Nasdaq-listed healthcare technology company Semler Scientific (SMLR) announced on Monday that it has acquired an additional 297 bitcoins while expanding its share offering program.

According to the press release, the company purchased the bitcoins between November 18-22 for $29.1 million, paying an average of $97,995 per bitcoin, including fees. This brings Semler’s total holdings to 1,570 bitcoins, acquired for $117.8 million at an average cost of $75,039 per bitcoin.

Alongside its bitcoin purchases, the company has expanded its at-the-market (ATM) stock offering with Cantor Fitzgerald & Co. An ATM program enables public companies to sell newly issued shares directly into the market at current trading prices through a broker-dealer, providing more flexibility than traditional secondary offerings where shares are sold at a fixed price. Through a new prospectus supplement to its August 13, 2024, Form S-3 shelf registration, Semler is adding $50 million to its existing ATM program, bringing the total to $100 million. The company reports having already raised approximately $50 million through this program as of November 22.

The share issuance has led to significant changes in Semler’s capital structure. Basic shares outstanding increased from 6,987,000 on June 30 to 8,289,000 by November 22, while outstanding options decreased from 1,098 to 855 during the same period. The company’s assumed diluted shares, which include all potential shares from option exercises regardless of vesting conditions or exercise prices, rose from 8,086,000 to 9,143,000.

Semler has introduced a new metric called “BTC Yield” to measure its Bitcoin acquisition strategy. The company reports this figure reached 58.4% for the period from July 1 (when it began its bitcoin strategy) through November 22 and 37.1% for the period from October 1 to November 22.

However, the company provides extensive disclaimers about this metric. BTC Yield measures the percentage change in the ratio between bitcoin holdings and assumed diluted shares outstanding. Semler emphasizes that this is not equivalent to a traditional financial yield, does not represent stockholder returns, and should not be considered a measure of operational performance or liquidity.

The metric has several limitations: it doesn’t account for whether bitcoin purchases were funded by operations or share sales, doesn’t predict stock performance, and may overstate or understate the impact of using equity capital for bitcoin purchases. Semler notes that stock ownership does not represent ownership of its bitcoin holdings, and the company has historically not paid dividends.

Chairman Eric Semler had this to say:

“We are thrilled to report a 58.4% BTC Yield and the outstanding progress we are making to accumulate bitcoin on our balance sheet in a highly accretive way for our stakeholders.“

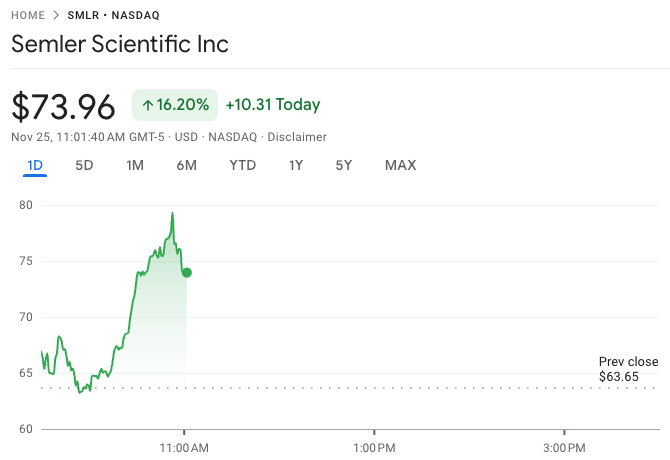

At the time of writing, Semler shares are trading at around $73.96, up over 16% on the day. In the year-to-date period, the shares are up 66.41%.

Featured Image via Pixabay