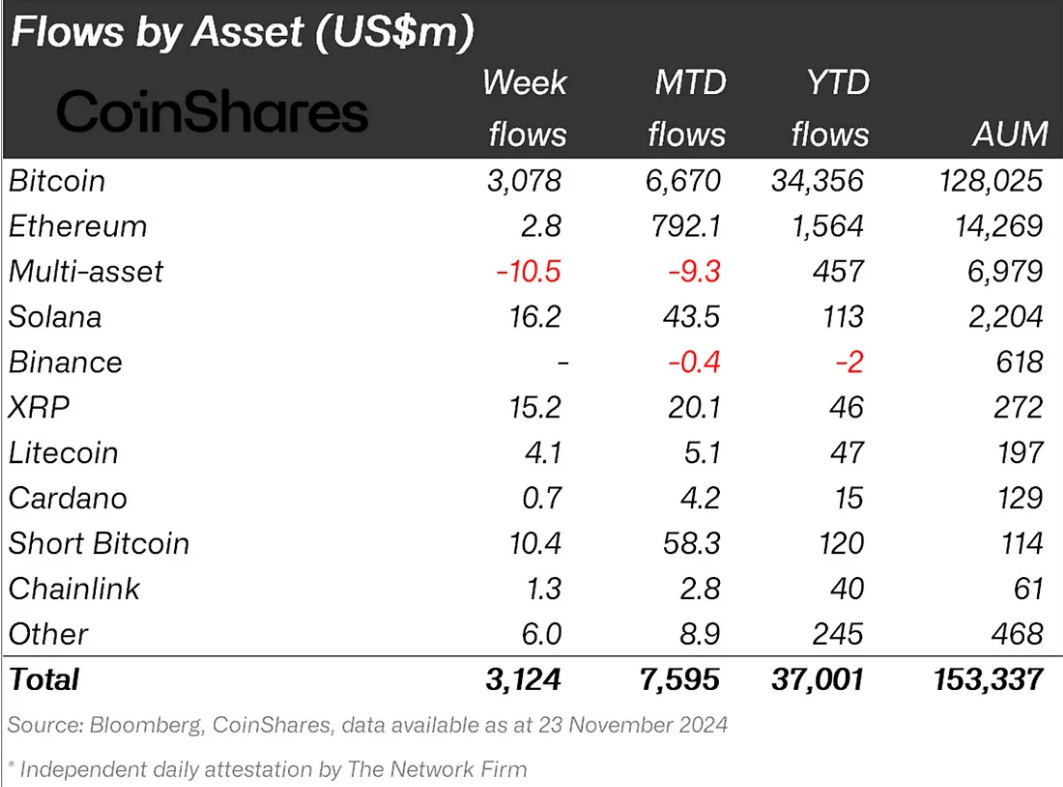

Cryptocurrency investment products saw a record weekly inflow of $3.13 billion over the past week, bringing their total year-to-date inflows to $37 billion as the crypto market rally keeps on going.

According to CoinShares’ latest Digital Asset Fund Flows weekly, Bitcoin investment products saw a total of $3.07 billion inflow over the past week, with the second-largest inflows going to Solana-focused products, at $16.2 million.

Notably, products offering investors exposure to XRP, the native token of the XRP Ledger, saw a whopping $15.2 million inflow, nearly one-third of these products’ $46 million year-to-date inflows.

Solana’s inflows surged amid growing investor interest, with its open interest recently surging past the $5 billion mark, as reported. As CryptoGlobe reported, Solana surged past BNB to become the fourth-largest cryptocurrency by market capitalization earlier this month as it outperformed most other digital assets.

The report also details that Ethereum-focused products saw $2.8 million inflows over the past week, while those offering exposure to Litecoin and Cardano saw $4.1 million and $700,000 inflows, respectively.

According to the report, products betting against a rise in the price of Bitcoin saw $10.4 million inflows, while the largest outflows were seen for products focusing on multiple cryptocurrencies, at $10.5 million.

In total, the assets under management (AUM) of cryptocurrency investment products grew to $153.3 billion as a result of these inflows and the recent cryptocurrency market rally, which saw the price of Bitcoin near $100,000 before a correction saw it drop to $92,800 at the time of writing.

Cryptocurrency prices have benefitted from Republican presidential candidate Donald Trump securing a victory in the US elections. A Trump victory was widely expected to help boost crypto prices, as the former U.S. President has expressed strong support for the cryptocurrency sector.

Featured image via Pexels.