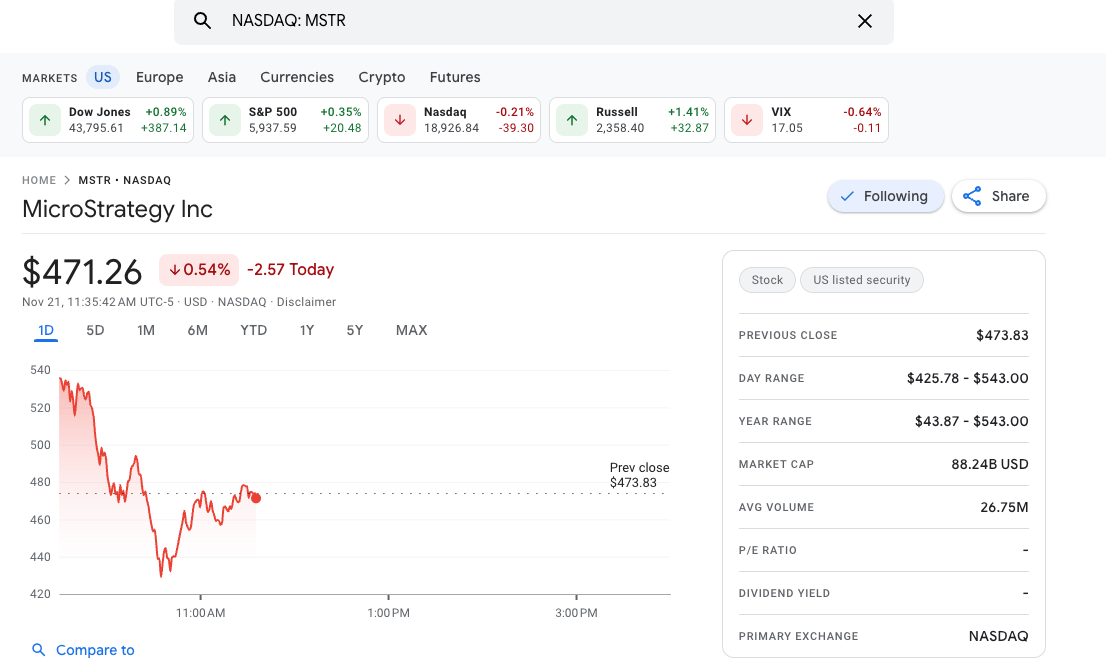

MicroStrategy’s stock showed remarkable volatility Thursday morning, falling to $467.53 by 11:36 AM EST, down over $6 from its previous close of $473.83. The intraday chart reveals a particularly turbulent morning session, with the stock opening near $520 before experiencing a sharp decline to around $440, followed by a partial recovery.

This volatile trading occurs against a mixed broader market backdrop, with the Dow Jones and S&P 500 showing modest gains (+0.83% and +0.27% respectively), while the Nasdaq edges lower (-0.20%).

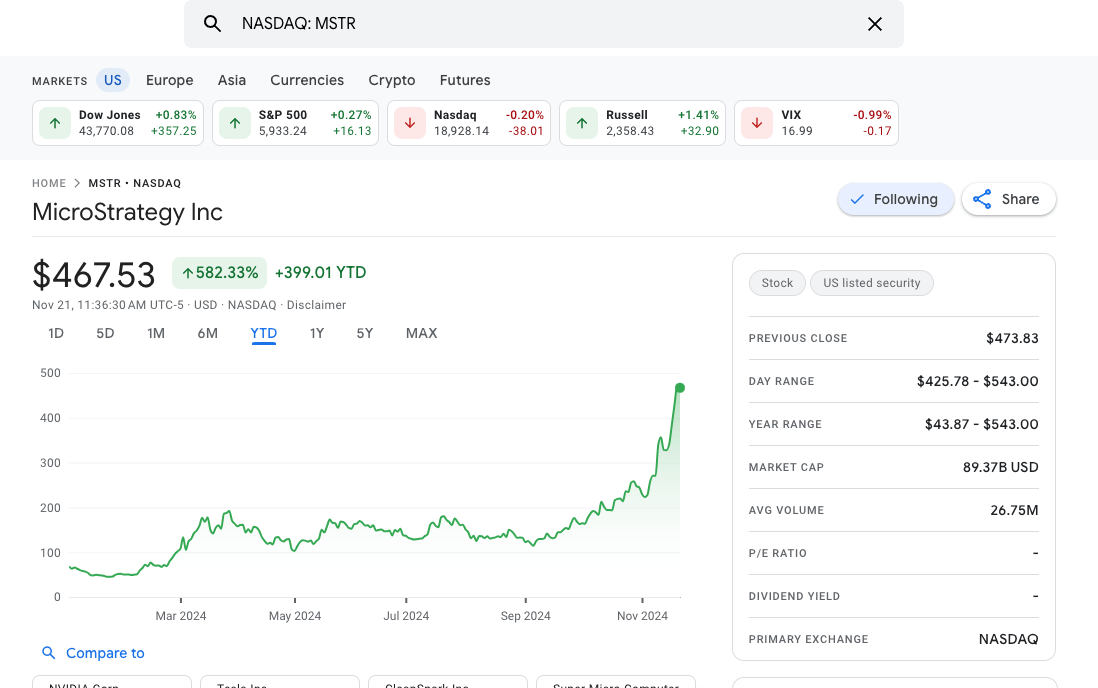

The company’s year-to-date performance tells an extraordinary story. MicroStrategy shares have skyrocketed 582%, delivering a staggering $399.01 per share gain since January. The chart shows a particularly steep acceleration starting in October 2024, with the stock climbing from around $200 to over $540 in just weeks.

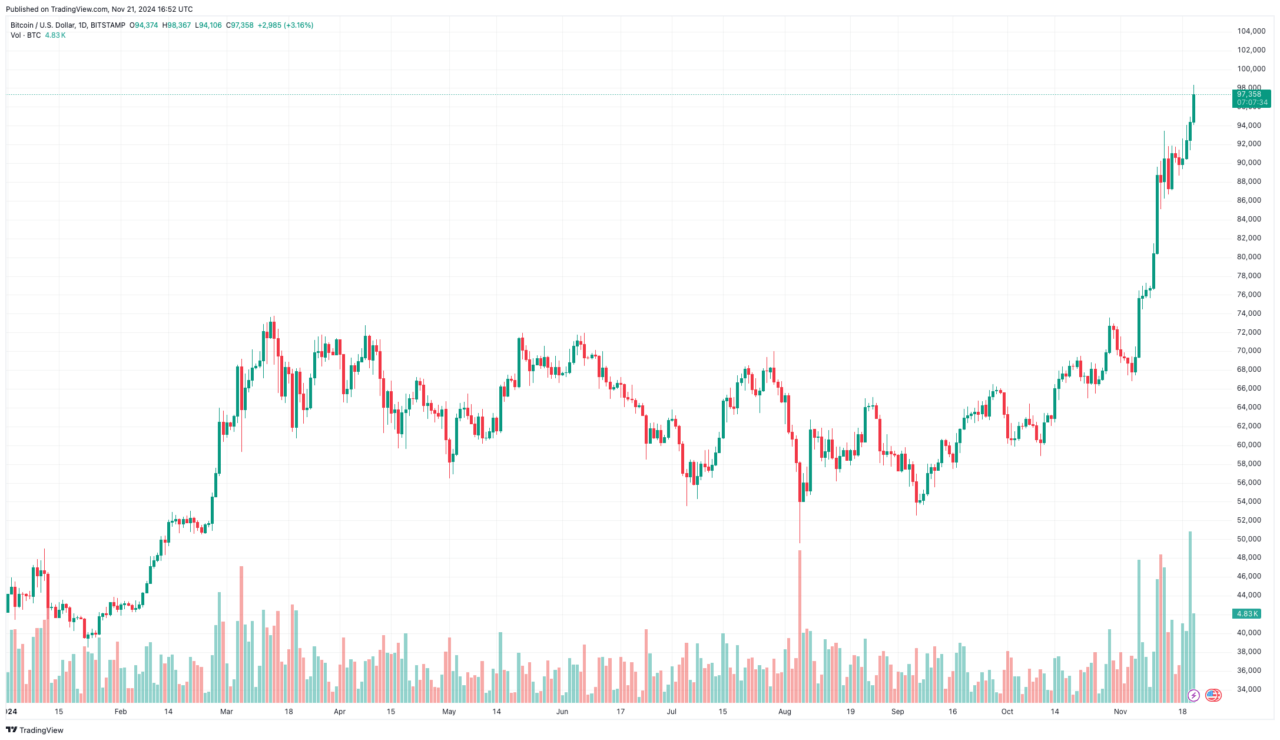

During this volatile session, prominent short-seller Citron Research announced a new bearish position on the company. This comes as MicroStrategy recently expanded its Bitcoin holdings, purchasing 51,780 bitcoins for approximately $4.6 billion in cash at an average price of $88,627 per bitcoin. The company’s total Bitcoin holdings now stand at 331,200 coins, acquired for $16.5 billion at an average cost of $49,874 per bitcoin.

The stock’s momentum intensified following Donald Trump’s election victory in early November, surging 110% while Bitcoin rose 44% to reach $98,000.

With a current market capitalization of $94.36 billion and an average daily trading volume of 26.75 million shares, MicroStrategy has become a significant player in the crypto-adjacent equity space. In fact, according to Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, MSTR was America’s most-traded stock yesterday.

At the time of writing, MSTR is the US stock with the second-highest daily trading volume:

Citron Research’s position marks a dramatic reversal from their late 2020 stance, when they recommended MicroStrategy with a $700 price target. While acknowledging CEO Michael Saylor’s “visionary Bitcoin strategy,” they now argue that the widespread availability of Bitcoin investment options through spot ETFs, Coinbase, and Robinhood has disconnected MicroStrategy’s trading volume from Bitcoin’s fundamentals.

Despite maintaining their bullish outlook on Bitcoin itself, Citron has chosen to hedge with a short position in MicroStrategy’s stock, suggesting the remarkable rally might be overextended.